Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the payout ratio, earnings per share, and return on common stockholders equity. (Round earning per share to 2 decimal places, e.g. $2.66 and all

Calculate the payout ratio, earnings per share, and return on common stockholders equity. (Round earning per share to 2 decimal places, e.g. $2.66 and all other answers to 1 decimal place. 17.5%.) I've included a completed balance sheet; let me know if any other values are needed to compute these three values.

The stockholders equity accounts of Miley Corporation on January 1, 2014, were as follows.

| Preferred Stock (7%, $100 par noncumulative, 5,400 shares authorized) | $324,000 | |

| Common Stock ($5 stated value, 297,800 shares authorized) | 1,191,200 | |

| Paid-in Capital in Excess of Par ValuePreferred Stock | 12,960 | |

| Paid-in Capital in Excess of Stated ValueCommon Stock | 476,480 | |

| Retained Earnings | 690,900 | |

| Treasury Stock(5,400 common shares) | 43,200 |

During 2014, the corporation had the following transactions and events pertaining to its stockholders equity.

| Feb. 1 | Issued 4,800 shares of common stock for $33,600. | |

| Mar. 20 | Purchased 1,180 additional shares of common treasury stock at $8 per share. | |

| Oct. 1 | Declared a 7% cash dividend on preferred stock, payable November 1. | |

| Nov. 1 | Paid the dividend declared on October 1. | |

| Dec. 1 | Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 2014. | |

| Dec. 31 | Determined that net income for the year was $279,600. Paid the dividend declared on December 1. |

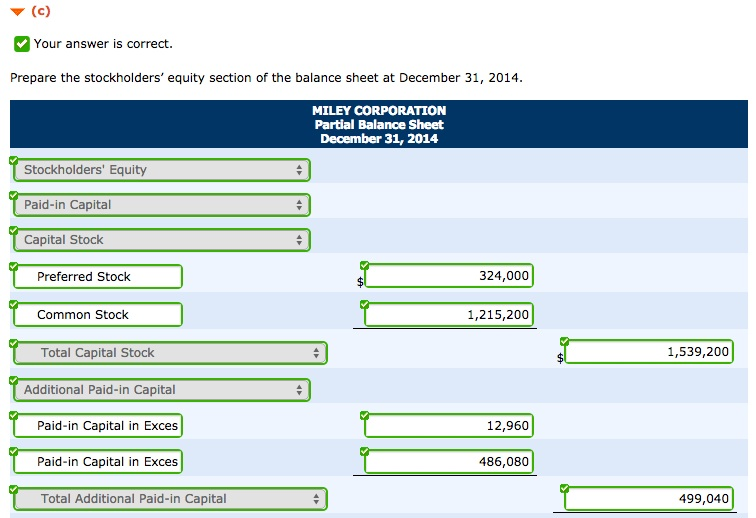

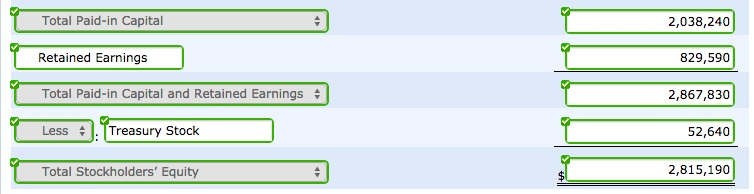

? (c) Your answer is correct Prepare the stockholders' equity section of the balance sheet at December 31, 2014 MILEY CORPORATION Partial Balance Sheet December 31, 2014 Stockholders' Equity Paid-in Capital Capital Stock Preferred Stock 324,000 Common Stock 1,215,200 Total Capital Stock 1,539,200 Additional Paid-in Capital Paid-in Capital in Exces Paid-in Capital in Exces Total Additional Paid-in Capital 12,960 486,080 499,040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started