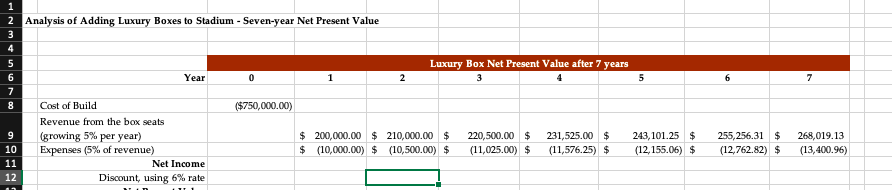

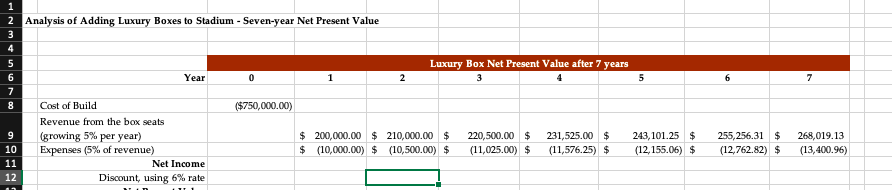

Calculate the net present value (NPV) of adding luxury boxes to a stadium, using the template provided. Determine NPV at the last step. Show all work in arriving at the answer.

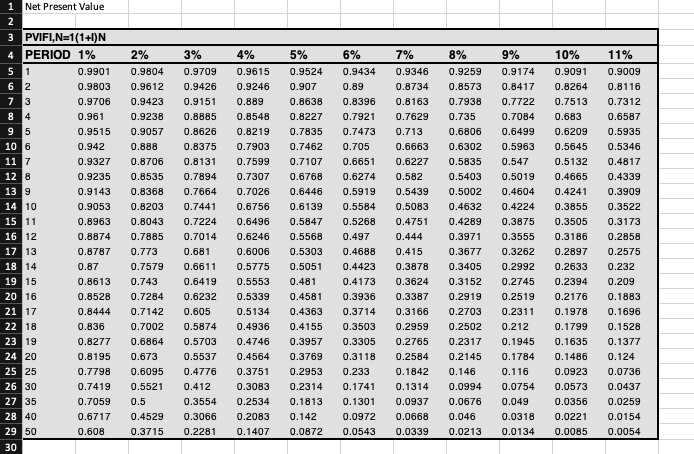

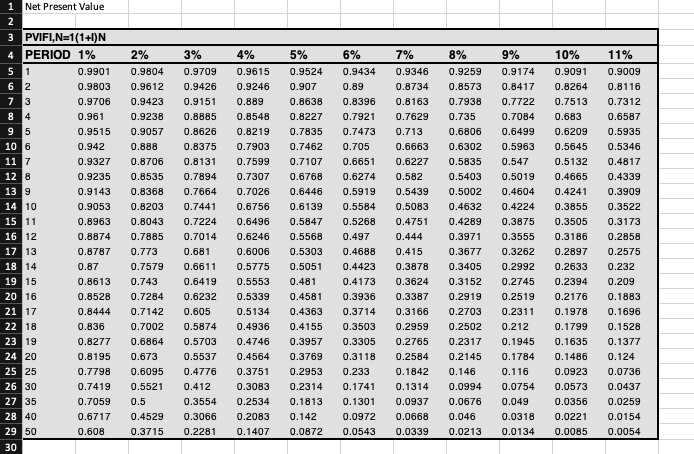

1 2 Analysis of Adding Luxury Boxes to Stadium - Seven-year Net Present Value o von WN 3 4 5 6 7 8 Luxury Box Net Present Value after 7 years 3 Year 0 1 2 5 7 ($750,000.00) Cost of Build Revenue from the box seats (growing 5% per year) Expenses (5% of revenue) Net Income Discount, using 6% rate $ 200,000.00 $ 210,000.00 $ $ (10,000.00) $ (10,500.00) $ 220,500.00 $ (11,025.00) $ 231,525.00 $ (11,576.25) $ 9 10 11 12 243, 101.25 $ (12,155.06) $ 255,256.31 $ (12,762.82) $ 268,019.13 (13,400.96) 1 Net Present Value Nm 3% 6% 7% 0.9346 0.9434 0.89 3 PVIFI,N=1(1+I)N 4 PERIOD 1% 5 1 0.9901 6 2 0.9803 7 3 0.9706 8 4 0.961 95 0.9515 10 6 0.942 11 7 0.9327 12 8 0.9235 13 9 0.9143 14 10 0.9053 15 11 0.8963 16 12 0.8874 17 13 0.8787 18 14 0.87 19 15 0.8613 20 16 0.8528 21 17 0.8444 22 18 0.836 23 19 0.8277 24 20 0.8195 25 25 0.7798 26 30 0.7419 27 35 0.7059 28 40 0.6717 29 50 0.608 30 2% 0.9804 0.9612 0.9423 0.9238 0.9057 0.888 0.8706 0.8535 0.8368 0.8203 0.8043 0.7885 0.773 0.7579 0.743 0.7284 0.7142 0.7002 0.6864 0.673 0.6095 0.5521 0.5 0.4529 0.3715 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7224 0.7014 0.681 0.6611 0.6419 0.6232 0.605 0.5874 0.5703 0.5537 0.4776 0.412 0.3554 0.3066 0.2281 4% 0.9615 0.9246 0.889 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.3751 0.3083 0.2534 0.2083 0.1407 5% 0.9524 0.907 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5847 0.5568 0.5303 0.5051 0.481 0.4581 0.4363 0.4155 0.3957 0.3769 0.2953 0.2314 0.1813 0.142 0.0872 0.8396 0.7921 0.7473 0.705 0.6651 0.6274 0.5919 0.5584 0.5268 0.497 0.4688 0.4423 0.4173 0.3936 0.3714 0.3503 0.3305 0.3118 0.233 0.1741 0.1301 0.0972 0.0543 0.8734 0.8163 0.7629 0.713 0.6663 0.6227 0.582 0.5439 0.5083 0.4751 0.444 0.415 0.3878 0.3624 0.3387 0.3166 0.2959 0.2765 0.2584 0.1842 0.1314 0.0937 0.0668 0.0339 8% 0.9259 0.8573 0.7938 0.735 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 0.2919 0.2703 0.2502 0.2317 0.2145 0.146 0.0994 0.0676 0.046 0.0213 9% 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.547 0.5019 0.4604 0.4224 0.3875 0.3555 0.3262 0.2992 0.2745 0.2519 0.2311 0.212 0.1945 0.1784 0.116 0.0754 0.049 0.0318 0.0134 10% 0.9091 0.8264 0.7513 0.683 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 0.0923 0.0573 0.0356 0.0221 0.0085 11% 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 0.3173 0.2858 0.2575 0.232 0.209 0.1883 0.1696 0.1528 0.1377 0.124 0.0736 0.0437 0.0259 0.0154 0.0054