Answered step by step

Verified Expert Solution

Question

1 Approved Answer

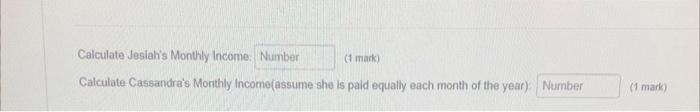

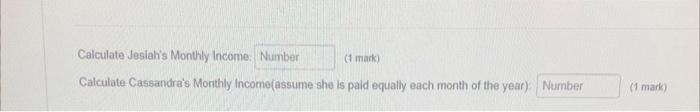

calculate Jesiah's monlthy income: Calculate Cassandra's Monthly Income (assume she is paid equally each month of the year): As a lender, go through the infomation

calculate Jesiah's monlthy income:

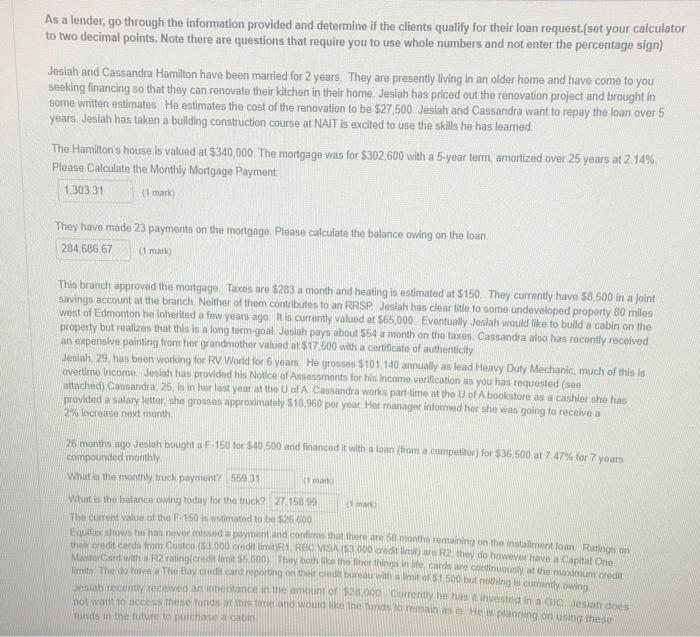

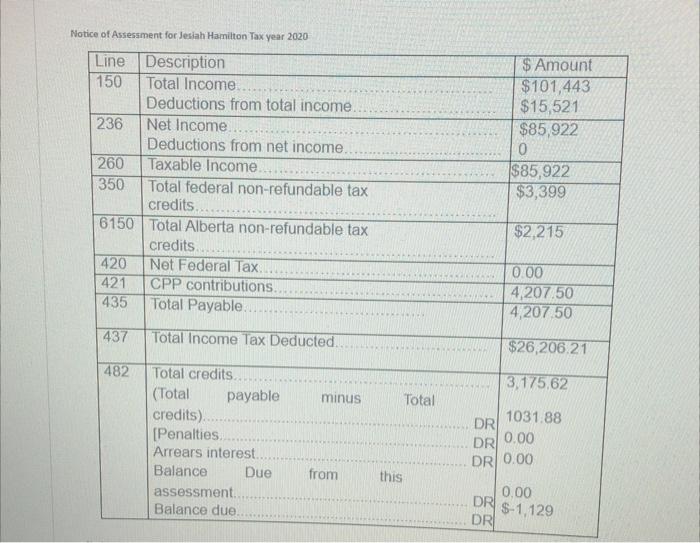

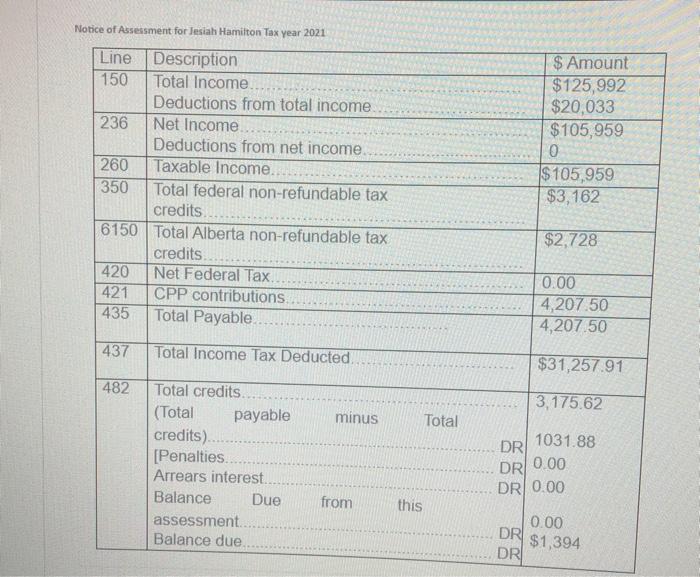

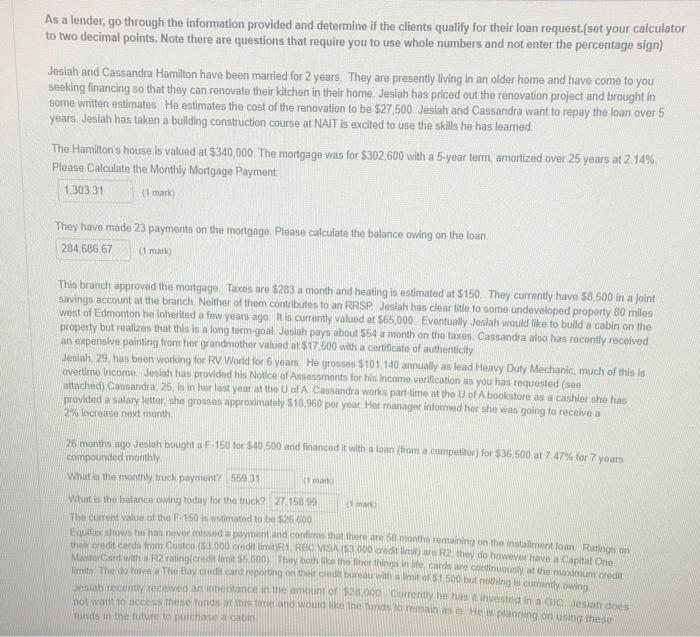

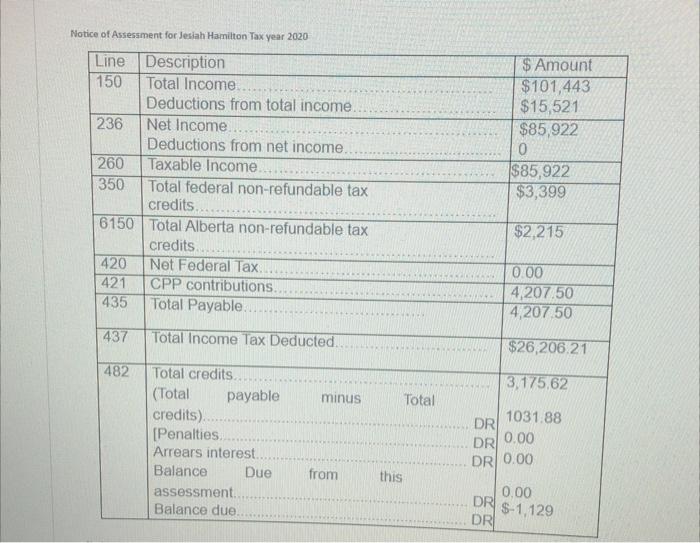

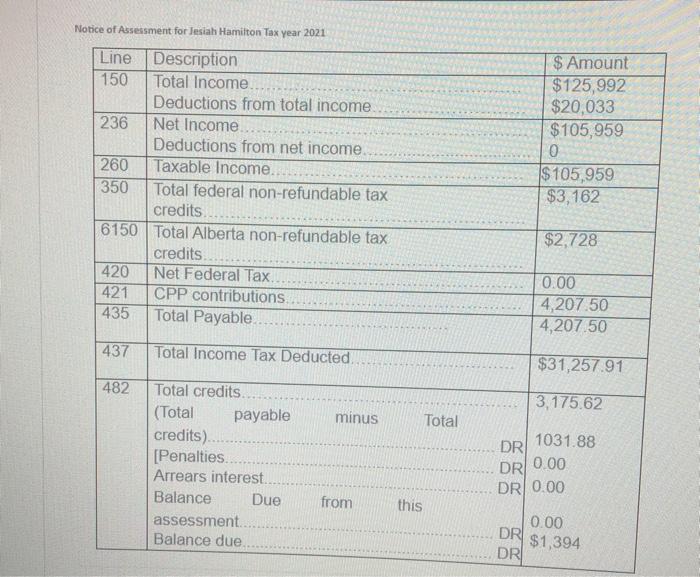

As a lender, go through the infomation provided and determine if the clients qualify for their loan request.(set your calculate to two decimal points. Note there are questions that require you to use whole numbers and not enter the percentage sign) Jesiah and Cassandra Hamilton have been married for 2 years. They are presently living in an older home and have come to you seeking financing so that they can renovate their kitchen in their home. Jesiah has priced out the renovation project and brought in some written estimates. He estimates the cost of the renovation to be $27,500 Jesiah and Cassandra want to repay the loan over 5 years. Jesiah has taken a building construction course at NAIT is excited to use the skils he has learned. The Hamilion's house is valued at $340,000. The mortgage was for $302,600 with a 5 -year term, amortized over 25 years at 2.14%. Please Calculate the Monthly Mortgage Payment. (1 mark) They have made 23 payments on the mortgage. Please calculate the balance owing on the loan. (1 mark) This branch approved the mortgage. Taxes are $283 a month and heating is astimated at $150 They currently have 58.500 in a joint savings account at the branch. Neither of them contributes to an RRSP Jesiah has clear title to some undeveloped property 80 miles West of Edmonton hei inherited a fev years ago. It is currently valued at $65,000. Eventually deslah would mike to build a cabin on the. property but realizes that this is a long term-goal Josiah pays about 554 a month on the taxes. Cassandra alio has recently received an