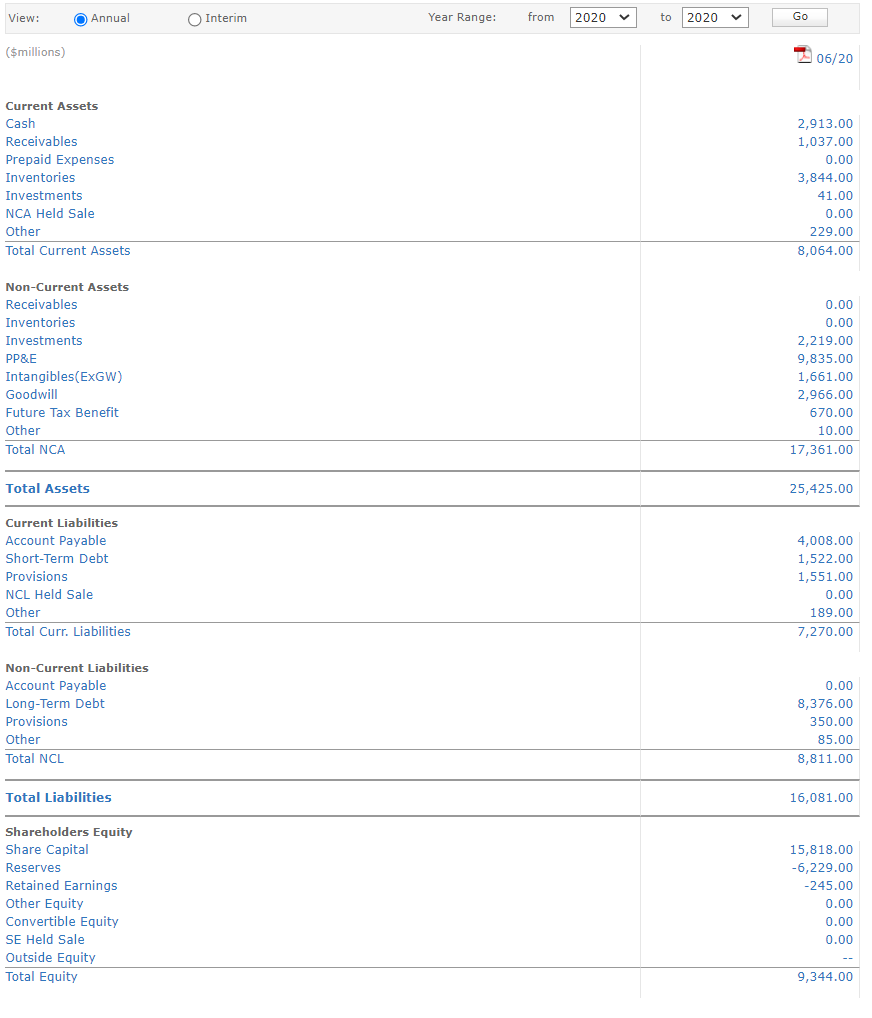

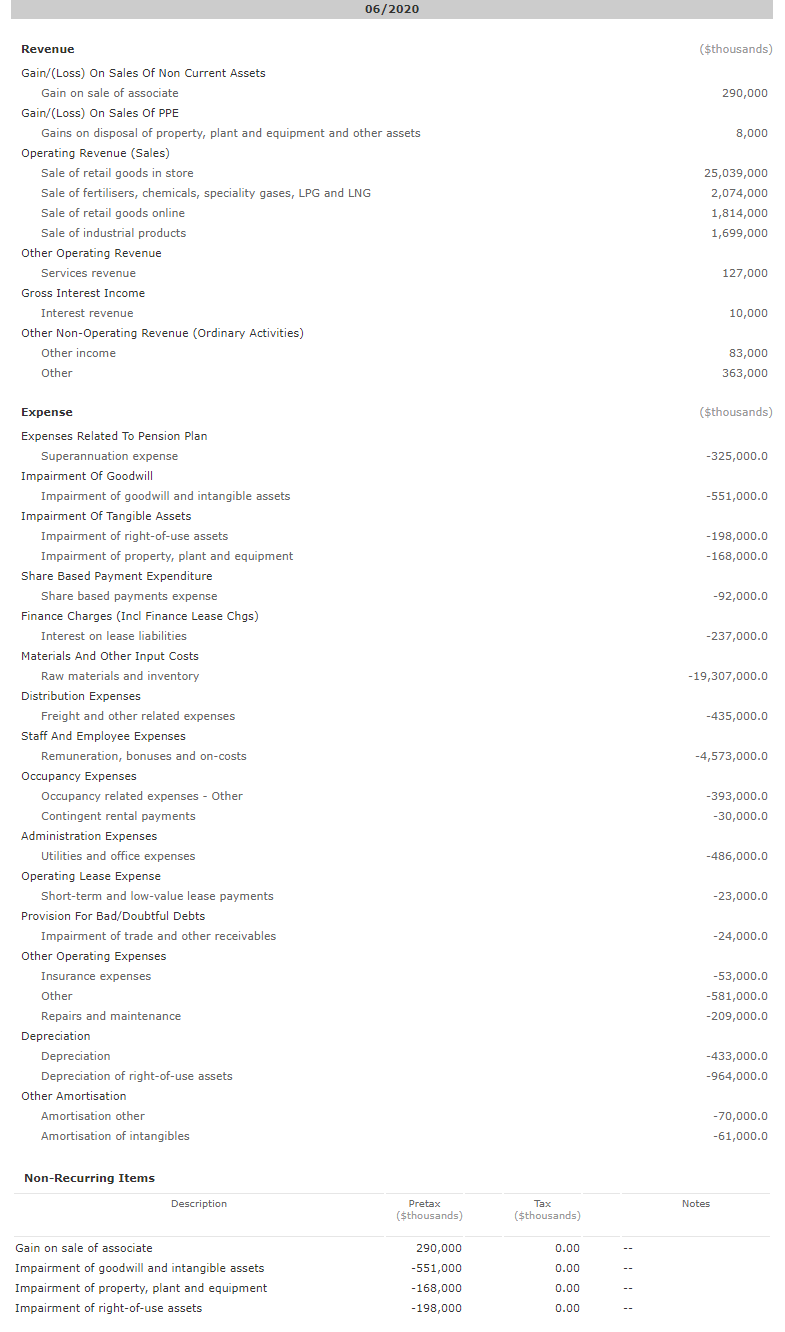

