Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the NPV of the investment at the start of 2020 assuming that your firm initially borrows 120 million and then pays down the debt

Calculate the NPV of the investment at the start of 2020 assuming that your firm initially borrows 120 million and then pays down the debt at a rate of 20 million per year. Assume that interest payments can always be used to offset the companys taxable profits over the life of the project.

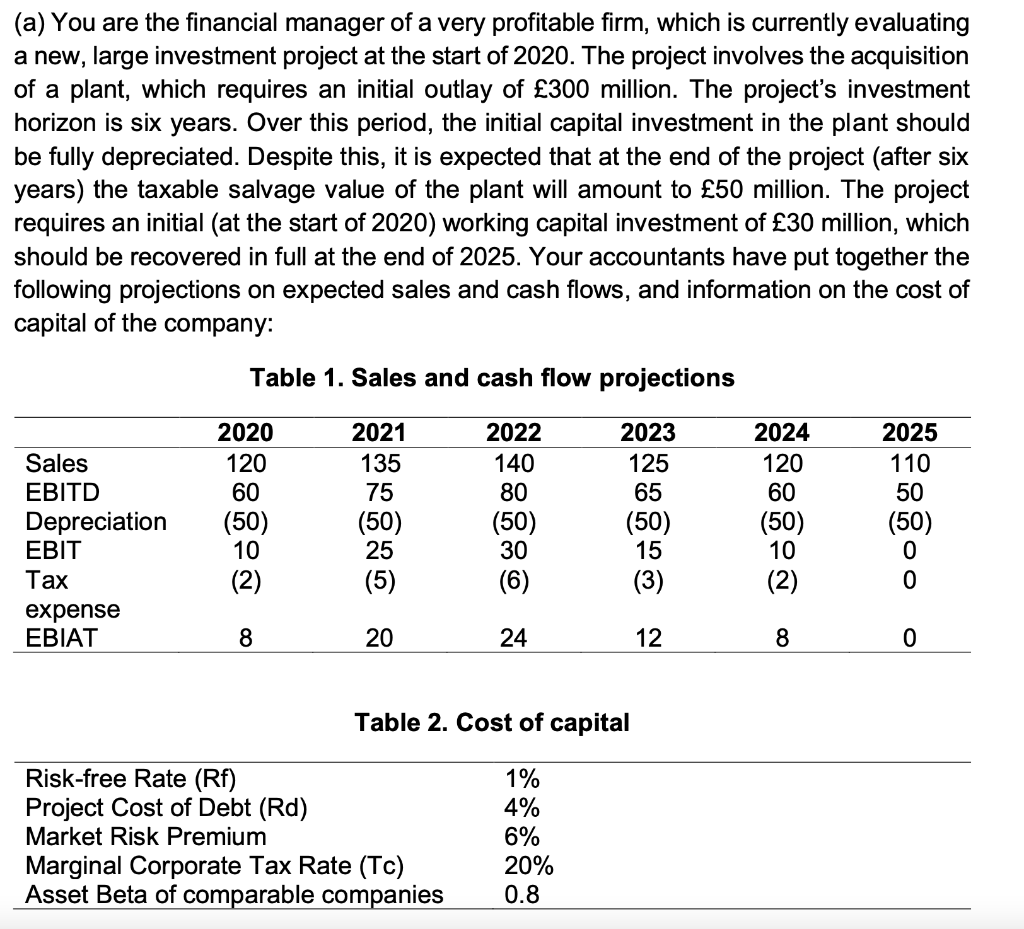

(a) You are the financial manager of a very profitable firm, which is currently evaluating a new, large investment project at the start of 2020. The project involves the acquisition of a plant, which requires an initial outlay of 300 million. The project's investment horizon is six years. Over this period, the initial capital investment in the plant should be fully depreciated. Despite this, it is expected that at the end of the project (after six years) the taxable salvage value of the plant will amount to 50 million. The project requires an initial (at the start of 2020) working capital investment of 30 million, which should be recovered in full at the end of 2025. Your accountants have put together the following projections on expected sales and cash flows, and information on the cost of capital of the company: Table 1. Sales and cash flow projections 2020 120 60 (50) 10 (2) Sales EBITD Depreciation EBIT Tax expense EBIAT 2021 135 75 (50) 25 (5) 2022 140 80 (50) 30 (6) 2023 125 65 (50) 15 (3) 2024 120 60 (50) 10 (2) 2025 110 50 (50) 0 8 20 24 12 8 0 Table 2. Cost of capital Risk-free Rate (RF) Project Cost of Debt (Rd) Market Risk Premium Marginal Corporate Tax Rate (Tc) Asset Beta of comparable companies 1% 4% 6% 20% 0.8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started