expensive painting from her grandmother valued at $17.500 with a cartificate of authenticity Wesiah, 29, has been working for RV World for 6 years He grosses \$101, 140 annually as lead Heavy Dury Mechanic, much of this is overtime income Sesiah has provided his Notce of Assessments for his income vedification as you has requeded (see. attached) Cassandra, 25, is in her last year at the U of A Cassandra works part-time at the U of A bookstore as a cashler che has provided a salary letter, she grosses approximately \$18,960 por year Her manager informed her she was going to receive a. 2is increase next month. 26 months ago Jeslath bought a F. 150 for $40,500 and financed it with a loan (fom a compeltion) for 536.500 at 7.47% for 7 years compounded monthly What tis the monthy truck payment? What e tho balance owing today for the truck? The current yalue of the F. 150 is estinated to be $266.600 Equifix shoms tre has niver mised a poyment and conline that ihere are 50 months ismaining on the installment loan. Ratings on luhas in the future to furchase a cabin Notice of Assessment for Jesiah Hamitton Tax year 2020 Notice of Asseasment for Jesiah Hamitton Tax year 2021 Calculate Jesiah's Monthly income (1 mark) Calculate Cassandra's. Monthly Incomofassume she is paid equally each month of the year) (1 mark) As a lender, go through the infomation provided and determine if the clients qualify for their loan request.(set your calculate to two decimal points. Note there are questions that require you to use whole numbers and not enter the percentage sign) Jesiah and Cassandra Hamilton have been married for 2 years. They are presently living in an older home and have come to you seeking financing so that they can renovate their kitchen in their home. Jesiah has priced out the renovation project and brought in some written estimates. He estimates the cost of the renovation to be $27,500 Jesiah and Cassandra want to repay the loan over 5 years. Jesiah has taken a building construction course at NAIT is excited to use the skils he has learned. The Hamilion's house is valued at $340,000. The mortgage was for $302,600 with a 5 -year term, amortized over 25 