Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate the NET PRESENT VALUE for each option and show a cash flow diagram for each option. Your client has contacted you for advice on

calculate the NET PRESENT VALUE for each option and show a cash flow diagram for each option.

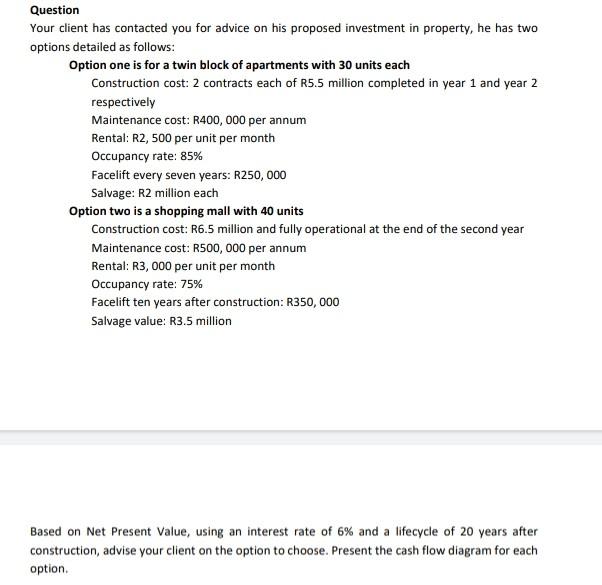

Your client has contacted you for advice on his proposed investment in property, he has two options detailed as follows: Option one is for a twin block of apartments with 30 units each Construction cost: 2 contracts each of R5.5 million completed in year 1 and year 2 respectively Maintenance cost: R400, 000 per annum Rental: RZ,500 per unit per month Occupancy rate: 85% Facelift every seven years: R250, 000 Salvage: R2 million each Option two is a shopping mall with 40 units Construction cost: R6.5 million and fully operational at the end of the second year Maintenance cost: R500, 000 per annum Rental: R3,000 per unit per month Occupancy rate: 75% Facelift ten years after construction: R350, 000 Salvage value: R3.5 million Based on Net Present Value, using an interest rate of 6% and a lifecycle of 20 years after construction, advise your client on the option to choose. Present the cash flow diagram for each optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started