Answered step by step

Verified Expert Solution

Question

1 Approved Answer

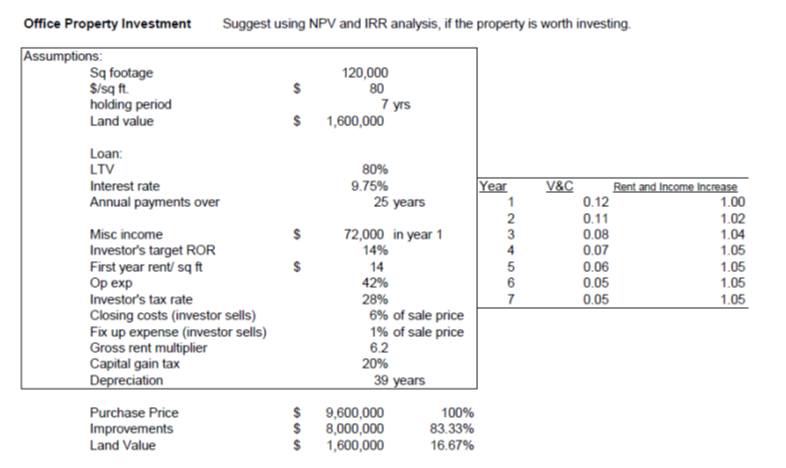

calculate NPV and IRR for the following scenarios: Cash flow from operations Cash flow after financing Cash flow after taxes Suggest using NPV and IRR

calculate NPV and IRR for the following scenarios:

Cash flow from operations

Cash flow after financing

Cash flow after taxes

Suggest using NPV and IRR analysis, if the property is worth investing. Office Property Investment Assumptions: Sq footage $/sq ft holding period Land value $ 80 120,000 7 yrs 1,600,000 $ $ Loan: LTV Interest rate Annual payments over Misc income Investor's target ROR First year rent sq ft Op exp Investor's tax rate Closing costs (investor sells) Fix up expense (investor sells) Gross rent multiplier Capital gain tax Depreciation 80% 9.75% Year 25 years 1 2 72,000 in year 1 3 14% 4 14 5 42% 6 28% 7 6% of sale price 1% of sale price 6.2 20% 39 years 9,600,000 100% 8,000,000 83.33% 1,600,000 16.67% V&C Rent and Income Increase 0.12 1.00 0.11 1.02 0.08 1.04 0.07 1.05 0.06 1.05 0.05 1.05 0.05 1.05 $ Purchase Price Improvements Land Value $ $ $ Suggest using NPV and IRR analysis, if the property is worth investing. Office Property Investment Assumptions: Sq footage $/sq ft holding period Land value $ 80 120,000 7 yrs 1,600,000 $ $ Loan: LTV Interest rate Annual payments over Misc income Investor's target ROR First year rent sq ft Op exp Investor's tax rate Closing costs (investor sells) Fix up expense (investor sells) Gross rent multiplier Capital gain tax Depreciation 80% 9.75% Year 25 years 1 2 72,000 in year 1 3 14% 4 14 5 42% 6 28% 7 6% of sale price 1% of sale price 6.2 20% 39 years 9,600,000 100% 8,000,000 83.33% 1,600,000 16.67% V&C Rent and Income Increase 0.12 1.00 0.11 1.02 0.08 1.04 0.07 1.05 0.06 1.05 0.05 1.05 0.05 1.05 $ Purchase Price Improvements Land Value $ $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started