Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate the Balance sheet calculate balance sheet with this following (only I have that information) 5 2,500 0 0 3,750 6,250 33,336 6,664 0 1,000

calculate the Balance sheet

calculate balance sheet with this following (only I have that information)

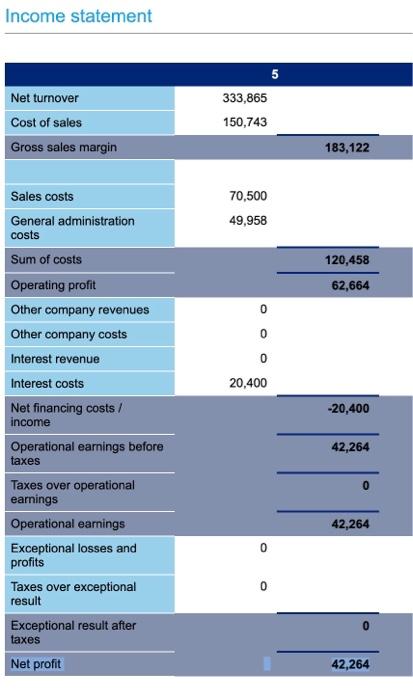

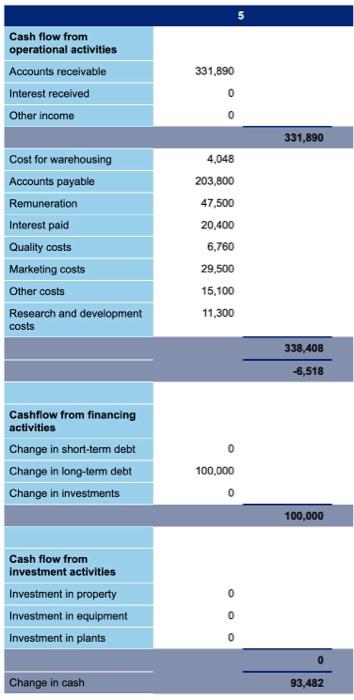

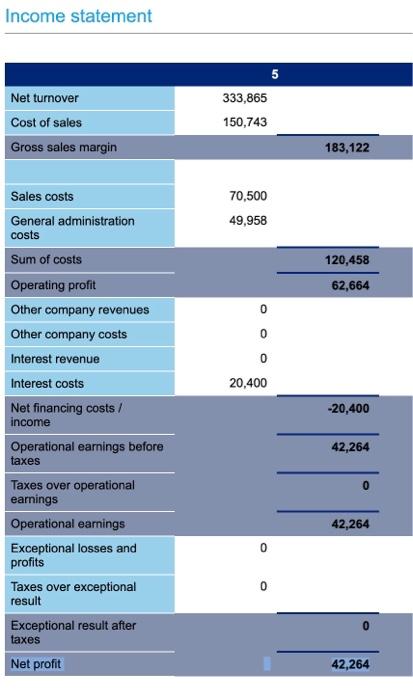

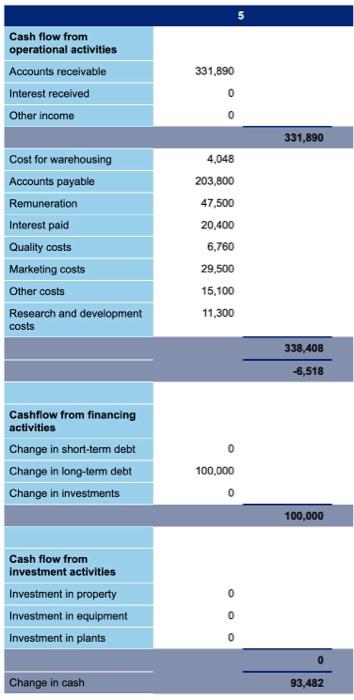

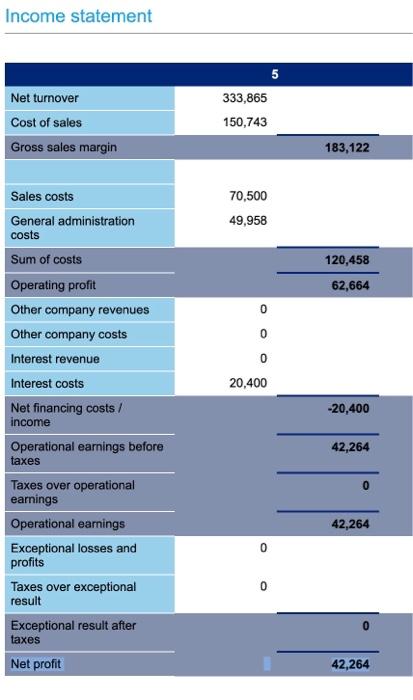

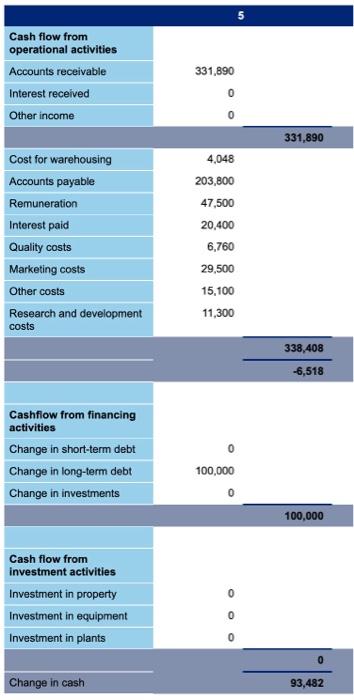

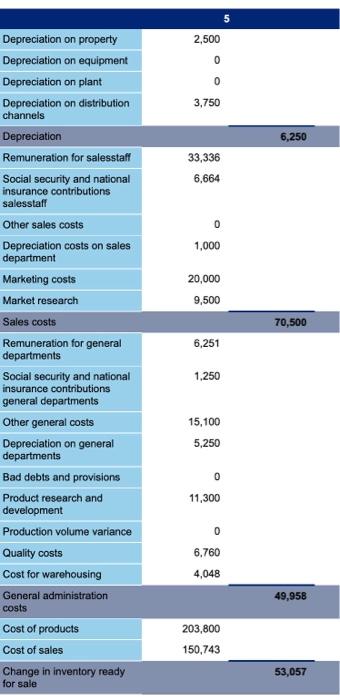

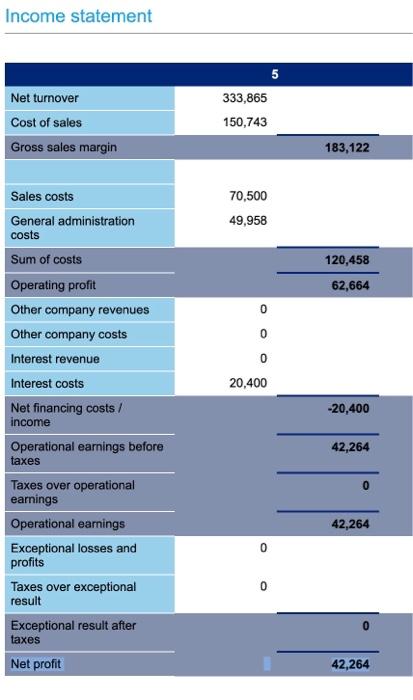

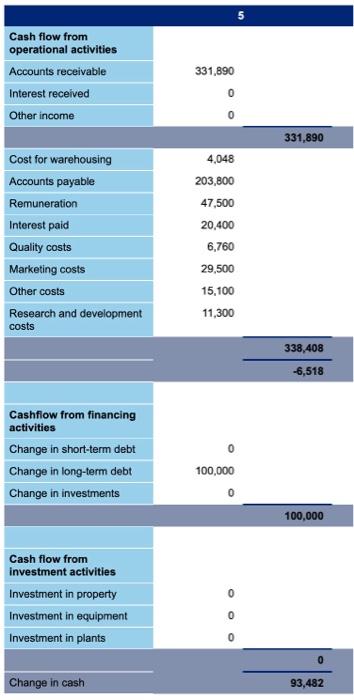

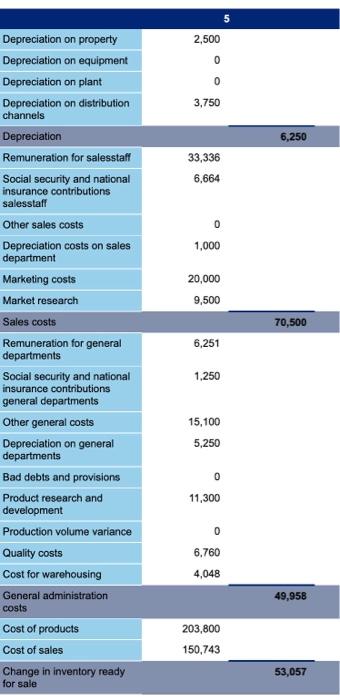

5 2,500 0 0 3,750 6,250 33,336 6,664 0 1,000 20,000 9,500 70,500 6,251 Depreciation on property Depreciation on equipment Depreciation on plant Depreciation on distribution channels Depreciation Remuneration for salesstaff Social security and national insurance contributions salesstaff Other sales costs Depreciation costs on sales department Marketing costs Market research Sales costs Remuneration for general departments Social security and national insurance contributions general departments Other general costs Depreciation on general departments Bad debts and provisions Product research and development Production volume variance Quality costs Cost for warehousing General administration costs Cost of products Cost of sales Change in inventory ready for sale 1,250 15,100 5,250 0 11,300 0 6,760 4,048 49,958 203,800 150,743 