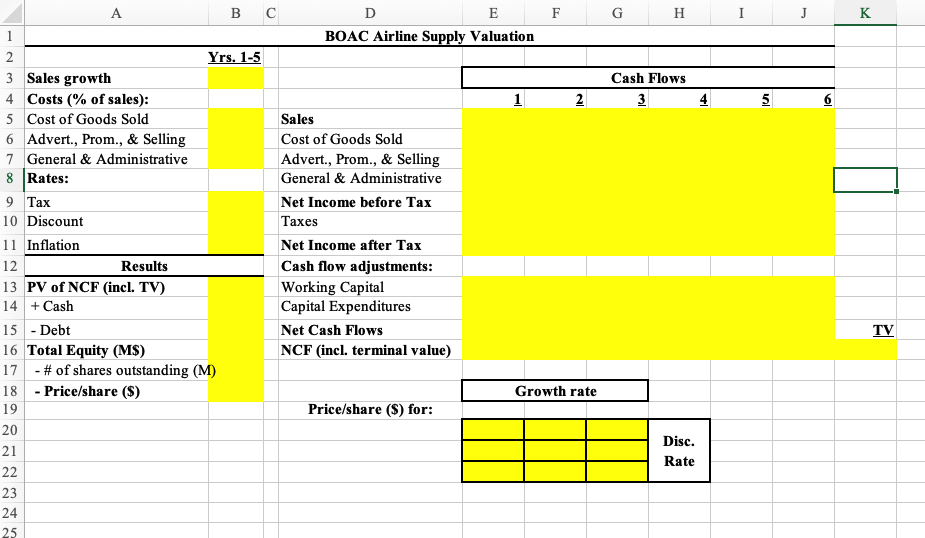

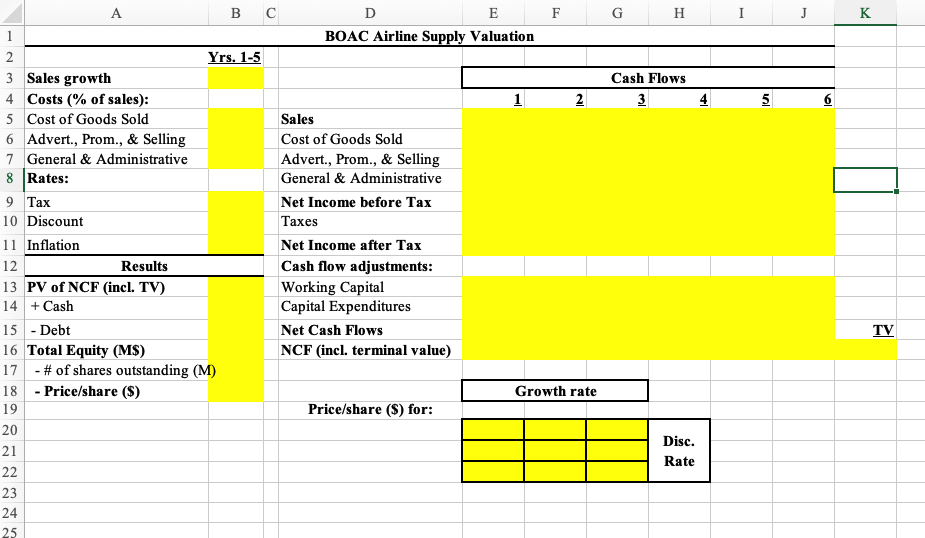

Calculate the per share price and sun sensitivities for growth rates of 3.0%, 3.5%, and 4% as well as discount rates of 8%, 9%, and 10%. Put these in a matrix

