Answered step by step

Verified Expert Solution

Question

1 Approved Answer

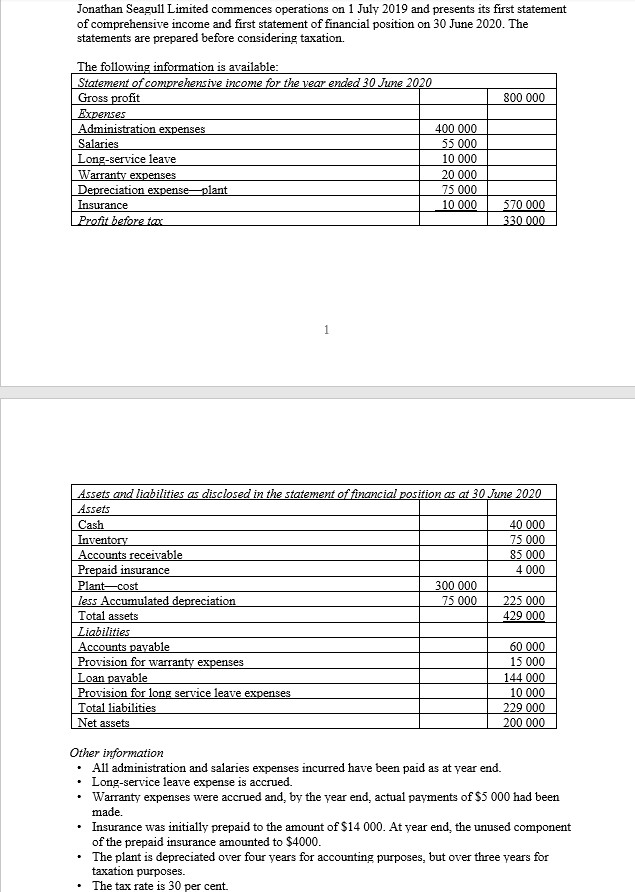

Calculate the current tax payable, deferred tax asset and liability at 30 June 2020 and provide the relevant journal entries. Briefly explain how deferred tax

Calculate the current tax payable, deferred tax asset and liability at 30 June 2020 and provide the relevant journal entries. Briefly explain how deferred tax should be presented in the Statement of financial position of Jonathan Seagull Ltd in accordance with AASB 112.

Jonathan Seagull Limited commences operations on 1 July 2019 and presents its first statement of comprehensive income and first statement of financial position on 30 June 2020. The statements are prepared before considering taxation. The following information is available: Statement of comprehensive income for the vear ended 30 June 2020 Gross profit 800 000 Expenses Administration expenses 400 000 Salaries 55 000 Long-service leave 10 000 Warranty expenses 20 000 Depreciation expense plant 75 000 Insurance 10 000 570 000 Profit before tai 330.000 1 Assets and liabilities as disclosed in the statement of financial position as at 30 June 2020 Assets Cash 40 000 Inventory 75 000 Accounts receivable 85 000 Prepaid insurance 4 000 Plant-cost 300 000 less Accumulated depreciation 75 000 225 000 Total assets 429 000 Liabilities Accounts payable 60 000 Provision for warranty expenses 15 000 Loan payable 144 000 Provision for long service leave expenses 10 000 Total liabilities 229 000 Net assets 200 000 + Other information All administration and salaries expenses incurred have been paid as at year end. Long-service leave expense is accrued. Warranty expenses were accrued and, by the year end, actual payments of $5 000 had been made. Insurance was initially prepaid to the amount of $14 000. At year end, the unused component of the prepaid insurance amounted to $4000. The plant is depreciated over four years for accounting purposes, but over three years for taxation purposes. The tax rate is 30 per cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started