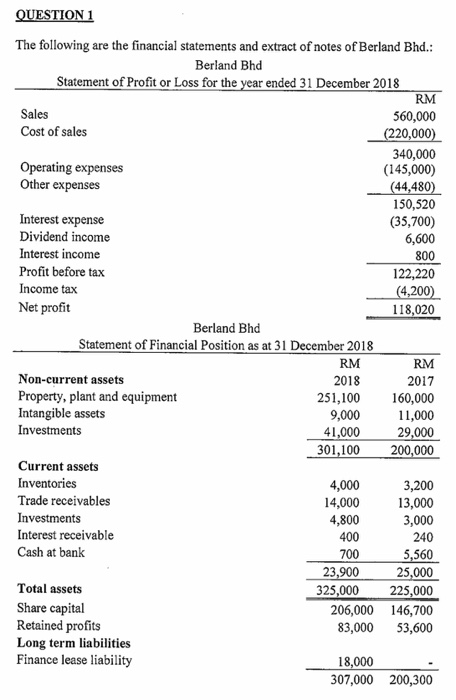

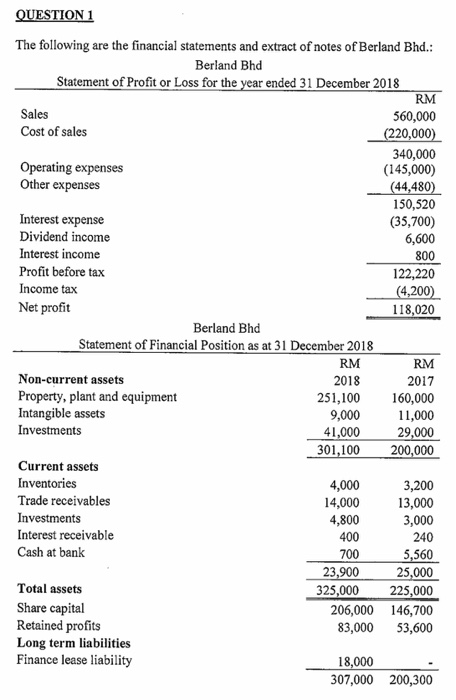

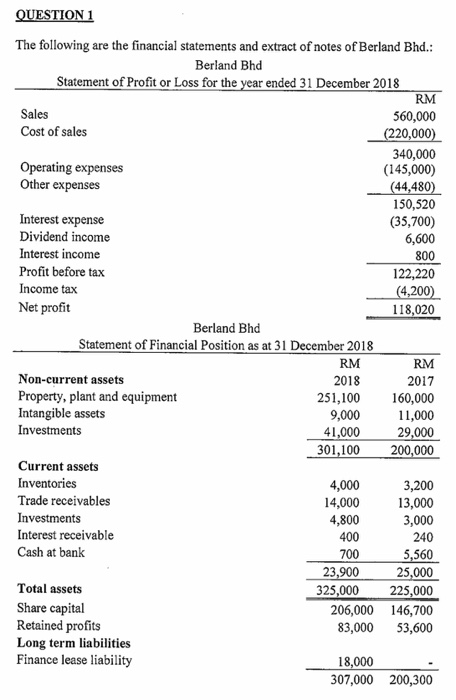

calculate the statement of cash flow using profit before tax

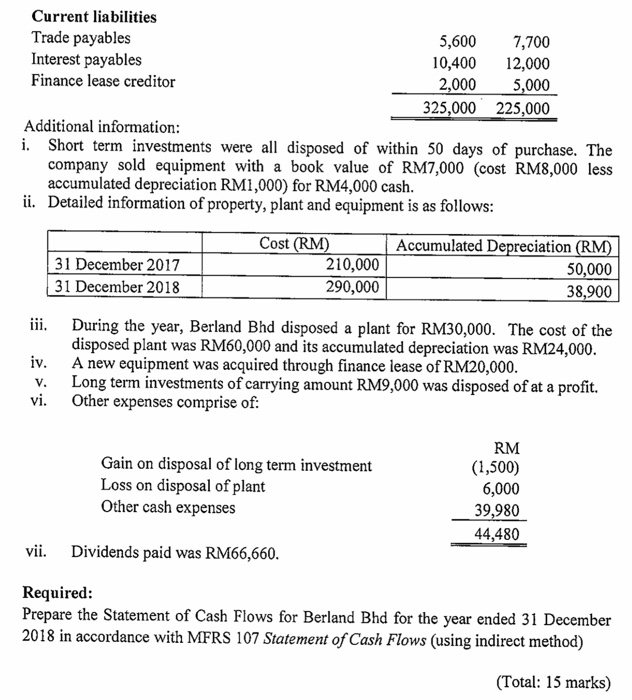

Current liabilities Trade payables 5,600 7,700 Interest payables 10,400 12,000 Finance lease creditor 2,000 5,000 325,000' 225,000 Additional information: i. Short term investments were all disposed of within 50 days of purchase. The company sold equipment with a book value of RM7,000 (cost RM8,000 less accumulated depreciation RM1,000) for RM4,000 cash. ii. Detailed information of property, plant and equipment is as follows: 31 December 2017 31 December 2018 Cost (RM) 210,000 290,000 Accumulated Depreciation (RM) 50,000 38,900 iii. During the year, Berland Bhd disposed a plant for RM30,000. The cost of the disposed plant was RM60,000 and its accumulated depreciation was RM24,000. iv. A new equipment was acquired through finance lease of RM20,000. Long term investments of carrying amount RM9,000 was disposed of at a profit. vi. Other expenses comprise of: Gain on disposal of long term investment Loss on disposal of plant Other cash expenses RM (1,500) 6,000 39,980 44,480 vii. Dividends paid was RM66,660. Required: Prepare the Statement of Cash Flows for Berland Bhd for the year ended 31 December 2018 in accordance with MFRS 107 Statement of Cash Flows (using indirect method) (Total: 15 marks) Current liabilities Trade payables 5,600 7,700 Interest payables 10,400 12,000 Finance lease creditor 2,000 5,000 325,000' 225,000 Additional information: i. Short term investments were all disposed of within 50 days of purchase. The company sold equipment with a book value of RM7,000 (cost RM8,000 less accumulated depreciation RM1,000) for RM4,000 cash. ii. Detailed information of property, plant and equipment is as follows: 31 December 2017 31 December 2018 Cost (RM) 210,000 290,000 Accumulated Depreciation (RM) 50,000 38,900 iii. During the year, Berland Bhd disposed a plant for RM30,000. The cost of the disposed plant was RM60,000 and its accumulated depreciation was RM24,000. iv. A new equipment was acquired through finance lease of RM20,000. Long term investments of carrying amount RM9,000 was disposed of at a profit. vi. Other expenses comprise of: Gain on disposal of long term investment Loss on disposal of plant Other cash expenses RM (1,500) 6,000 39,980 44,480 vii. Dividends paid was RM66,660. Required: Prepare the Statement of Cash Flows for Berland Bhd for the year ended 31 December 2018 in accordance with MFRS 107 Statement of Cash Flows (using indirect method) (Total: 15 marks)