Calculate the 5-year unit demand forecast for Metabical using each of the three approaches considered by Printup. Assume that we have decided to package the product as a 4-week supply.

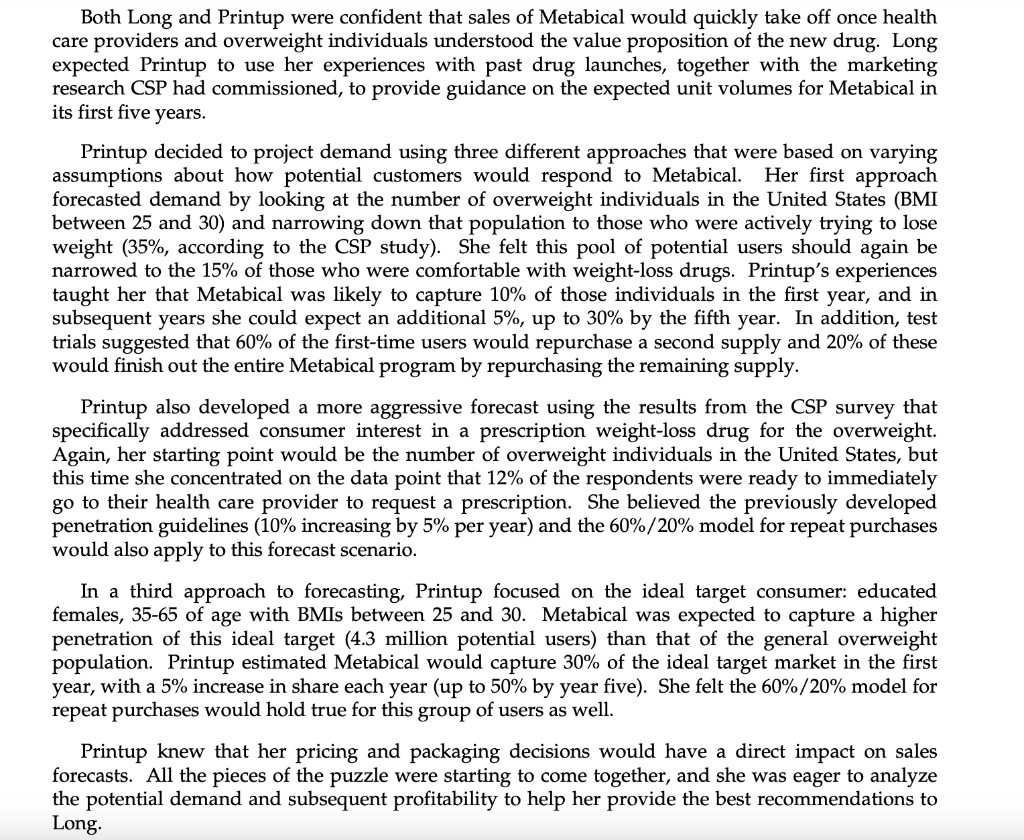

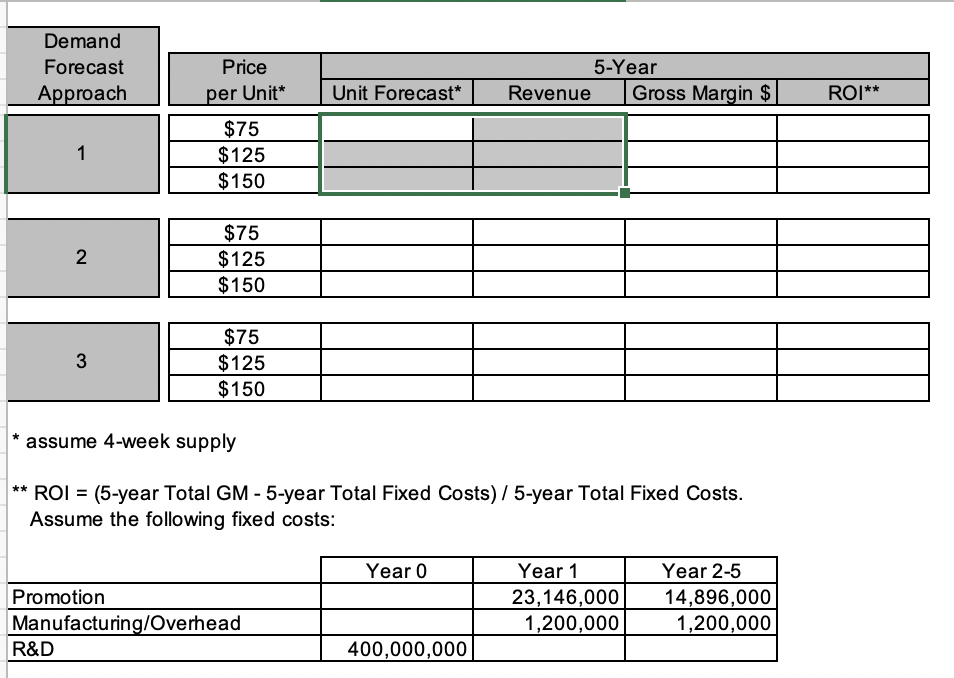

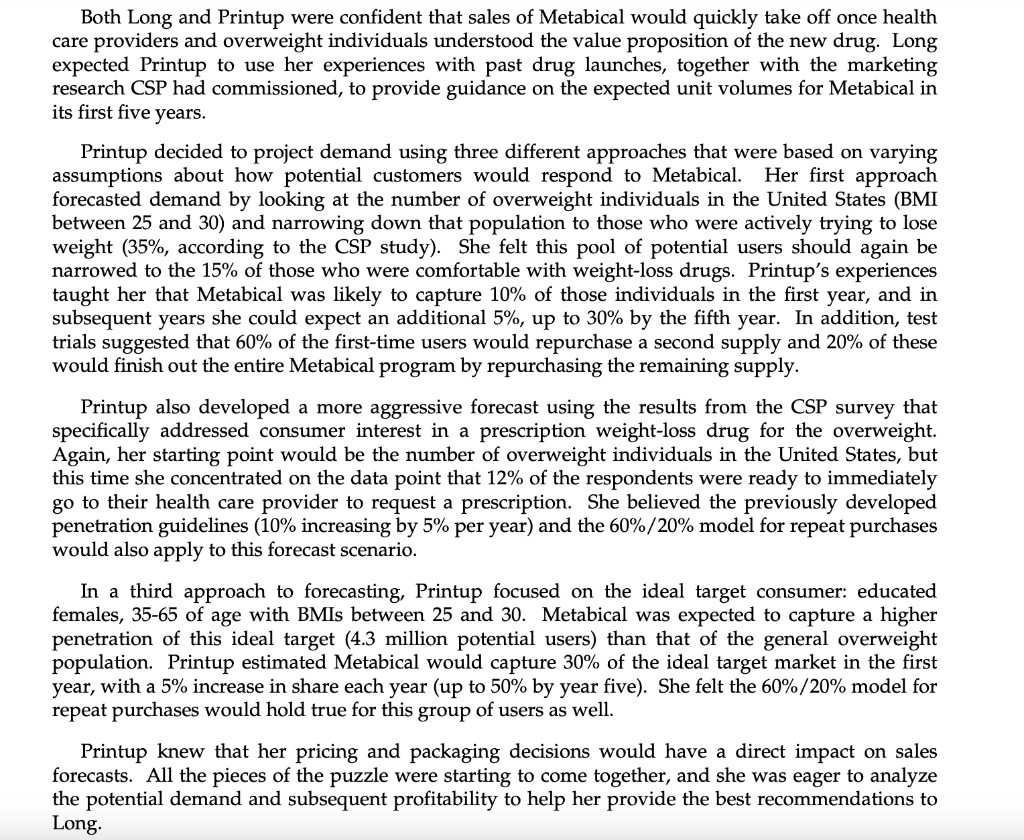

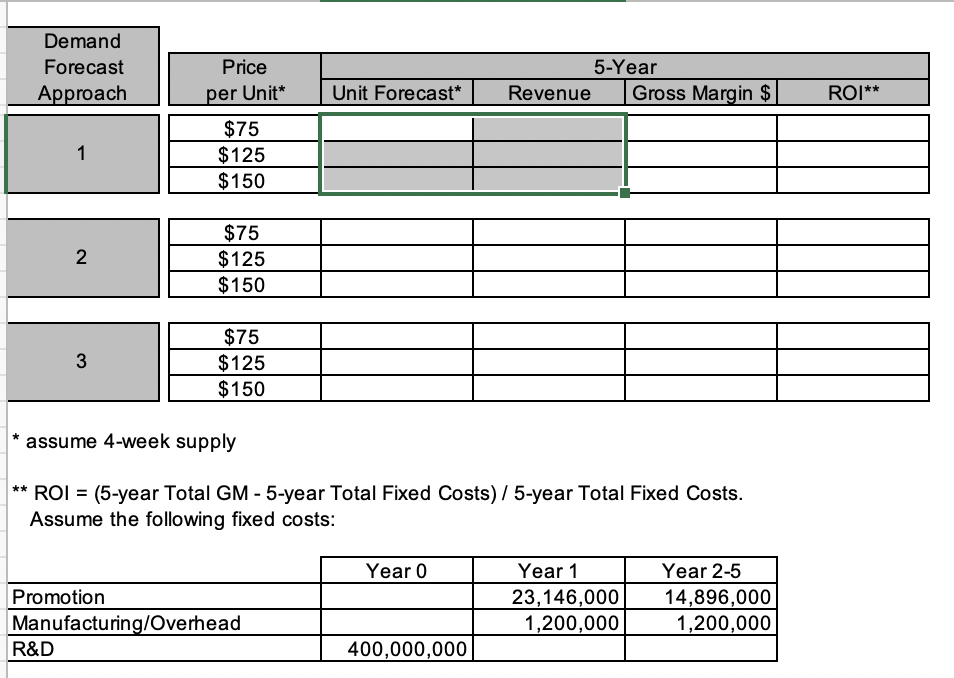

Both Long and Printup were confident that sales of Metabical would quickly take off once health care providers and overweight individuals understood the value proposition of the new drug. Long expected Printup to use her experiences with past drug launches, together with the marketing research CSP had commissioned, to provide guidance on the expected unit volumes for Metabical in its first five years. Printup decided to project demand using three different approaches that were based on varying assumptions about how potential customers would respond to Metabical. Her first approach forecasted demand by looking at the number of overweight individuals in the United States (BMI between 25 and 30) and narrowing down that population to those who were actively trying to lose weight (35%, according to the CSP study). She felt this pool of potential users should again be narrowed to the 15% of those who were comfortable with weight-loss drugs. Printup's experiences taught her that Metabical was likely to capture 10% of those individuals in the first year, and in subsequent years she could expect an additional 5%, up to 30% by the fifth year. In addition, test trials suggested that 60% of the first-time users would repurchase a second supply and 20% of these would finish out the entire Metabical program by repurchasing the remaining supply. Printup also developed a more aggressive forecast using the results from the CSP survey that specifically addressed consumer interest in a prescription weight-loss drug for the overweight. Again, her starting point would be the number of overweight individuals in the United States, but this time she concentrated on the data point that 12% of the respondents were ready to immediately go to their health care provider to request a prescription. She believed the previously developed penetration guidelines (10% increasing by 5% per year) and the 