53,057 Income statement 5 Net turnover Cost of sales Gross sales margin 333,865 150,743 183,122 70,500 49,958 120,458 62,664 0 0 0 20,400 -20,400 Sales costs General administration costs Sum of costs Operating profit Other company revenues Other company costs Interest revenue Interest costs Net financing costs / income Operational earnings before taxes Taxes over operational earnings Operational earnings Exceptional losses and profits Taxes over exceptional result Exceptional result after taxes Net profit 42,264 0 42,264 0 0 42,264 5 Cash flow from operational activities Accounts receivable Interest received Other income 331,890 0 0 331,890 Cost for warehousing Accounts payable Remuneration Interest paid Quality costs Marketing costs Other costs Research and development costs 4,048 203,800 47,500 20,400 6.760 29,500 15,100 11,300 338,408 -6,518 0 Cashflow from financing activities Change in short-term debt Change in long-term debt Change in investments 100,000 0 100,000 Cash flow from investment activities Investment in property Investment in equipment Investment in plants Change in cash 93,482 Income statement 5 Net turnover Cost of sales Gross sales margin 333,865 150,743 183,122 70,500 49,958 120,458 62,664 0 0 0 20,400 -20,400 Sales costs General administration costs Sum of costs Operating profit Other company revenues Other company costs Interest revenue Interest costs Net financing costs / income Operational earnings before taxes Taxes over operational earnings Operational earnings Exceptional losses and profits Taxes over