Answered step by step

Verified Expert Solution

Question

1 Approved Answer

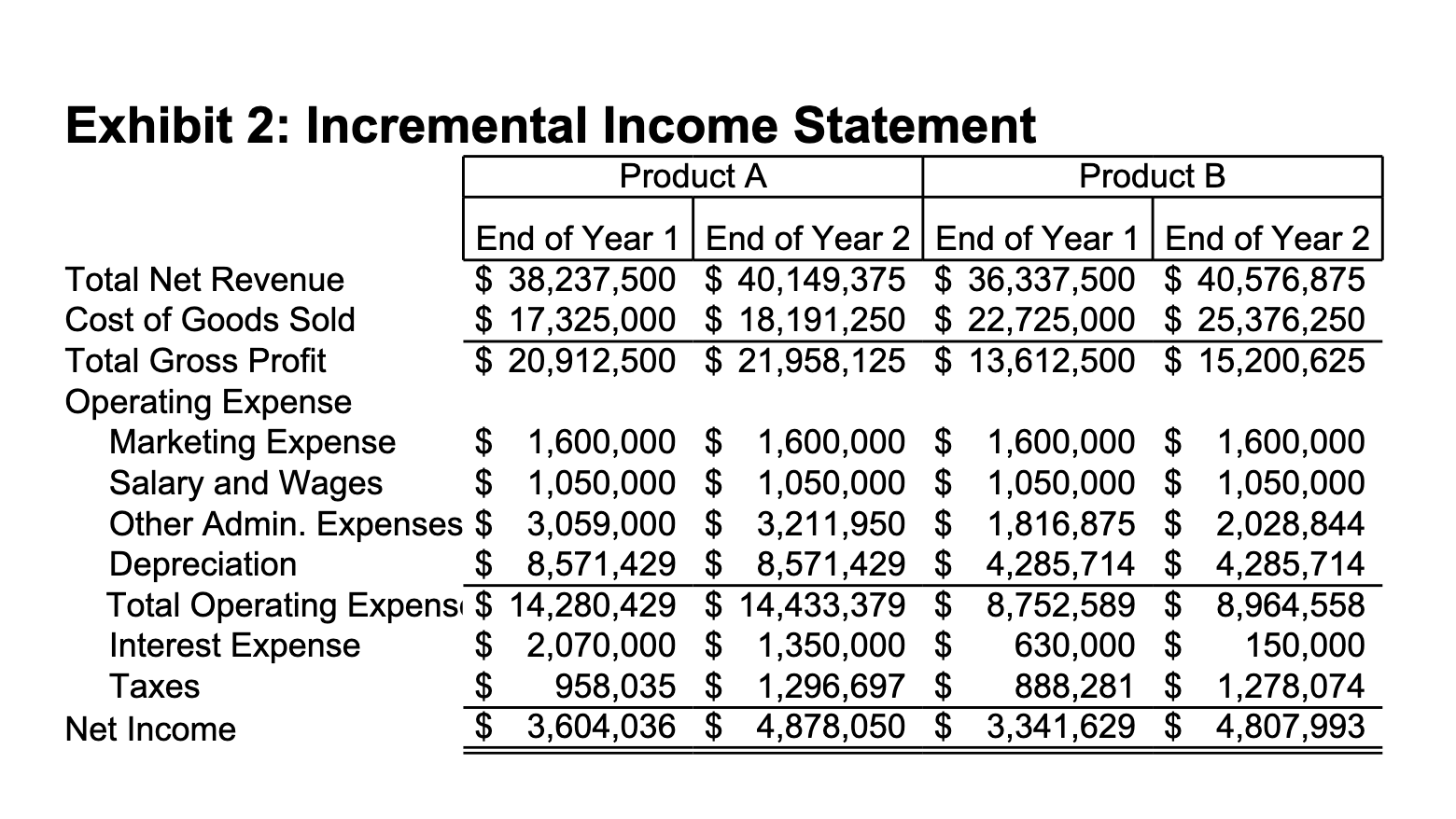

For the product launch that you believe adds the most value, at the end of year 2, what will be the product launch's: Question 1:

For the product launch that you believe adds the most value, at the end of year 2, what will be the product launch's:

- Question 1: Net Profit Margin

- Question 2: Asset Turnover Ratio (also referred to as Asset Utilization)

- Question 3: Financial Leverage Ratio

- Question 4: Return on Equity

- Question 5: Return on Net Operating Assets

**When calculating financial ratios, where appropriate please use average balances from the balance sheet. Also, assume a tax rate of 21%.

Question 6: What is the incremental difference in operating cash flow between the two product launches (enter answer in absolute value)?

