Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In underwriting a new 30-year, monthly payment mortgage loan at 5% interest for Jackie, the lender requires that Jackie meet three ratios to be

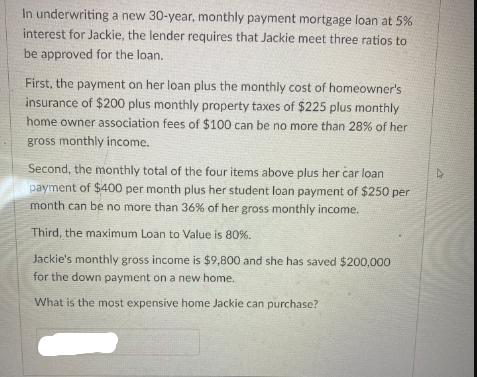

In underwriting a new 30-year, monthly payment mortgage loan at 5% interest for Jackie, the lender requires that Jackie meet three ratios to be approved for the loan. First, the payment on her loan plus the monthly cost of homeowner's insurance of $200 plus monthly property taxes of $225 plus monthly home owner association fees of $100 can be no more than 28% of her gross monthly income. Second, the monthly total of the four items above plus her car loan payment of $400 per month plus her student loan payment of $250 per month can be no more than 36% of her gross monthly income. Third, the maximum Loan to Value is 80%. Jackie's monthly gross income is $9,800 and she has saved $200,000 for the down payment on a new home. What is the most expensive home Jackie can purchase?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Heres how much the most expensive home Jackie can purchase 1 Calculate Jackies maximum qualifying mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e9a52a4051_954112.pdf

180 KBs PDF File

663e9a52a4051_954112.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started