Question

Calculate the financial ratios listed below for 2022, 2021, and 2020 financial statements. Provide both a horizontal and vertical analysis. A. Liquidity and Efficiency i.

Calculate the financial ratios listed below for 2022, 2021, and 2020 financial statements. Provide both a horizontal and vertical analysis.

A. Liquidity and Efficiency

i. Current Ratio = Current Assets / Current Liabilities

ii. Total Assets Turnover = Net Sales / Average Total Assets (use the total assets for each year)

B. Solvency

i. Debt Ratio = Total Liabilities / Total Assets

ii. Equity Ratio = Total Equity / Total Assets

C. Profitability

i. Net Income / Net Sales

ii. Net Income / Average Total Assets

D. Market Prospects

i. Price Earnings Ratio = Market Price Per Common Share / Earnings Per Share (EPS) (Market Price: 62.08 USD)

E. Analyze the company’s financial position and its ability to prosper going forward.

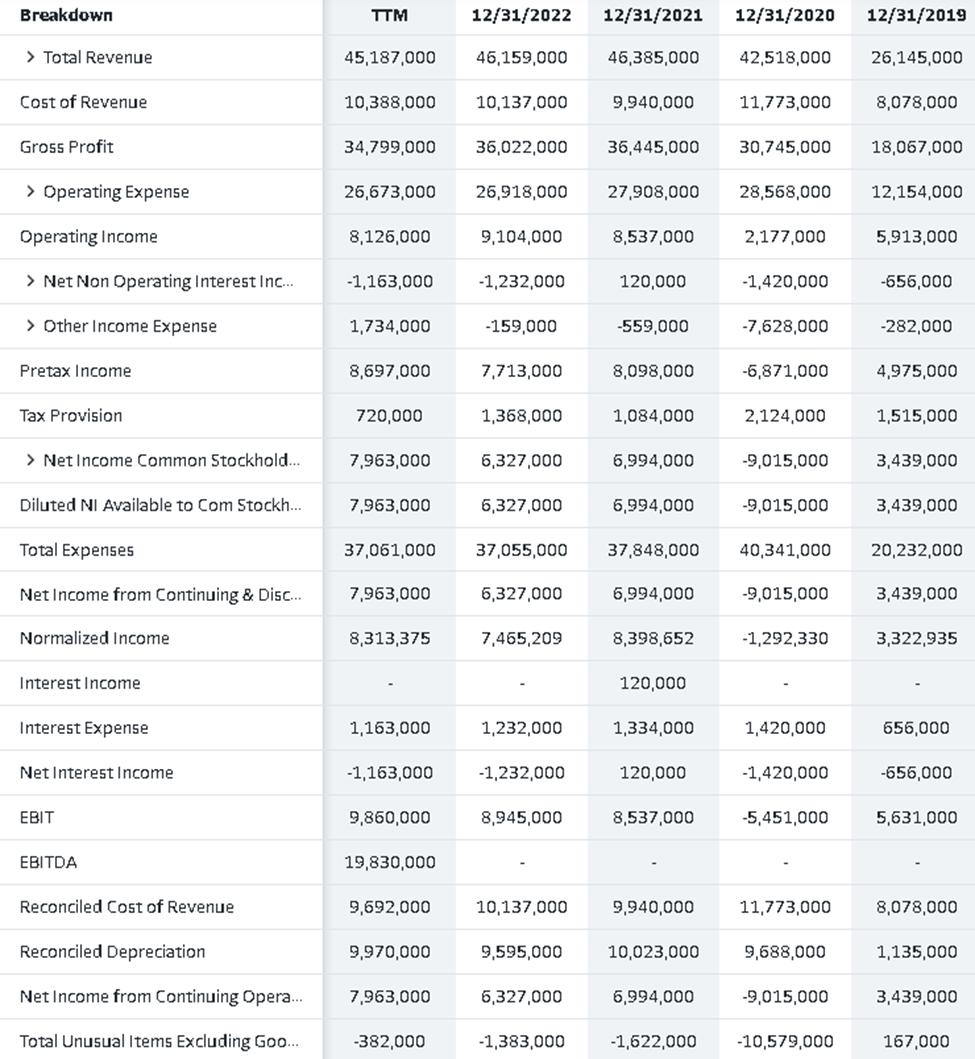

Income Statement:

Balance sheet:

Cash Flow:

Breakdown > Total Revenue Cost of Revenue Gross Profit > Operating Expense Operating Income > Net Non Operating Interest Inc... > Other Income Expense Pretax Income Tax Provision > Net Income Common Stockhold.... Diluted NI Available to Com Stockh..... Total Expenses Net Income from Continuing & Disc... Normalized Income Interest Income Interest Expense Net Interest Income EBIT EBITDA Reconciled Cost of Revenue Reconciled Depreciation Net Income from Continuing Opera... Total Unusual Items Excluding Goo.... TTM 45,187,000 10,388,000 34,799,000 26,673,000 8,126,000 -1,163,000 1,734,000 8,697,000 720,000 7,963,000 7,963,000 37,061,000 7,963,000 8,313,375 1,163,000 -1,163,000 9,860,000 19,830,000 9,692,000 9,970,000 7,963,000 -382,000 12/31/2022 12/31/2021 12/31/2020 12/31/2019 46,159,000 46,385,000 42,518,000 26,145,000 10,137,000 36,022,000 36,445,000 26,918,000 9,104,000 -1,232,000 -159,000 7,713,000 1,368,000 6,327,000 6,327,000 37,055,000 6,327,000 7,465,209 1,232,000 -1,232,000 8,945,000 10,137,000 9,595,000 6,327,000 9,940,000 -1,383,000 27,908,000 8,537,000 120,000 -559,000 8,098,000 1,084,000 6,994,000 6,994,000 37,848,000 6,994,000 8,398,652 120,000 1,334,000 120,000 8,537,000 9,940,000 10,023,000 6,994,000 -1,622,000 11,773,000 30,745,000 28,568,000 2,177,000 -1,420,000 -7,628,000 -6,871,000 2,124,000 -9,015,000 -9,015,000 40,341,000 -9,015,000 -1,292,330 1,420,000 -1,420,000 -5,451,000 11,773,000 9,688,000 -9,015,000 -10,579,000 8,078,000 18,067,000 12,154,000 5,913,000 -656,000 -282,000 4,975,000 1,515,000 3,439,000 3,439,000 20,232,000 3,439,000 3,322,935 656,000 -656,000 5,631,000 8,078,000 1,135,000 3,439,000 167,000

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A You will need to utilize the appropriate information from the financial statements you provided to compute the financial ratios for liquidity and efficiency current ratio and total assets turnover f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started