exceptional result Exceptional result after taxes Net profit 42,264 0 42,264 0 0 42,264 5 Cash flow from operational activities Accounts receivable Interest received Other income 331,890 0 0 331,890 Cost for warehousing Accounts payable Remuneration Interest paid Quality costs Marketing costs Other costs Research and development costs 4,048 203,800 47,500 20,400 6.760 29,500 15,100 11,300 338,408 -6,518 0 Cashflow from financing activities Change in short-term debt Change in long-term debt Change in investments 100,000 0 100,000 Cash flow from investment activities Investment in property Investment in equipment Investment in plants Change in cash 93,482 5 2,500 0 0 3,750 6,250 33,336 6,664 0 1,000 20,000 9,500 70,500 6,251 Depreciation on property Depreciation on equipment Depreciation on plant Depreciation on distribution channels Depreciation Remuneration for salesstaff Social security and national insurance contributions salesstaff Other sales costs Depreciation costs on sales department Marketing costs Market research Sales costs Remuneration for general departments Social security and national insurance contributions general departments Other general costs Depreciation on general departments Bad debts and provisions Product research and development Production volume variance Quality costs Cost for warehousing General administration costs Cost of products Cost of sales Change in inventory ready for sale 1,250 15,100 5,250 0 11,300 0 6,760 4,048 49,958 203,800 150,743 53,057

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started