years at 2.14%. Please Calculate the Monthly Mortgage Payment. (1 mark) They have made 23 payments on the mortgage. Please calculate the balance owing on the loan. (1 mark) This branch approved the mortgage. Taxes are $283 a month and heating is astimated at $150 They currently have 58.500 in a joint savings account at the branch. Neither of them contributes to an RRSP Jesiah has clear title to some undeveloped property 80 miles West of Edmonton hei inherited a fev years ago. It is currently valued at $65,000. Eventually deslah would mike to build a cabin on the. property but realizes that this is a long term-goal Josiah pays about 554 a month on the taxes. Cassandra alio has recently received an expensive painting from her grandmother valued at $17.500 with a cartificate of authenticity Wesiah, 29, has been working for RV World for 6 years He grosses \$101, 140 annually as lead Heavy Dury Mechanic, much of this is overtime income Sesiah has provided his Notce of Assessments for his income vedification as you has requeded (see. attached) Cassandra, 25, is in her last year at the U of A Cassandra works part-time at the U of A bookstore as a cashler che has provided a salary letter, she grosses approximately \$18,960 por year Her manager informed her she was going to receive a. 2is increase next month. 26 months ago Jeslath bought a F. 150 for $40,500 and financed it with a loan (fom a compeltion) for 536.500 at 7.47% for 7 years compounded monthly What tis the monthy truck payment? What e tho balance owing today for the truck? The current yalue of the F. 150 is estinated to be $266.600 Equifix shoms tre has niver mised a poyment and conline that ihere are 50 months ismaining on the installment loan. Ratings on luhas in the future to furchase a cabin Notice of Assessment for Jesiah Hamitton Tax year 2020 Notice of Asseasment for Jesiah Hamitton Tax year 2021 Calculate Jesiah's Monthly income (1 mark) Calculate Cassandra's. Monthly Incomofassume she is paid equally each month of the year) (1 mark) Calculate Cassandra's Monthly Income (assume she is paid equally each month of the year):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started