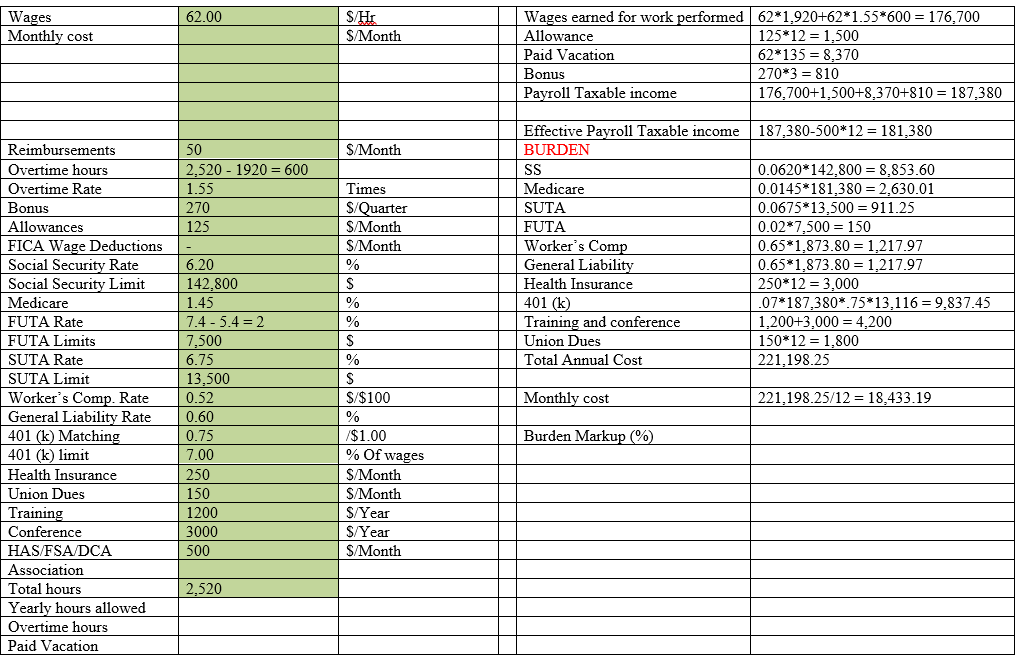

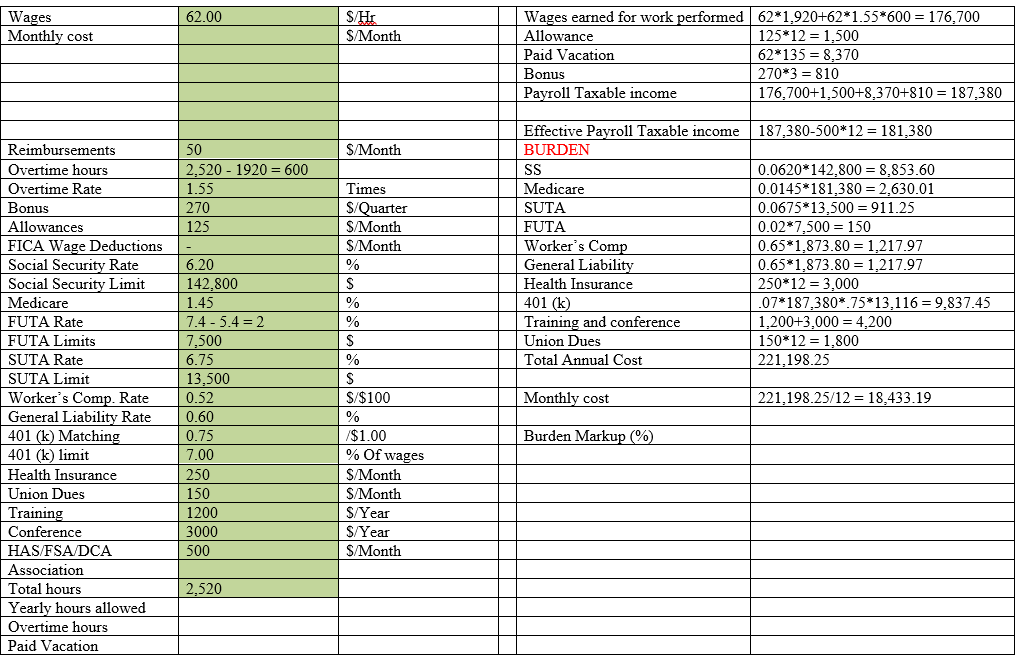

calculate labor burden

62.00 Wages Monthly cost S/H S/Month Wages earned for work performed 62*1,920+62*1.55*600 = 176,700 Allowance 125*12 = 1.500 Paid Vacation 62*135 = 8,370 Bonus 270*3 = 810 Payroll Taxable income 176,700+1,500+8,370+810 = 187,380 187,380-500*12 = 181,380 S/Month 50 2,520 - 1920 = 600 1.55 270 125 Effective Payroll Taxable income BURDEN SS Medicare SUTA FUTA Worker's Comp General Liability Health Insurance 401 (k) Training and conference Union Dues Total Annual Cost 0.0620*142.800 = 8,853.60 0.0145*181,380 = 2,630.01 0.0675*13,500 = 911.25 0.02*7,500 = 150 0.65*1.873.80 = 1.217.97 0.65*1,873.80 = 1,217.97 250*12 = 3.000 .07*187,380*.75*13,116 = 9,837.45 1,200+3,000 = 4,200 150*12 = 1,800 221.198.25 Reimbursements Overtime hours Overtime Rate Bonus Allowances FICA Wage Deductions Social Security Rate Social Security Limit Medicare FUTA Rate FUTA Limits SUTA Rate SUTA Limit Worker's Comp. Rate General Liability Rate 401 (k) Matching 401 (k) limit Health Insurance Union Dues Training Conference HAS/FSA/DCA Association Total hours Yearly hours allowed Overtime hours Paid Vacation 6.20 142.800 1.45 7.4 - 5.4 = 2 7,500 6.75 13,500 0.52 0.60 0.75 7.00 250 150 1200 3000 500 Times S/Quarter S/Month S/Month % S % % S % S $/$100 % /$1.00 % Of wages S/Month S/Month S/Year S/Year S/Month Monthly