Question

Calculate the groups goodwill on acquisition date and the non-controlling interest on reporting date. Moreover, Snow Group trades in the textile industry. In January 2019

Calculate the groups goodwill on acquisition date and the non-controlling interest on reporting date.

Moreover, Snow Group trades in the textile industry. In January 2019 Snow AG purchased 200 skirts for a total amount of 2,400 from an external supplier. In February 2019 Snow AG sold 50 of these units to Stone SA with a 25% mark-up. Moreover, Sand SA bought 40 skirts from Snow AG in March 2019 for a total amount of 640. By 31 December 2019 Sand SA and Stone SA sold 30 skirts each. The rest of the units are stored in their warehouses. a) What is the unrealised profit within the group?

Thank you very much!

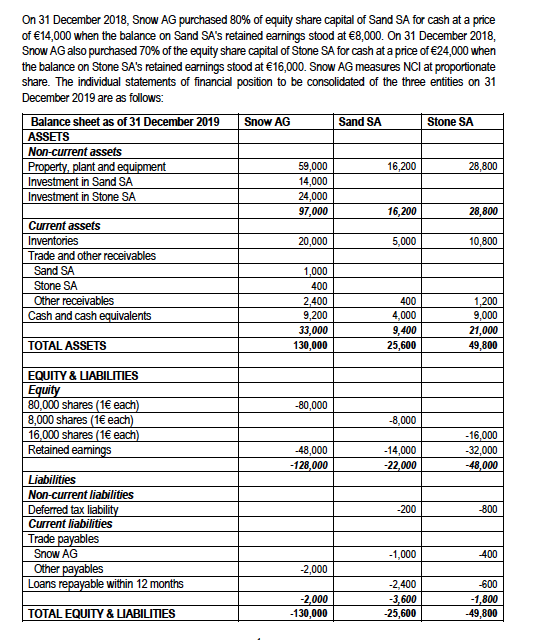

On 31 December 2018, Snow AG purchased 80% of equity share capital of Sand SA for cash at a price of 14,000 when the balance on Sand SA's retained earnings stood at 8,000. On 31 December 2018, Snow AG also purchased 70% of the equity share capital of Stone SA for cash at a price of 24,000 when the balance on Stone SA's retained earnings stood at 16,000. Snow AG measures NCI at proportionate share. The individual statements of financial position to be consolidated of the three entities on 31 December 2019 are as follows: Balance sheet as of 31 December 2019 Snow AG Sand SA Stone SA ASSETS Non-current assets Property, plant and equipment 59,000 16,200 28,800 Investment in Sand SA 14,000 Investment in Stone SA 24,000 97,000 16,200 28,800 Current assets Inventories 20,000 5,000 10,800 Trade and other receivables Sand SA 1,000 Stone SA 400 Other receivables 2.400 400 1,200 Cash and cash equivalents 9,200 4,000 9,000 33,000 9,400 21,000 TOTAL ASSETS 130,000 25,600 49,800 -80,000 EQUITY & LIABILITIES Equity 80,000 shares (1 each) 8,000 shares (1 each) 16,000 shares (1 each) Retained earings -8,000 -48,000 -128,000 -14,000 -22,000 - 16,000 -32,000 - 48,000 -200 -800 Liabilities Non-current liabilities Deferred tax liability Current liabilities Trade payables Snow AG Other payables Loans repayable within 12 months -1,000 400 -2,000 -2,000 -130,000 -2,400 -3,600 -25,600 -600 -1,800 -49,800 TOTAL EQUITY & LIABILITIES On 31 December 2018, Snow AG purchased 80% of equity share capital of Sand SA for cash at a price of 14,000 when the balance on Sand SA's retained earnings stood at 8,000. On 31 December 2018, Snow AG also purchased 70% of the equity share capital of Stone SA for cash at a price of 24,000 when the balance on Stone SA's retained earnings stood at 16,000. Snow AG measures NCI at proportionate share. The individual statements of financial position to be consolidated of the three entities on 31 December 2019 are as follows: Balance sheet as of 31 December 2019 Snow AG Sand SA Stone SA ASSETS Non-current assets Property, plant and equipment 59,000 16,200 28,800 Investment in Sand SA 14,000 Investment in Stone SA 24,000 97,000 16,200 28,800 Current assets Inventories 20,000 5,000 10,800 Trade and other receivables Sand SA 1,000 Stone SA 400 Other receivables 2.400 400 1,200 Cash and cash equivalents 9,200 4,000 9,000 33,000 9,400 21,000 TOTAL ASSETS 130,000 25,600 49,800 -80,000 EQUITY & LIABILITIES Equity 80,000 shares (1 each) 8,000 shares (1 each) 16,000 shares (1 each) Retained earings -8,000 -48,000 -128,000 -14,000 -22,000 - 16,000 -32,000 - 48,000 -200 -800 Liabilities Non-current liabilities Deferred tax liability Current liabilities Trade payables Snow AG Other payables Loans repayable within 12 months -1,000 400 -2,000 -2,000 -130,000 -2,400 -3,600 -25,600 -600 -1,800 -49,800 TOTAL EQUITY & LIABILITIES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started