Answered step by step

Verified Expert Solution

Question

1 Approved Answer

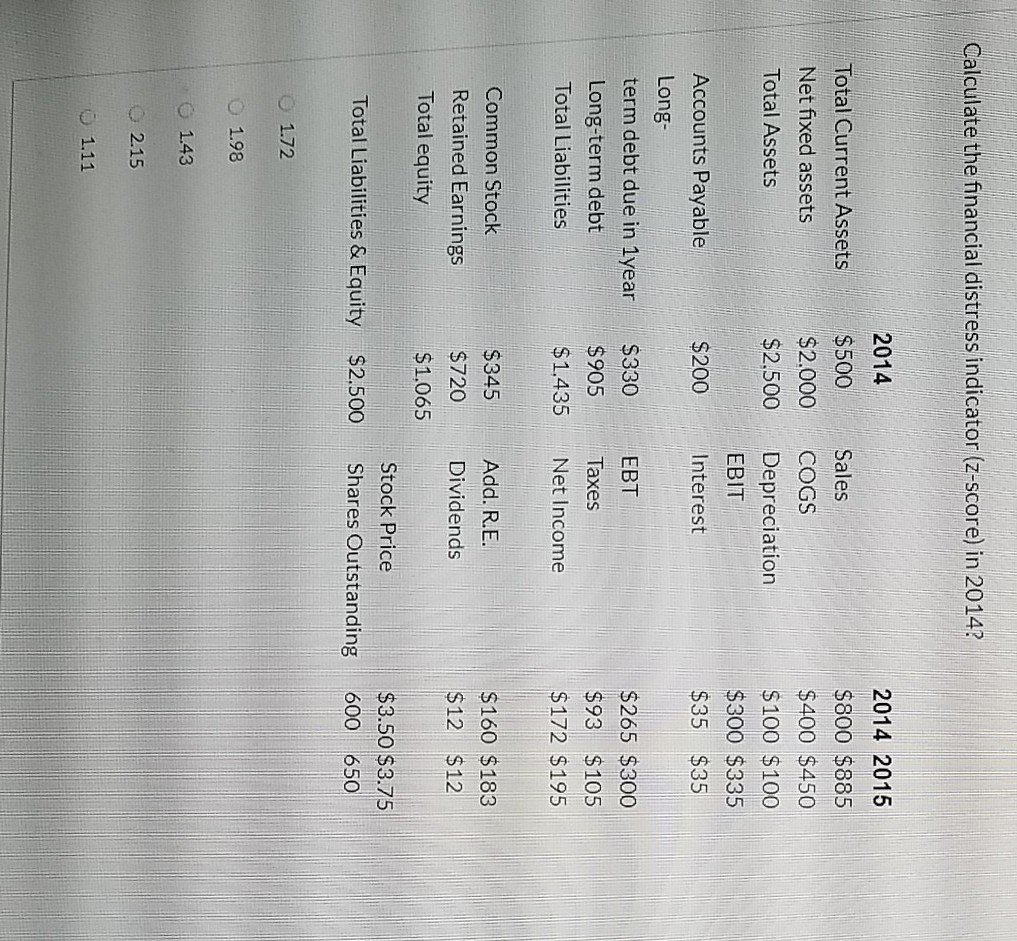

Calculate the financial distress indicator (z-score) in 2014? Total Current Assets Net fixed assets Total Assets 2014 $500 $2.000 $2.500 Sales COGS Depreciation EBIT 2014

Calculate the financial distress indicator (z-score) in 2014? Total Current Assets Net fixed assets Total Assets 2014 $500 $2.000 $2.500 Sales COGS Depreciation EBIT 2014 2015 $800 $885 $400 $450 $100 $100 $300 $335 $35 $35 Accounts Payable $200 Interest Long EBT term debt due in 1year Long-term debt Total Liabilities $330 $905 $1.435 Taxes Net Income $265 $300 $93 $105 $172 $195 Common Stock Retained Earnings Total equity $345 $720 $1.065 Add. R.E. Dividends $160 $183 $12 $12 Total Liabilities & Equity Stock Price Shares Outstanding $3.50 $3.75 600 650 $2.500 1.72 1.98 1.43 2.15 1.11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started