Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the NPV of the project Answer^, please explain through excel how to achieve these numbers Dr. Hunter Thompson is considering opening an MRI clinic

Calculate the NPV of the project

Answer^, please explain through excel how to achieve these numbers

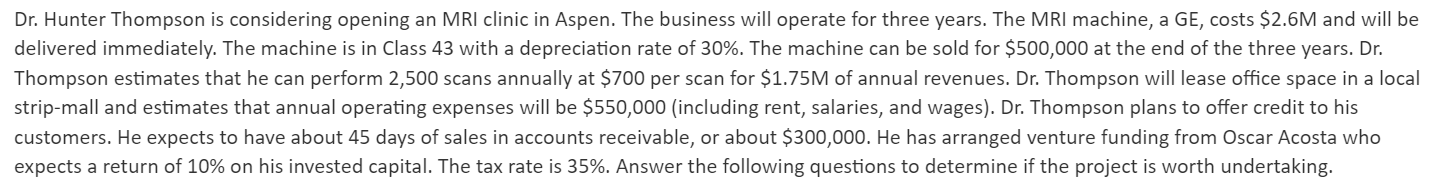

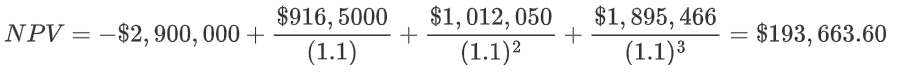

Dr. Hunter Thompson is considering opening an MRI clinic in Aspen. The business will operate for three years. The MRI machine, a GE, costs $2.6M and will be delivered immediately. The machine is in Class 43 with a depreciation rate of 30%. The machine can be sold for $500,000 at the end of the three years. Dr. Thompson estimates that he can perform 2,500 scans annually at $700 per scan for $1.75M of annual revenues. Dr. Thompson will lease office space in a local strip-mall and estimates that annual operating expenses will be $550,000 (including rent, salaries, and wages). Dr. Thompson plans to offer credit to his customers. He expects to have about 45 days of sales in accounts receivable, or about $300,000. He has arranged venture funding from Oscar Acosta who expects a return of 10% on his invested capital. The tax rate is 35%. Answer the following questions to determine if the project is worth undertaking. NPV=$2,900,000+(1.1)$916,5000+(1.1)2$1,012,050+(1.1)3$1,895,466=$193,663.60Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started