Question

Calculate the 2019 net profit from Nates Schedule C. Calculate the total 2019 self-employment tax for the Fischers Calculate 2019 Gross Income and Adjusted Gross

- Calculate the 2019 net profit from Nates Schedule C.

- Calculate the total 2019 self-employment tax for the Fischers

- Calculate 2019 Gross Income and Adjusted Gross Income.

- Calculate 2019 Itemized Deductions

- Calculate the 2019 Qualified Business Income Deduction

- Calculate the Fischers tax liability (including Self Employment taxes, Net Investment Income Taxes, and additional Medicare tax) and tax due/refund

- Using IRS fill in forms, Prepare the following 2019 tax return forms for the Fischers. Please include Forms 1040 with schedules 1-4 along with schedules A, B, C, D, E (page 2), SE-Long, Forms 4952, 8959, 8960.

Nate and Ruth Fischer are married and file a joint return. They have three dependent children under the age of 15. None of their children work. Fischers 2019 financial information follows:

Nates Salary $130,000

Ruths Salary $420,000

Interest from Plains National Bank $12,500

Interest from U.S. Treasury Bonds $22,500

Interest from the state of California bonds $10,250

Dividends from Microsoft $23,000

Long term capital gain $31,000

Short term capital gain $15,000

Gambling winnings - lottery $20,000

Annuity payments received (Inv: $60,000, return $100,000) $40,000

Life Insurance Proceeds $450,000

Inheritance from Grandmother $750,000

Gift from family $420,000

Legitimate out of pocket medical expenses $72,000

Contributions to a Roth IRA $9,000

Mortgage interest ($1,500,000 principal) $82,000 (acquired in 2018)

Real estate taxes (on value of homes) $21,800

Charitable contributions $32,000

Investment interest expense $69,000

K-1 Ordinary Income Ruth (LLC) $82,000- Eligible for QBI

K-1 Ordinary Loss - Nate (Partnership) ($37,000)- Eligible for QBI

K-1 Ruth S Corporation (Ordinary Income) $36,000 - Eligible for QBI

Federal Income Taxes withheld/paid during the year 2019 $375,000

Sole Proprietorship for Nate- (Eligible for QBI)

Revenue $750,000

Salaries paid to his staff $152,000

Self Employed Medical Insurance $17,000 (be careful where you deduct these)

SEP Payments $46,000 (be careful where you deduct these)

Office expenses $19,500

Travel $19,000

Legal and professional fees $7,750

Rent expense $32,400

Business meals $16,400

Country club memberships $8,000

Payroll tax expense $26,250

Business gifts ($100 per gift to 8 customers) $800

Penalties and fines payable to the State of Texas $6,500

Withdrawals by the business owner of cash $65,000 (these are owners draws)

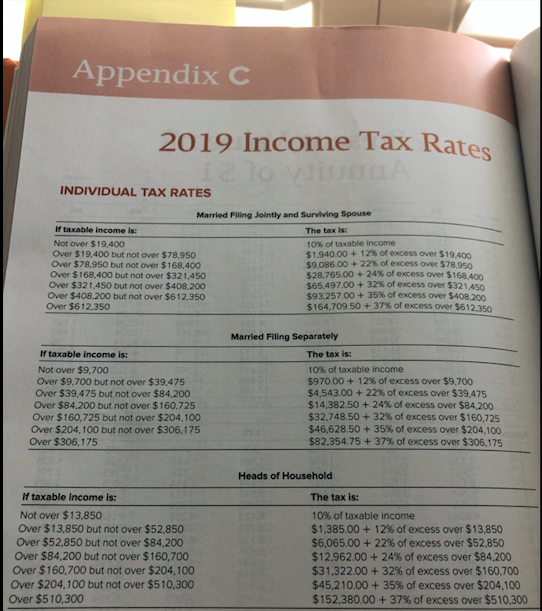

Appendix C 2019 Income Tax Rates To va INDIVIDUAL TAX RATES Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19,400 10% of taxable income Over $19.400 but not over $78,950 $1.940.00 + 12% of excess over $19.400 Over $78,950 but not over $168,400 $9,086.00 + 22% of excess over $78,950 Over $168,400 but not over $321,450 $28,765.00 +24% of excess over $168.400 Over $321,450 but not over $408.200 $65.497.00 + 32% of excess over $321.450 Over $408.200 but not over $612,350 $93.257.00 + 35% of excess over $408.200 Over $612,350 $164.709.50 +37% of excess over $612350 If taxable income is: Not over $9.700 Over $9.700 but not over $39,475 Over $39,475 but not over $84.200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 Married Filing Separately The tax is: 10% of taxable income $970.00 + 12% of excess over $9,700 $4,543.00 + 22% of excess over $39.475 $14,382.50 + 24% of excess over $84.200 $32.748.50 + 32% of excess over $160,725 $46.628.50 + 35% of excess over $204,100 $82.354.75 + 37% of excess over $306,175 Heads of Household If taxable income is: The tax is: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84.200 Over $84,200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of taxable income $1,385.00 + 12% of excess over $13,850 $6,065.00 + 22% of excess over $52,850 $12.962.00 +24% of excess over $84.200 $31.322.00 + 32% of excess over $160,700 $45,210.00 + 35% of excess over $204,100 $152,380.00 + 37% of excess over $510,300 Appendix C 2019 Income Tax Rates To va INDIVIDUAL TAX RATES Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19,400 10% of taxable income Over $19.400 but not over $78,950 $1.940.00 + 12% of excess over $19.400 Over $78,950 but not over $168,400 $9,086.00 + 22% of excess over $78,950 Over $168,400 but not over $321,450 $28,765.00 +24% of excess over $168.400 Over $321,450 but not over $408.200 $65.497.00 + 32% of excess over $321.450 Over $408.200 but not over $612,350 $93.257.00 + 35% of excess over $408.200 Over $612,350 $164.709.50 +37% of excess over $612350 If taxable income is: Not over $9.700 Over $9.700 but not over $39,475 Over $39,475 but not over $84.200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 Married Filing Separately The tax is: 10% of taxable income $970.00 + 12% of excess over $9,700 $4,543.00 + 22% of excess over $39.475 $14,382.50 + 24% of excess over $84.200 $32.748.50 + 32% of excess over $160,725 $46.628.50 + 35% of excess over $204,100 $82.354.75 + 37% of excess over $306,175 Heads of Household If taxable income is: The tax is: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84.200 Over $84,200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of taxable income $1,385.00 + 12% of excess over $13,850 $6,065.00 + 22% of excess over $52,850 $12.962.00 +24% of excess over $84.200 $31.322.00 + 32% of excess over $160,700 $45,210.00 + 35% of excess over $204,100 $152,380.00 + 37% of excess over $510,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started