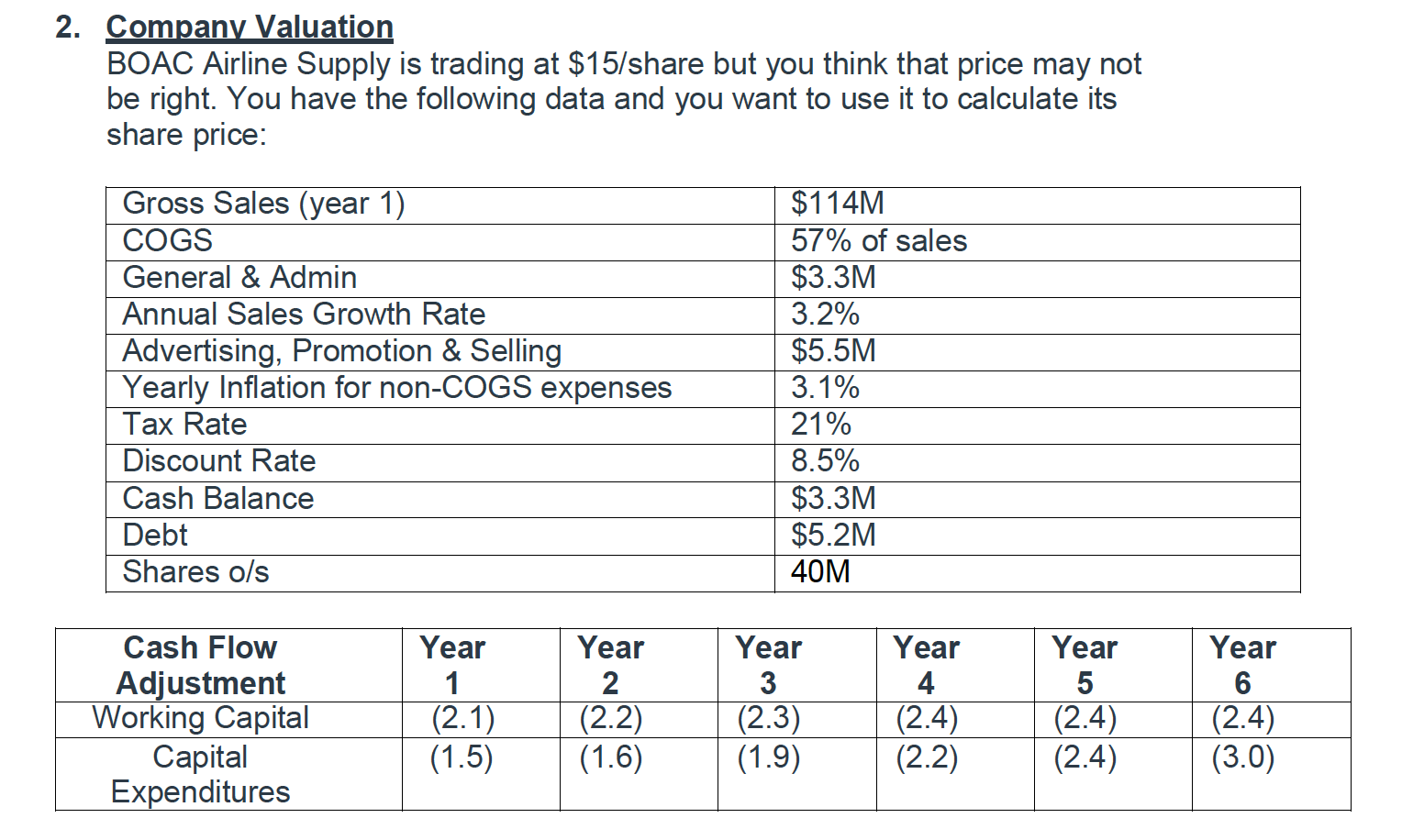

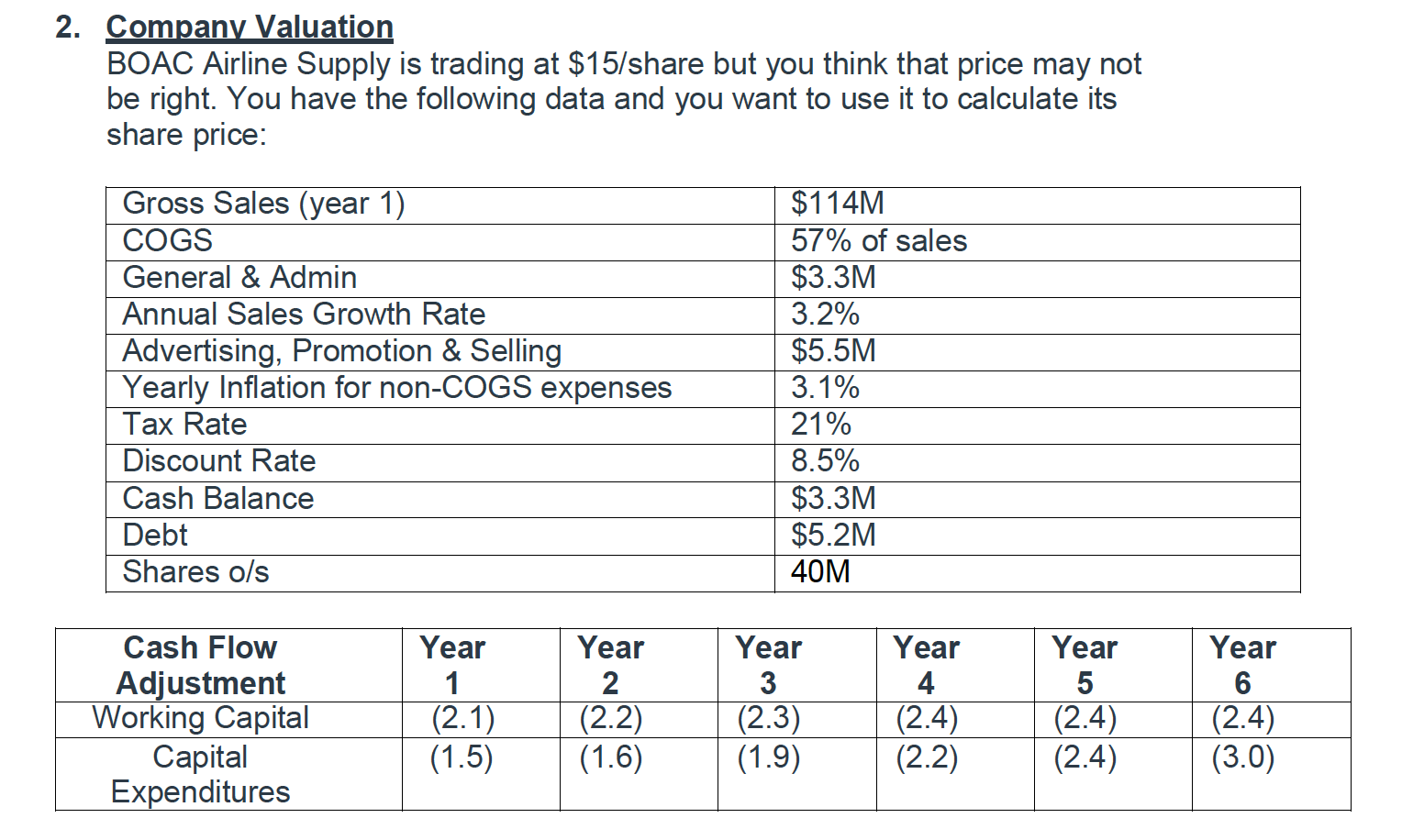

2. Company Valuation BOAC Airline Supply is trading at $15/share but you think that price may not be right. You have the following data and you want to use it to calculate its share price: Gross Sales (year 1). COGS General & Admin Annual Sales Growth Rate Advertising, Promotion & Selling Yearly Inflation for non-COGS expenses Tax Rate Discount Rate Cash Balance Debt Shares o/s $114M 57% of sales $3.3M 3.2% $5.5M 3.1% 21% 8.5% $3.3M $5.2M 40M Cash Flow Adjustment Working Capital Capital Expenditures Year 1 (2.1) (1.5) Year 2 (2.2) (1.6) Year 3 (2.3) (1.9) Year 4 (2.4) (2.2) Year 5 (2.4) (2.4) Year 6 (2.4) (3.0) A B F G H I J K D E BOAC Airline Supply Valuation Cash Flows 3 1 2 5 val 1 2 Yrs. 1-5 3 Sales growth 4 Costs (% of sales): 5 Cost of Goods Sold 6 Advert., Prom., & Selling 7 General & Administrative 8 Rates: 9 Tax 10 Discount 11 Inflation 12 Results 13 PV of NCF (incl. TV) 14 + Cash 15 - Debt 16 Total Equity (MS) 17 - # of shares outstanding (M) 18 - Price/share ($) 19 Sales Cost of Goods Sold Advert., Prom., & Selling General & Administrative Net Income before Tax Taxes Net Income after Tax Cash flow adjustments: Working Capital Capital Expenditures Net Cash Flows NCF (incl. terminal value) TV Growth rate Price/share ($) for: 20 Disc. Rate 21 22 23 24 25 2. Company Valuation BOAC Airline Supply is trading at $15/share but you think that price may not be right. You have the following data and you want to use it to calculate its share price: Gross Sales (year 1). COGS General & Admin Annual Sales Growth Rate Advertising, Promotion & Selling Yearly Inflation for non-COGS expenses Tax Rate Discount Rate Cash Balance Debt Shares o/s $114M 57% of sales $3.3M 3.2% $5.5M 3.1% 21% 8.5% $3.3M $5.2M 40M Cash Flow Adjustment Working Capital Capital Expenditures Year 1 (2.1) (1.5) Year 2 (2.2) (1.6) Year 3 (2.3) (1.9) Year 4 (2.4) (2.2) Year 5 (2.4) (2.4) Year 6 (2.4) (3.0) A B F G H I J K D E BOAC Airline Supply Valuation Cash Flows 3 1 2 5 val 1 2 Yrs. 1-5 3 Sales growth 4 Costs (% of sales): 5 Cost of Goods Sold 6 Advert., Prom., & Selling 7 General & Administrative 8 Rates: 9 Tax 10 Discount 11 Inflation 12 Results 13 PV of NCF (incl. TV) 14 + Cash 15 - Debt 16 Total Equity (MS) 17 - # of shares outstanding (M) 18 - Price/share ($) 19 Sales Cost of Goods Sold Advert., Prom., & Selling General & Administrative Net Income before Tax Taxes Net Income after Tax Cash flow adjustments: Working Capital Capital Expenditures Net Cash Flows NCF (incl. terminal value) TV Growth rate Price/share ($) for: 20 Disc. Rate 21 22 23 24 25