Answered step by step

Verified Expert Solution

Question

1 Approved Answer

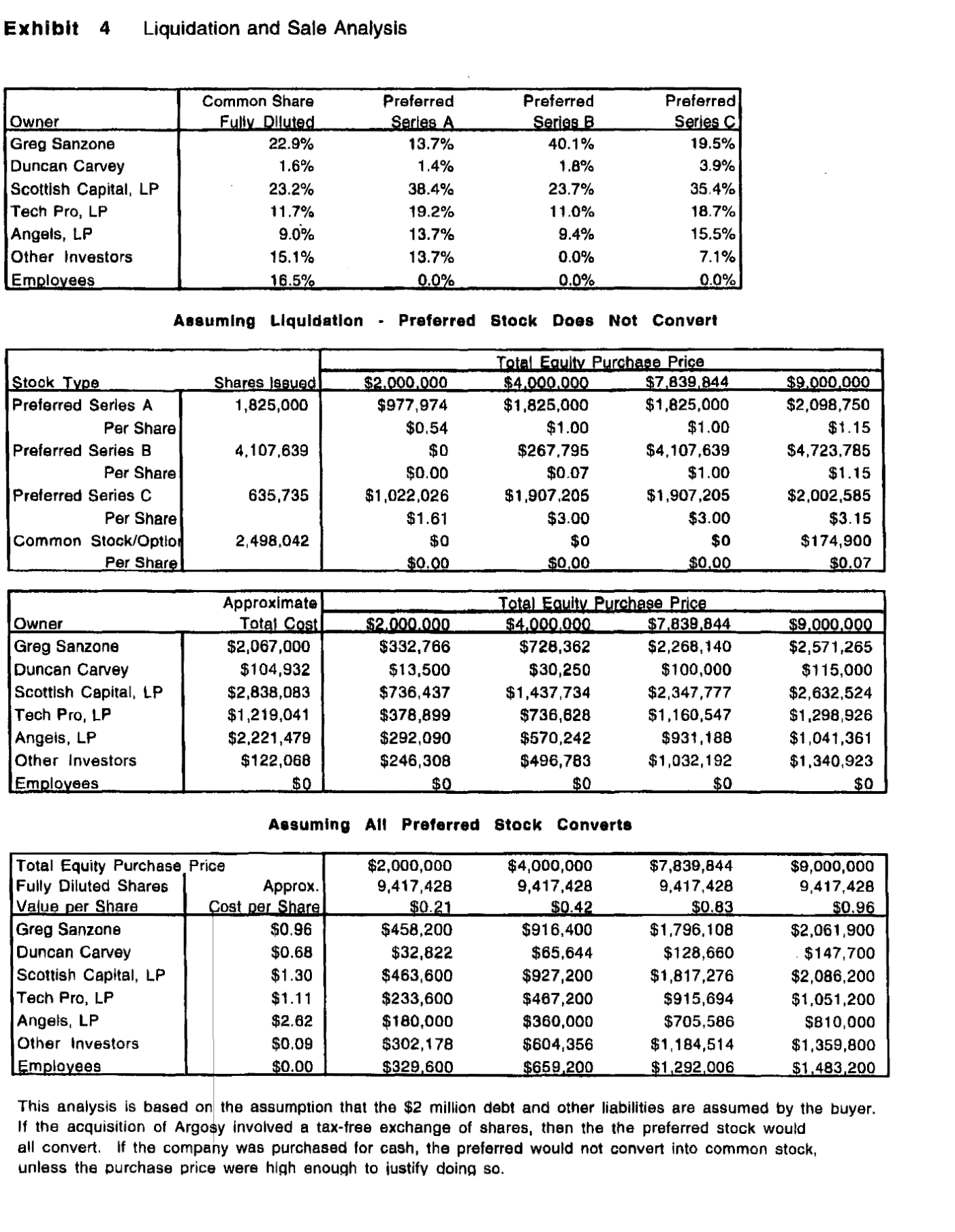

Calculate the financial value of each alternative to each director or his/her organization. Based on your analysis, which alternative do prefer? Exhibit 4 Liquidation and

Calculate the financial value of each alternative to each director or his/her organization. Based on your analysis, which alternative do prefer?

Exhibit 4 Liquidation and Sale Analysis Owner Greg Sanzone Duncan Carvey Scottish Capital, LP Tech Pro, LP Angels, LP Other Investors Employees Common Share Preferred Preferred Fully Diluted Series A Series B 22.9% 13.7% 40.1% Preferred Series C 19.5% 1.6% 1.4% 1.8% 3.9% 23.2% 38.4% 23.7% 35.4% 11.7% 19.2% 11.0% 18.7% 9.0% 13.7% 9.4% 15.5% 15.1% 13.7% 0.0% 7.1% 16.5% 0.0% 0.0% 0.0% Assuming Liquidation Preferred Stock Does Not Convert Total Equity Purchase Price Stock Type Shares Issued $2,000,000 $4,000,000 $7,839,844 $9,000,000 Preferred Series A 1,825,000 $977,974 $1,825,000 $1,825,000 $2,098,750 Per Share $0.54 $1.00 $1.00 $1.15 Preferred Series B 4,107,639 $0 Per Share $0.00 Preferred Series C 635,735 $1,022,026 $267,795 $0.07 $1,907,205 $4,107,639 $4,723,785 $1.00 $1,907,205 $1.15 $2,002,585 Per Share $1.61 Common Stock/Option 2,498,042 Per Share $0 $0.00 $3.00 $0 $0,00 $3.00 $0 $3.15 $174,900 $0.00 $0.07 Owner Approximate Total Cost Total Equity Purchase Price $2.000.000 $4,000,000 $7,839,844 $9,000,000 Greg Sanzone $2,067,000 $332,766 $728,362 $2,268,140 $2,571,265 Duncan Carvey $104,932 $13,500 $30,250 $100,000 $115,000 Scottish Capital, LP $2,838,083 $736,437 $1,437,734 $2,347,777 $2,632,524 Tech Pro, LP $1,219,041 $378,899 $736,828 $1,160,547 $1,298,926 Angels, LP $2,221,479 $292,090 $570,242 $931,188 $1,041,361 Other Investors $122,068 $246,308 Employees $0 $0 $496,783 $0 $1,032,192 $1,340,923 $0 $0 Assuming All Preferred Stock Converts Total Equity Purchase Price $2,000,000 $4,000,000 Fully Diluted Shares Approx. 9,417,428 9,417,428 $7,839,844 9,417,428 $9,000,000 9,417,428 Value per Share Cost per Share $0.21 Greg Sanzone $0.96 $458,200 $0.42 $916,400 $0.83 $1,796,108 $0.96 $2,061,900 Duncan Carvey $0.68 $32,822 $65,644 $128,660 $147,700 Scottish Capital, LP $1.30 $463,600 $927,200 $1,817,276 $2,086,200 Tech Pro, LP $1.11 $233,600 $467,200 $915,694 $1,051,200 Angels, LP $2.62 $180,000 $360,000 $705,586 $810,000 Other Investors $0.09 $302,178 $604,356 $1,184,514 $1,359,800 Employees $0.00 $329,600 $659,200 $1,292,006 $1,483,200 This analysis is based on the assumption that the $2 million debt and other liabilities are assumed by the buyer. If the acquisition of Argosy involved a tax-free exchange of shares, then the the preferred stock would all convert. If the company was purchased for cash, the preferred would not convert into common stock, unless the purchase price were high enough to justify doing so.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started