60%/20% model for repeat purchases would also apply to this forecast scenario. In a third approach to forecasting, Printup focused on the ideal target consumer: educated females, 35-65 of age with BMIs between 25 and 30. Metabical was expected to capture a higher penetration of this ideal target (4.3 million potential users) than that of the general overweight population. Printup estimated Metabical would capture 30% of the ideal target market in the first year, with a 5% increase in share each year (up to 50% by year five). She felt the 60%/20% model for repeat purchases would hold true for this group of users as well. Printup knew that her pricing and packaging decisions would have a direct impact on sales forecasts. All the pieces of the puzzle were starting to come together, and she was eager to analyze the potential demand and subsequent profitability to help her provide the best recommendations to Long Demand Forecast Approach Price 5-Year Revenue Gross Margin $ per Unit* Unit Forecast* ROI** 1 $75 $125 $150 2 $75 $125 $150 3 $75 $125 $150 assume 4-week supply ** ROI = (5-year Total GM - 5-year Total Fixed Costs) / 5-year Total Fixed Costs. Assume the following fixed costs: Year 0 Promotion Manufacturing/Overhead R&D Year 1 23,146,000 1,200,000 Year 2-5 14,896,000 1,200,000 400,000,000 Both Long and Printup were confident that sales of Metabical would quickly take off once health care providers and overweight individuals understood the value proposition of the new drug. Long expected Printup to use her experiences with past drug launches, together with the marketing research CSP had commissioned, to provide guidance on the expected unit volumes for Metabical in its first five years. Printup decided to project demand using three different approaches that were based on varying assumptions about how potential customers would respond to Metabical. Her first approach forecasted demand by looking at the number of overweight individuals in the United States (BMI between 25 and 30) and narrowing down that population to those who were actively trying to lose weight (35%, according to the CSP study). She felt this pool of potential users should again be narrowed to the 15% of those who were comfortable with weight-loss drugs. Printup's