Answered step by step

Verified Expert Solution

Question

1 Approved Answer

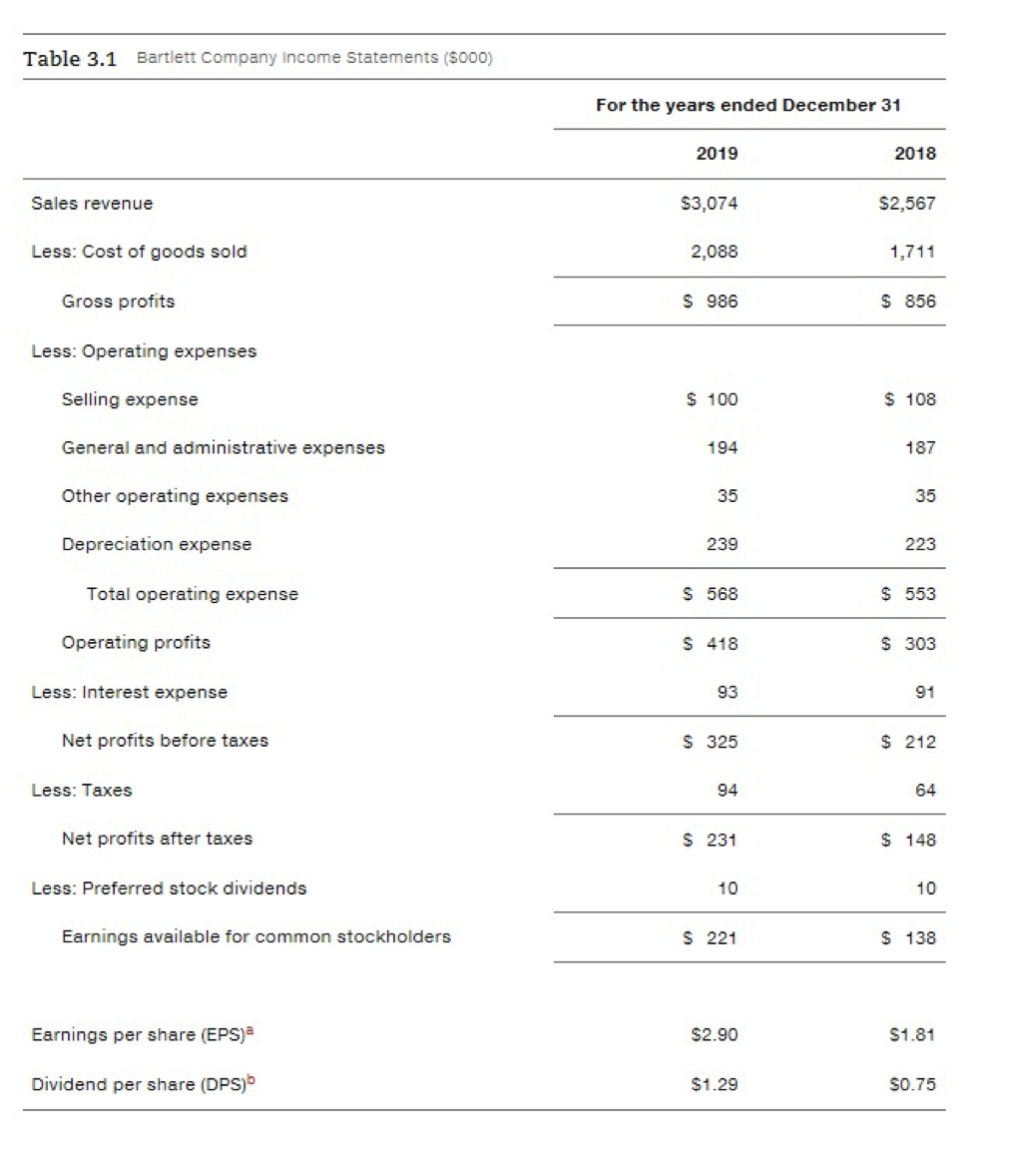

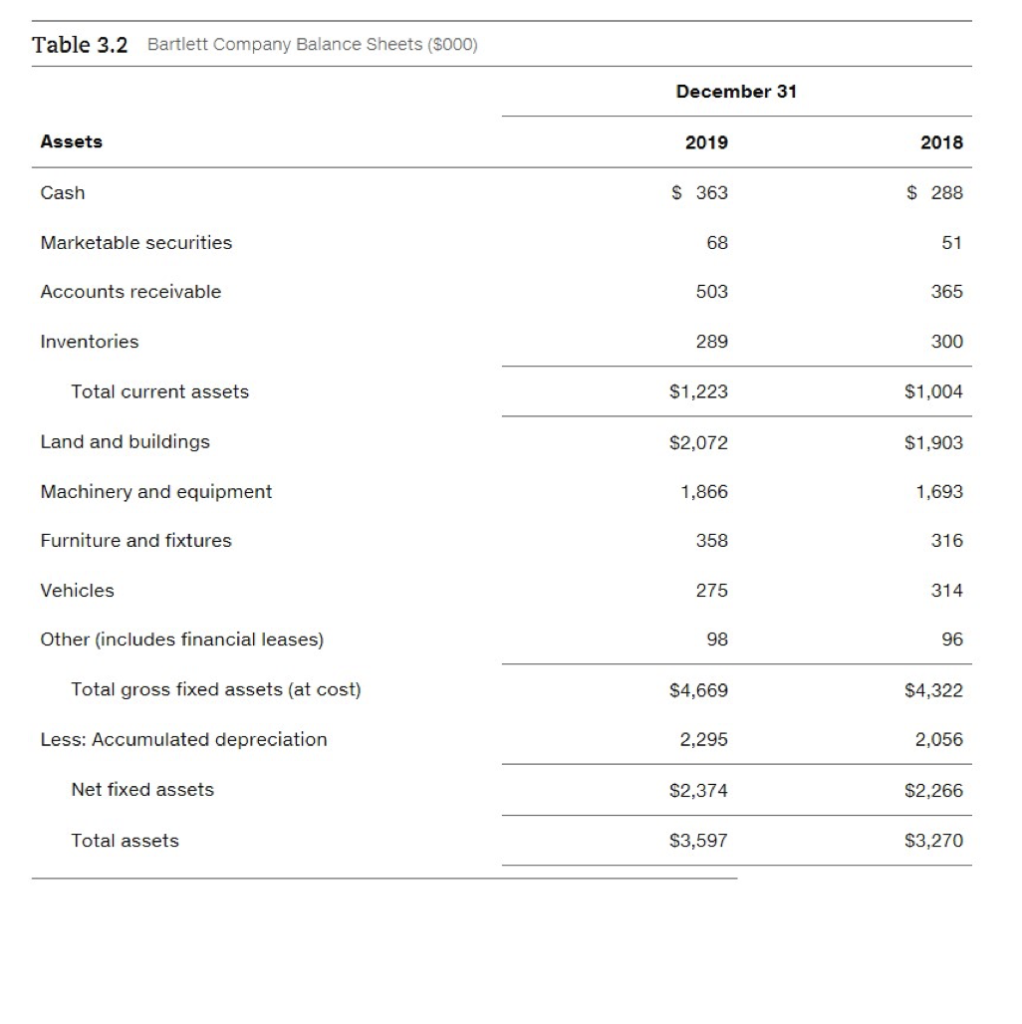

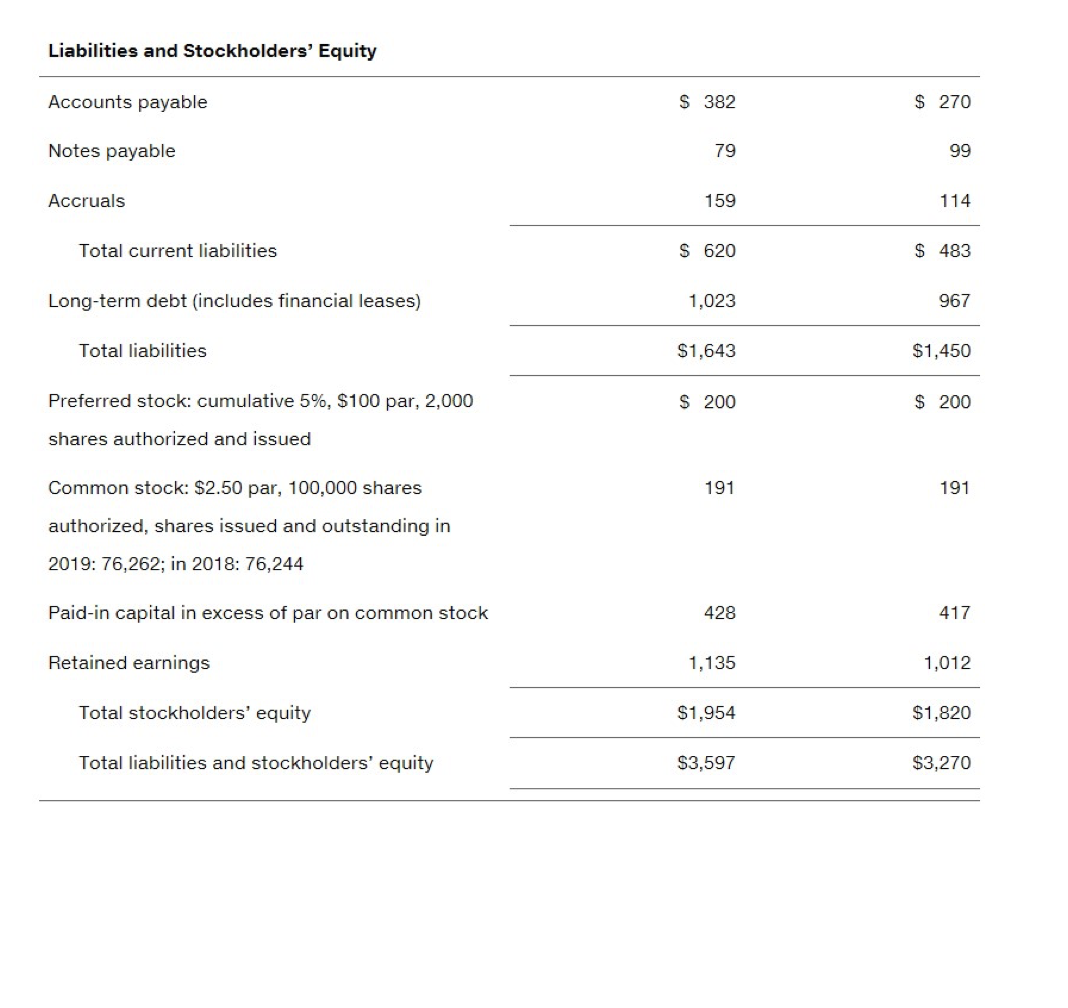

Calculate the following ratios for Bartlett Company in 2018 , compare them with the ratios in 2019 and provide one- or two-sentence comments on how

Calculate the following ratios for Bartlett Company in 2018, compare them with the ratios in 2019 and provide one- or two-sentence comments on how Bartlett Company did over the past two years on each ratio.

- Debt ratio

- Debt-to-equity ratio

- Times interest earned ratio

Example:

Current ratio (2018)= 1,004/483=2.08.

Current ratio (2019)= 1.97 (from the slide 16).

It indicates that in general Bartlett Company has a good liquidity position. However, it is decreasing from 2018 to 2019, so managers need to keep an eye on this ratio.

Table 3.1 Bartlett Company income Statements (\$000) Earnings per share (EPS)a \begin{tabular}{ll} $2.90 & $1.81 \\ $1.29 & $0.75 \\ \hline \end{tabular} Table 3.2 Bartlett Company Balance Sheets (\$000) Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started