cost 221,198.25/12 = 18,433.19 Burden Markup (%) 2,520 62.00 Wages Monthly cost S/H S/Month Wages earned for work performed 62*1,920+62*1.55*600 = 176,700 Allowance 125*12 = 1.500 Paid Vacation 62*135 = 8,370 Bonus 270*3 = 810 Payroll Taxable income 176,700+1,500+8,370+810 = 187,380 187,380-500*12 = 181,380 S/Month 50 2,520 - 1920 = 600 1.55 270 125 Effective Payroll Taxable income BURDEN SS Medicare SUTA FUTA Worker's Comp General Liability Health Insurance 401 (k) Training and conference Union Dues Total Annual Cost 0.0620*142.800 = 8,853.60 0.0145*181,380 = 2,630.01 0.0675*13,500 = 911.25 0.02*7,500 = 150 0.65*1.873.80 = 1.217.97 0.65*1,873.80 = 1,217.97 250*12 = 3.000 .07*187,380*.75*13,116 = 9,837.45 1,200+3,000 = 4,200 150*12 = 1,800 221.198.25 Reimbursements Overtime hours Overtime Rate Bonus Allowances FICA Wage Deductions Social Security Rate Social Security Limit Medicare FUTA Rate FUTA Limits SUTA Rate SUTA Limit Worker's Comp. Rate General Liability Rate 401 (k) Matching 401 (k) limit Health Insurance Union Dues Training Conference HAS/FSA/DCA Association Total hours Yearly hours allowed Overtime hours Paid Vacation 6.20 142.800 1.45 7.4 - 5.4 = 2 7,500 6.75 13,500 0.52 0.60 0.75 7.00 250 150 1200 3000 500 Times S/Quarter S/Month S/Month % S % % S % S $/$100 % /$1.00 % Of wages S/Month S/Month S/Year S/Year S/Month Monthly cost 221,198.25/12 = 18,433.19 Burden Markup (%) 2,520