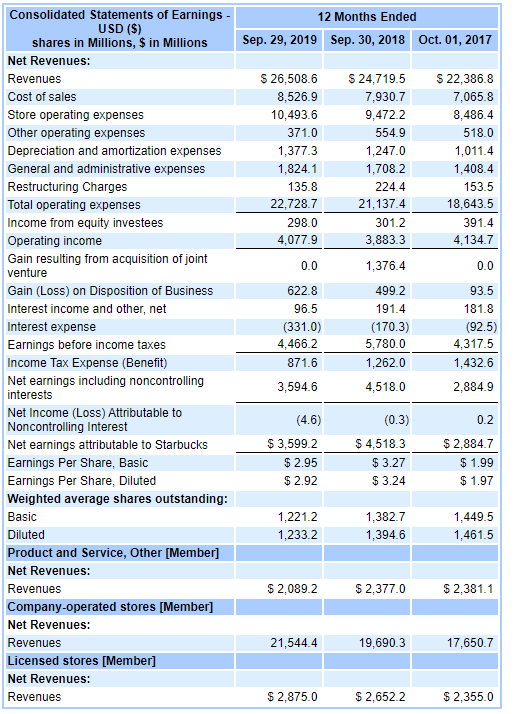

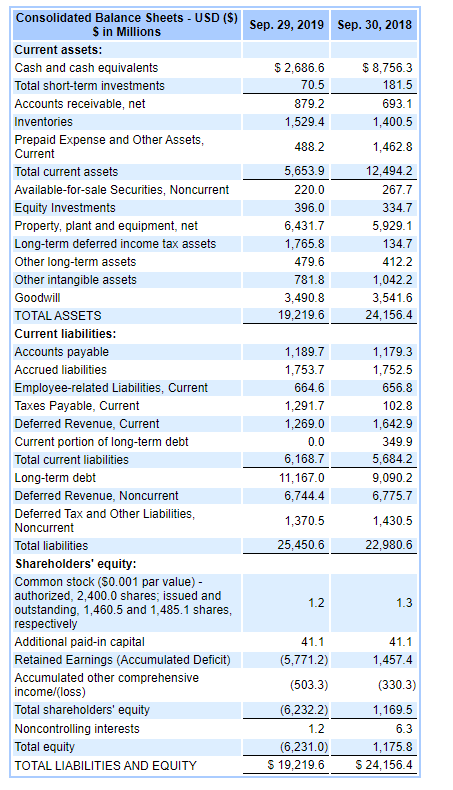

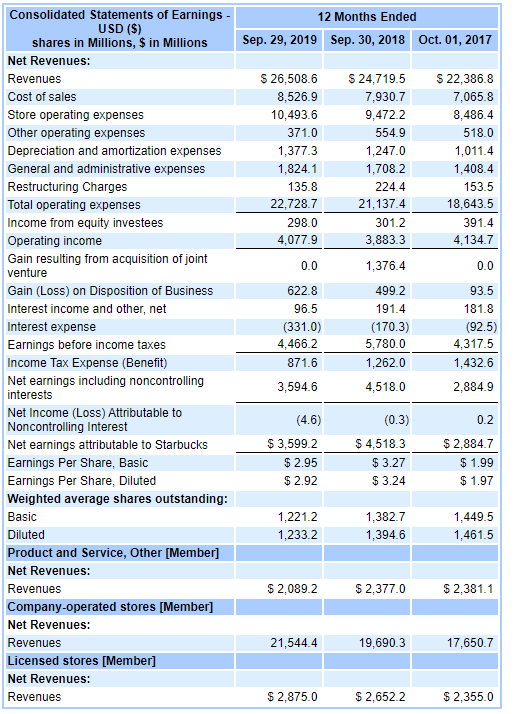

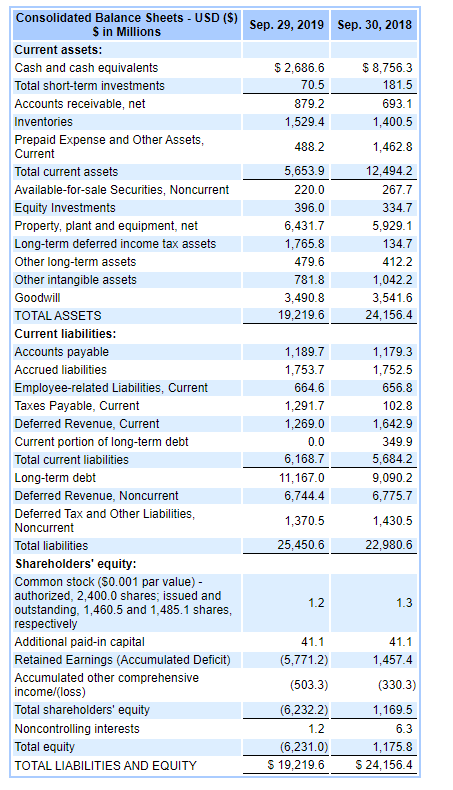

Calculate the following: (attached is Income Statement & Balance Sheet)

1. Net Income

2. Working Capital

3. Current Ratio

4. Debt to Equity Ratio

5. Return on (average) shareholders equity (%)

12 Months Ended Sep. 29, 2019 Sep. 30, 2018 Oct. 01, 2017 $ 26,508.6 8,526.9 10,493.6 371.0 1,377.3 1.824.1 135.8 22.728.7 298.0 4,077.9 $24.719.5 7,930.7 9,472.2 554.9 1,247.0 1,708.2 224.4 21,137.4 301.2 3,883.3 $22,386.8 7,065.8 8,486.4 518.0 1,011.4 1,408.4 153.5 18,643.5 391.4 4.134.7 1,376.4 0.0 0.0 622.8 96.5 (331.0) 4,466.2 Consolidated Statements of Earnings - USD ($) shares in Millions, $ in Millions Net Revenues: Revenues Cost of sales Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring Charges Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Gain (Loss) on Disposition of Business Interest income and other, net Interest expense Earnings before income taxes Income Tax Expense (Benefit) Net earnings including noncontrolling interests Net Income (Loss) Attributable to Noncontrolling Interest Net earnings attributable to Starbucks Earnings Per Share, Basic Earnings Per Share, Diluted Weighted average shares outstanding: Basic Diluted Product and Service, Other [Member] Net Revenues: Revenues Company operated stores (Member) Net Revenues: Revenues Licensed stores (Member) Net Revenues: Revenues 499.2 191.4 (170.3) 5,780.0 1,262.0 4,518.0 93.5 181.8 (92.5) 4,317.5 1,432.6 2,884.9 871.6 3,594.6 (4.6) $ 3,599.2 $ 2.95 $ 2.92 (0.3) $4,518.3 $ 3.27 $ 3.24 0.2 $2,884.7 $ 1.99 $1.97 1.221.2 