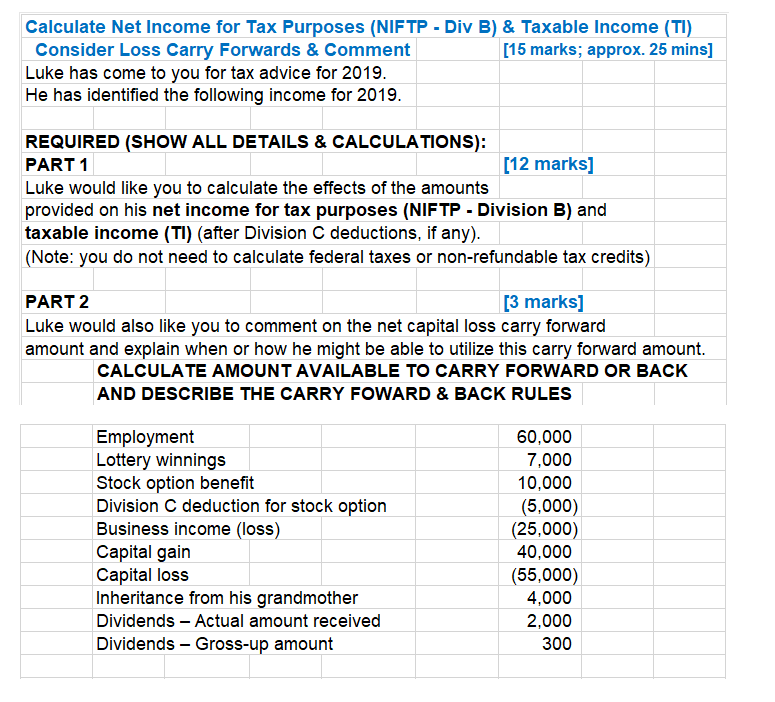

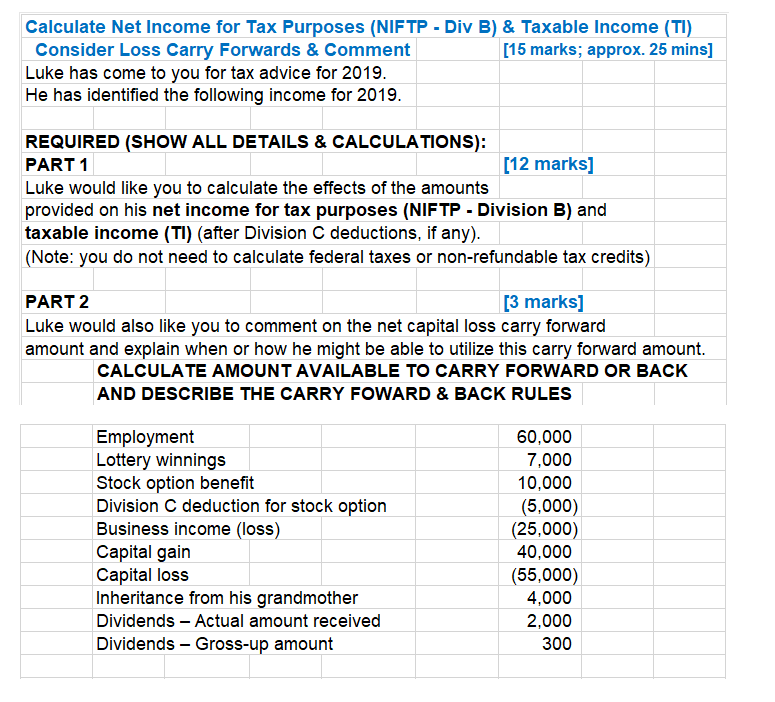

Calculate Net Income for Tax Purposes (NIFTP - Div B) & Taxable Income (TI) Consider Loss Carry Forwards & Comment [15 marks; approx. 25 mins] Luke has come to you for tax advice for 2019. He has identified the following income for 2019. REQUIRED (SHOW ALL DETAILS & CALCULATIONS): PART 1 [12 marks] Luke would like you to calculate the effects of the amounts provided on his net income for tax purposes (NIFTP - Division B) and taxable income (TI) (after Division C deductions, if any). (Note: you do not need to calculate federal taxes or non-refundable tax credits) PART 2 [3 marks] Luke would also like you to comment on the net capital loss carry forward amount and explain when or how he might be able to utilize this carry forward amount. CALCULATE AMOUNT AVAILABLE TO CARRY FORWARD OR BACK AND DESCRIBE THE CARRY FOWARD & BACK RULES Employment Lottery winnings Stock option benefit Division C deduction for stock option Business income (loss) Capital gain Capital loss Inheritance from his grandmother Dividends - Actual amount received Dividends - Gross-up amount 60 000 7,000 10,000 (5,000) (25,000) 40,000 (55,000) 4,000 2,000 300 Calculate Net Income for Tax Purposes (NIFTP - Div B) & Taxable Income (TI) Consider Loss Carry Forwards & Comment [15 marks; approx. 25 mins] Luke has come to you for tax advice for 2019. He has identified the following income for 2019. REQUIRED (SHOW ALL DETAILS & CALCULATIONS): PART 1 [12 marks] Luke would like you to calculate the effects of the amounts provided on his net income for tax purposes (NIFTP - Division B) and taxable income (TI) (after Division C deductions, if any). (Note: you do not need to calculate federal taxes or non-refundable tax credits) PART 2 [3 marks] Luke would also like you to comment on the net capital loss carry forward amount and explain when or how he might be able to utilize this carry forward amount. CALCULATE AMOUNT AVAILABLE TO CARRY FORWARD OR BACK AND DESCRIBE THE CARRY FOWARD & BACK RULES Employment Lottery winnings Stock option benefit Division C deduction for stock option Business income (loss) Capital gain Capital loss Inheritance from his grandmother Dividends - Actual amount received Dividends - Gross-up amount 60 000 7,000 10,000 (5,000) (25,000) 40,000 (55,000) 4,000 2,000 300