Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate the NPV of after tax cost if MG buys new equipment America - B.. UB Wahlstrom Libra... VitalSource Booksh. Pubs I'm Catching My Br

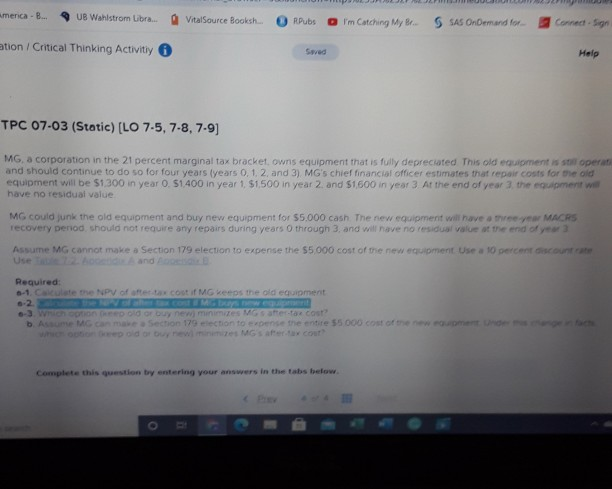

calculate the NPV of after tax cost if MG buys new equipment

America - B.. UB Wahlstrom Libra... VitalSource Booksh. Pubs I'm Catching My Br SSAS OnDemand for Connect Sign tion / Critical Thinking Activity Seved Help TPC 07-03 (Static) (LO 7-5, 7-8, 7-9) MG, a corporation in the 21 percent marginal tax bracket owns equipment that is fully depreciated This old equipment is still operate and should continue to do so for four years (years 0, 1, 2, and 3) MG's chief financial officer estimates that repair costs for the old equipment will be $1.300 in year 0. 51400 in year 1, $1.500 in year 2. and 1600 in year 3 At the end of year the equipment will have no residual value MG could junk the old equipment and buy new equipment for 55.000 cash The new equipment will have three year MACRS recovery period, should not require any repairs during years through 3, and will have no residual value at the end of year Assume MG cannot make a Section 179 election to expense the $5,000 cost of the new equipment Use a 10 percent scount Required: .-1. Calculate the NPV offer cost if MG keeps the old equipment .-3. Wood or buy new minutes seran cost b. AMG cave Section 179 election to expense the entire 55000 cost of the new emert und Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started