1,233.2 1,382.7 1,394.6 1,449.5 1,461.5 $ 2,089.2 $2,377.0 $2,381.1 21,544.4 19,690.3 17,650.7 $ 2.875.0 $2,6522 $2,355.0 Sep. 29, 2019 Sep. 30, 2018 $ 2,686.6 70.5 879.2 1,529.4 488.2 5.653.9 220.0 396.0 6,431.7 1,765.8 479.6 781.8 3,490.8 19,219.6 $ 8,756.3 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 Consolidated Balance Sheets - USD ($) Sin Millions Current assets: Cash and cash equivalents Total short-term investments Accounts receivable, net Inventories Prepaid Expense and Other Assets, Current Total current assets Available-for-sale Securities, Noncurrent Equity Investments Property, plant and equipment, net Long-term deferred income tax assets Other long-term assets Other intangible assets Goodwill TOTAL ASSETS Current liabilities: Accounts payable Accrued liabilities Employee-related Liabilities, Current Taxes Payable, Current Deferred Revenue, Current Current portion of long-term debt Total current liabilities Long-term debt Deferred Revenue, Noncurrent Deferred Tax and Other Liabilities, Noncurrent Total liabilities Shareholders' equity: Common stock (50.001 par value) - authorized, 2,400.0 shares, issued and outstanding, 1,460.5 and 1,485.1 shares, respectively Additional paid-in capital Retained Earnings (Accumulated Deficit) Accumulated other comprehensive income/(loss Total shareholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY 1,189.7 1,753.7 664.6 1,291.7 1,269.0 0.0 6,168.7 11,167.0 6,744.4 1,179.3 1,752.5 656.8 102.8 1,642.9 349.9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 1,370.5 25.450.6 12. 41.1 (5.771.2) (503.3) (6.232.2) 1.2 (6.231.0) $ 19,219.6 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 $ 24,156.4