Question

Calculate the following. Using the data below, evaluate Paneras financial position. Financial Analysis: Panera Bread Part 1: Financial Ratios Exhibit 1 in the Panera case

Calculate the following. Using the data below, evaluate Paneras financial position.

Financial Analysis: Panera Bread

Part 1: Financial Ratios

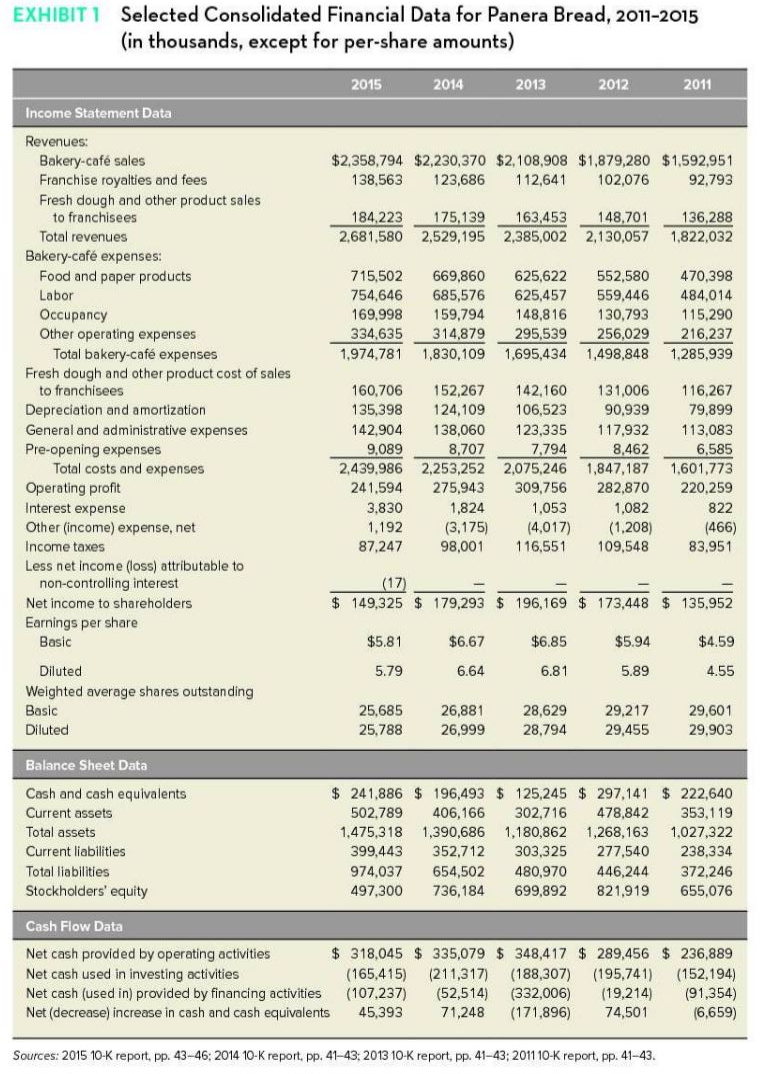

Exhibit 1 in the Panera case provides information on Paneras financial data for the years 2011 through 2015. Calculate the following operating and financial ratios for the years 2011 to 2015. All calculations should be rounded to one decimal (e.g., 12.7%).

| Financial ratios | 2015 | 2014 | 2013 | 2012 | 2011 |

| Total bakery caf expenses as a % of total revenues

|

|

|

|

|

|

| General and administrative expenses as a % of total revenues

|

|

|

|

|

|

| Operating profit as % of a total revenue (operating profit margin)

|

|

|

|

|

|

| Net income as a % of total revenue (net profit margin)

|

|

|

|

|

|

| Net income as a % of stockholders equity (ROE)

|

|

|

|

|

|

Part 2: Annual Growth Activity

Using available data in the case (exhibit 1), calculate the requested annual growth percentages. Round all numbers to the nearest hundredth.

All growth rates can be calculated using the following equation: [Year (x) value Year (x-1) value] / Year (x-1) value.

For example, if Total revenue for 2014 is 5,000 and Total revenue for 2013 is 4,000, the annual growth rate from 2013 to 2014 would be calculated as: [5000 4000] / 4000 = .25. This translates to 25.0% growth.

|

| 2014-2015 | 2011-2012 |

| Net income |

|

|

| Net cash provided by operating activities |

|

|

| EPS (diluted) |

|

|

| Franchise royalties and fees |

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started