Answered step by step

Verified Expert Solution

Question

1 Approved Answer

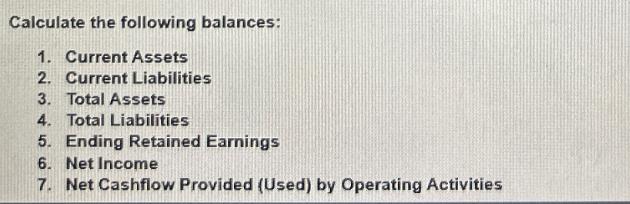

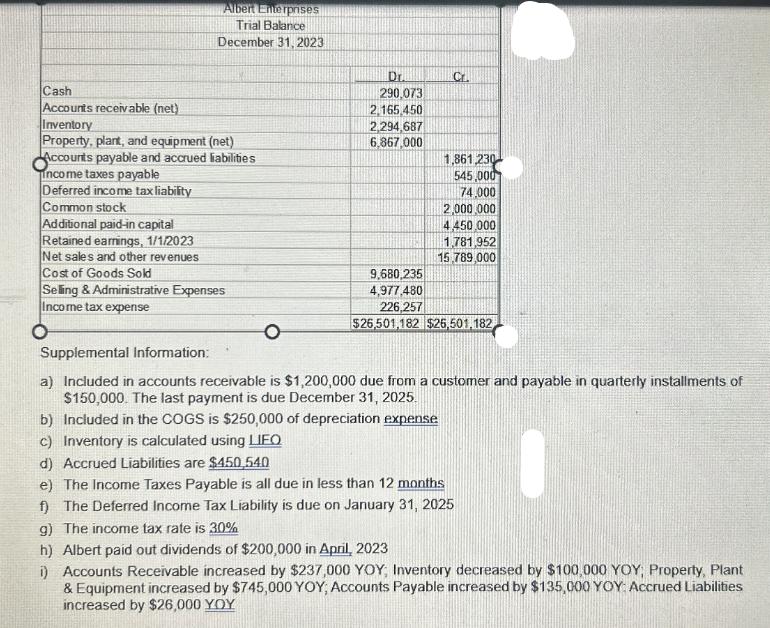

Calculate the following balances: 1. Current Assets 2. Current Liabilities 3. Total Assets 4. Total Liabilities 5. Ending Retained Earnings 6. Net Income 7.

Calculate the following balances: 1. Current Assets 2. Current Liabilities 3. Total Assets 4. Total Liabilities 5. Ending Retained Earnings 6. Net Income 7. Net Cashflow Provided (Used) by Operating Activities Cash Accounts receivable (net) Inventory Albert Enterprises Trial Balance December 31, 2023 Dr 290,073 2,165,450 2,294,687 6,867,000 Cr 8 Property, plant, and equipment (net) Accounts payable and accrued liabilities income taxes payable Deferred income tax liability Common stock Additional paid-in capital Retained earnings, 1/1/2023 Net sales and other revenues Cost of Goods Sold Seling & Administrative Expenses Income tax expense Supplemental Information: 1.861.230 545,000 74.000 2,000,000 4,450,000 1,781,952 15,789,000 9,680,235 4,977,480 226,257 $26,501,182 $26,501,182 a) Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 31, 2025. b) Included in the COGS is $250,000 of depreciation expense c) Inventory is calculated using LIFO d) Accrued Liabilities are $450,540 e) The Income Taxes Payable is all due in less than 12 months f) The Deferred Income Tax Liability is due on January 31, 2025 g) The income tax rate is 30% h) Albert paid out dividends of $200,000 in April, 2023 i) Accounts Receivable increased by $237,000 YOY; Inventory decreased by $100,000 YOY; Property, Plant & Equipment increased by $745,000 YOY; Accounts Payable increased by $135,000 YOY: Accrued Liabilities increased by $26,000 YOY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started