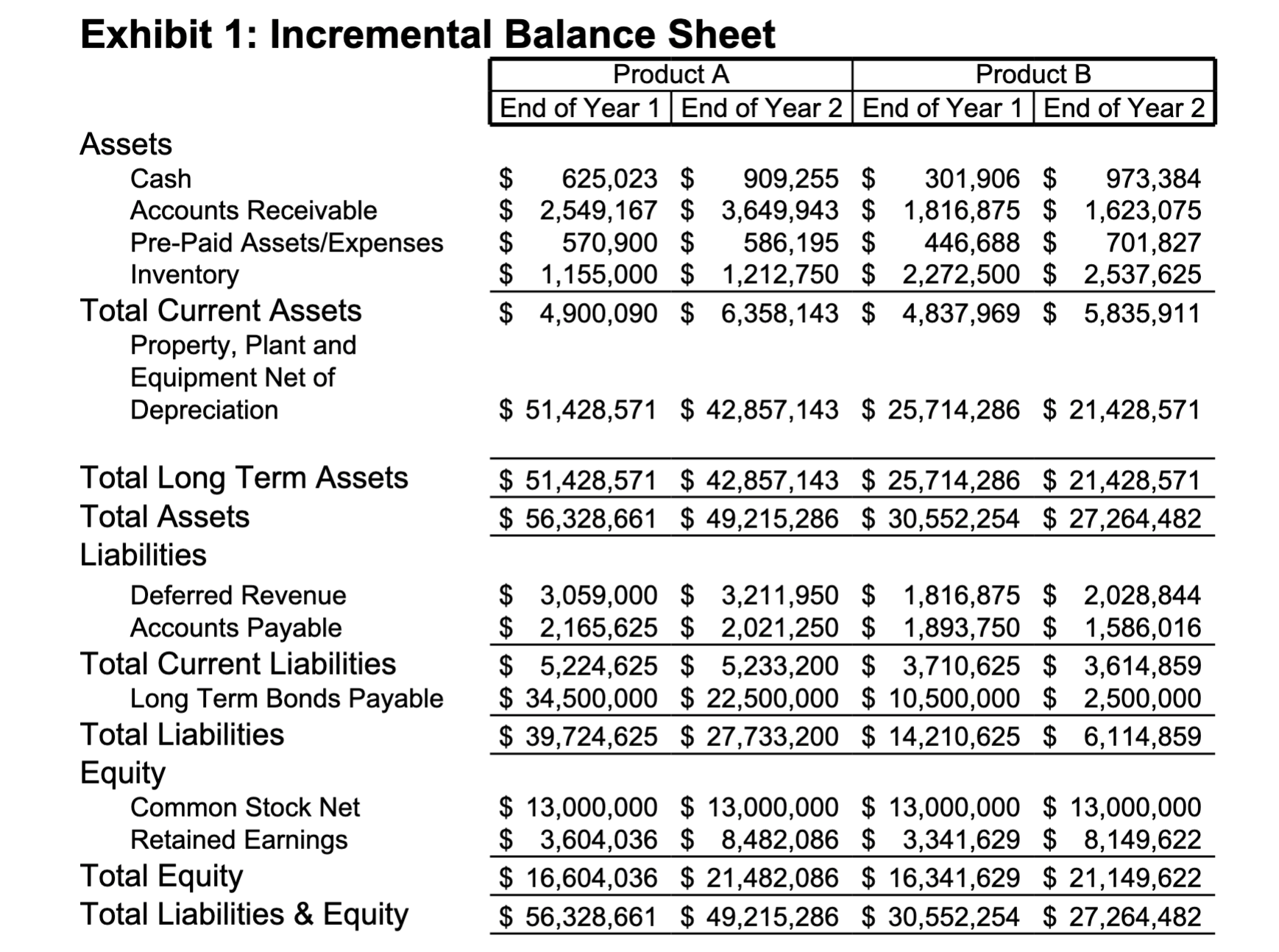

Exhibit 1: Incremental Balance Sheet Product A Product B End of Year 1 End of Year 2 End of Year 1 End of Year 2 Assets Cash $ Accounts Receivable Pre-Paid Assets/Expenses Inventory $ $ 570,900 $ 1,155,000 $ $ 4,900,090 $ 625,023 $ 909,255 $ $ 2,549,167 $ 3,649,943 $ 586,195 $ 446,688 $ 701,827 1,212,750 $ 2,272,500 $ 2,537,625 6,358,143 $ 4,837,969 $ 5,835,911 301,906 $ 973,384 1,816,875 $ 1,623,075 Total Current Assets Property, Plant and Equipment Net of Depreciation Total Long Term Assets Total Assets Liabilities Deferred Revenue Accounts Payable Total Current Liabilities Long Term Bonds Payable Total Liabilities Equity Common Stock Net Retained Earnings Total Equity Total Liabilities & Equity $ 51,428,571 $ 42,857,143 $ 25,714,286 $ 21,428,571 $51,428,571 $ 42,857,143 $ 25,714,286 $ 21,428,571 $ 56,328,661 $ 49,215,286 $ 30,552,254 $ 27,264,482 $ 3,059,000 $ 3,211,950 $ 1,816,875 $ 2,028,844 $ 2,165,625 $ 2,021,250 $ 1,893,750 $ 1,586,016 $ 5,224,625 $ 5,233,200 $ 3,710,625 $ 3,614,859 $ 34,500,000 $ 22,500,000 $10,500,000 $2,500,000 $ 39,724,625 $ 27,733,200 $14,210,625 $ 6,114,859 $13,000,000 $13,000,000 $13,000,000 $13,000,000 $ 3,604,036 $ 8,482,086 $ 3,341,629 $ 8,149,622 $ 16,604,036 $ 21,482,086 $ 16,341,629 $ 21,149,622 $ 56,328,661 $ 49,215,286 $ 30,552,254 $ 27,264,482

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started