Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the price of Bond 2. Calculate the weighted average cost of capital for the company Cansns manager thinks that the new division in Paris

Calculate the price of Bond 2. Calculate the weighted average cost of capital for the company Cansns manager thinks that the new division in Paris is riskier than the ongoing operations of the company. The company has 3% adjustment factor for projects with different risks. Determine the discount rate to be used for this new division and briefly explain your answer.

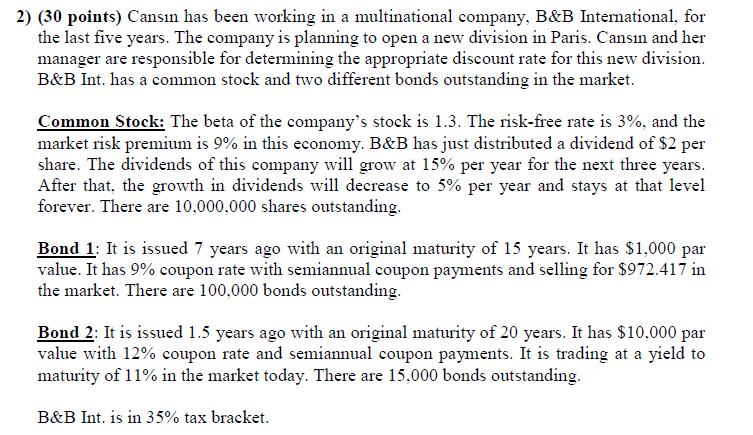

2) (30 points) Cansn has been working in a multinational company, B&B International, for the last five years. The company is planning to open a new division in Paris. Cansin and her manager are responsible for determining the appropriate discount rate for this new division. B&B Int. has a common stock and two different bonds outstanding in the market. Common Stock: The beta of the company's stock is 1.3. The risk-free rate is 3%, and the market risk premium is 9% in this economy. B&B has just distributed a dividend of $2 per share. The dividends of this company will grow at 15% per year for the next three years. After that, the growth in dividends will decrease to 5% per year and stays at that level forever. There are 10,000,000 shares outstanding. Bond 1: It is issued 7 years ago with an original maturity of 15 years. It has $1,000 par value. It has 9% coupon rate with semiannual coupon payments and selling for $972.417 in the market. There are 100,000 bonds outstanding. Bond 2: It is issued 1.5 years ago with an original maturity of 20 years. It has $10,000 par value with 12% coupon rate and semiannual coupon payments. It is trading at a yield to maturity of 11% in the market today. There are 15,000 bonds outstanding. B&B Int. is in 35% tax bracketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started