Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the followings Return on equity Gross profit rates Working capital Operating expense ratio Inventory turnover ratio Accounts Receivable turnover rate Debt ratio Quick ratio

Calculate the followings

Calculate the followings

- Return on equity

- Gross profit rates

- Working capital

- Operating expense ratio

- Inventory turnover ratio

- Accounts Receivable turnover rate

- Debt ratio

- Quick ratio

- Earnings pet share

- Net income percentage

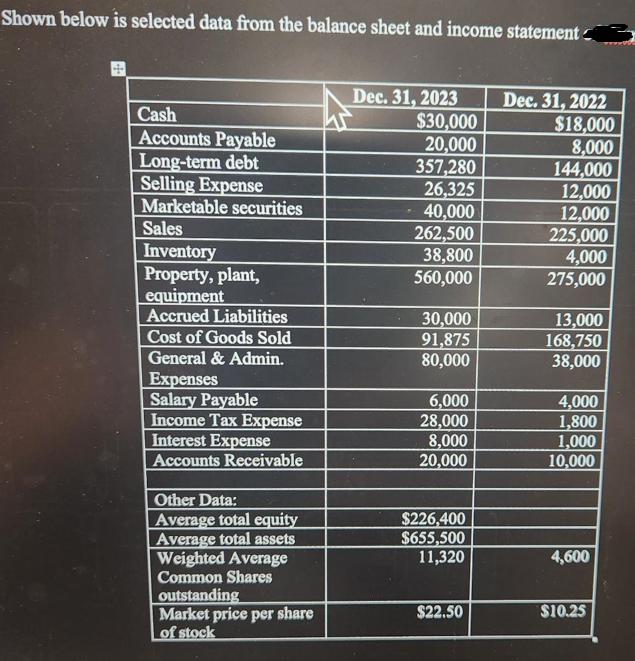

Shown below is selected data from the balance sheet and income statement Cash Accounts Payable Long-term debt Selling Expense Marketable securities Sales Inventory Property, plant, equipment Accrued Liabilities Cost of Goods Sold General & Admin. Expenses Salary Payable Income Tax Expense Interest Expense Accounts Receivable Other Data: Average total equity Average total assets Weighted Average Common Shares outstanding Market price per share of stock Dec. 31, 2023 $30,000 20,000 357,280 26,325 40,000 262,500 38,800 560,000 30,000 91,875 80,000 6,000 28,000 8,000 20,000 $226,400 $655,500 11,320 $22.50 Dec. 31, 2022 $18,000 8,000 144,000 12,000 12,000 225,000 4,000 275,000 13,000 168,750 38,000 4,000 1,800 1,000 10,000 4,600 $10.25

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Return on Equity ROE Net Income Sales Cost of Goods Sold Selling Expense General Admin Expenses Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started