experiences taught her that Metabical was likely to capture 10% of those individuals in the first year, and in subsequent years she could expect an additional 5%, up to 30% by the fifth year. In addition, test trials suggested that 60% of the first-time users would repurchase a second supply and 20% of these would finish out the entire Metabical program by repurchasing the remaining supply. Printup also developed a more aggressive forecast using the results from the CSP survey that specifically addressed consumer interest in a prescription weight-loss drug for the overweight. Again, her starting point would be the number of overweight individuals in the United States, but this time she concentrated on the data point that 12% of the respondents were ready to immediately go to their health care provider to request a prescription. She believed the previously developed penetration guidelines (10% increasing by 5% per year) and the 60%/20% model for repeat purchases would also apply to this forecast scenario. In a third approach to forecasting, Printup focused on the ideal target consumer: educated females, 35-65 of age with BMIs between 25 and 30. Metabical was expected to capture a higher penetration of this ideal target (4.3 million potential users) than that of the general overweight population. Printup estimated Metabical would capture 30% of the ideal target market in the first year, with a 5% increase in share each year (up to 50% by year five). She felt the 60%/20% model for repeat purchases would hold true for this group of users as well. Printup knew that her pricing and packaging decisions would have a direct impact on sales forecasts. All the pieces of the puzzle were starting to come together, and she was eager to analyze the potential demand and subsequent profitability to help her provide the best recommendations to Long Demand Forecast Approach Price 5-Year Revenue Gross Margin $ per Unit* Unit Forecast* ROI** 1 $75 $125 $150 2 $75 $125 $150 3 $75 $125 $150 assume 4-week supply ** ROI = (5-year Total GM - 5-year Total Fixed Costs) / 5-year Total Fixed Costs. Assume the following fixed costs: Year 0 Promotion Manufacturing/Overhead R&D Year 1 23,146,000 1,200,000 Year 2-5 14,896,000 1,200,000 400,000,000