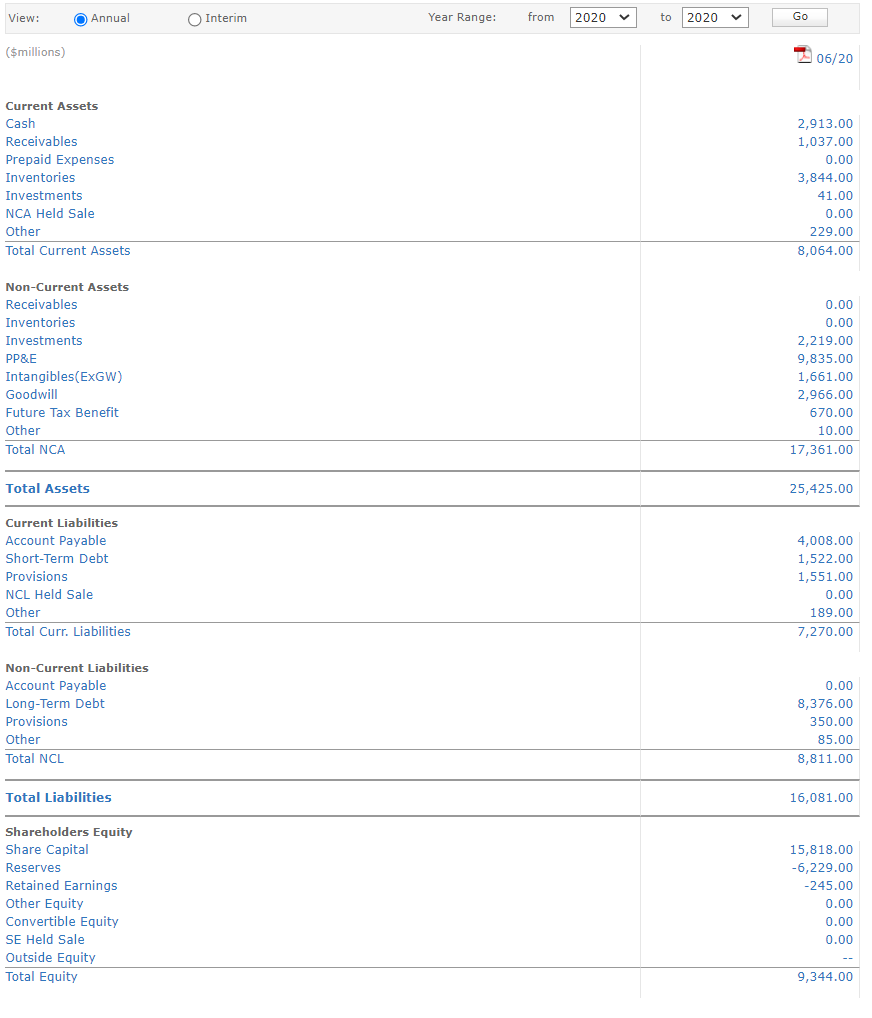

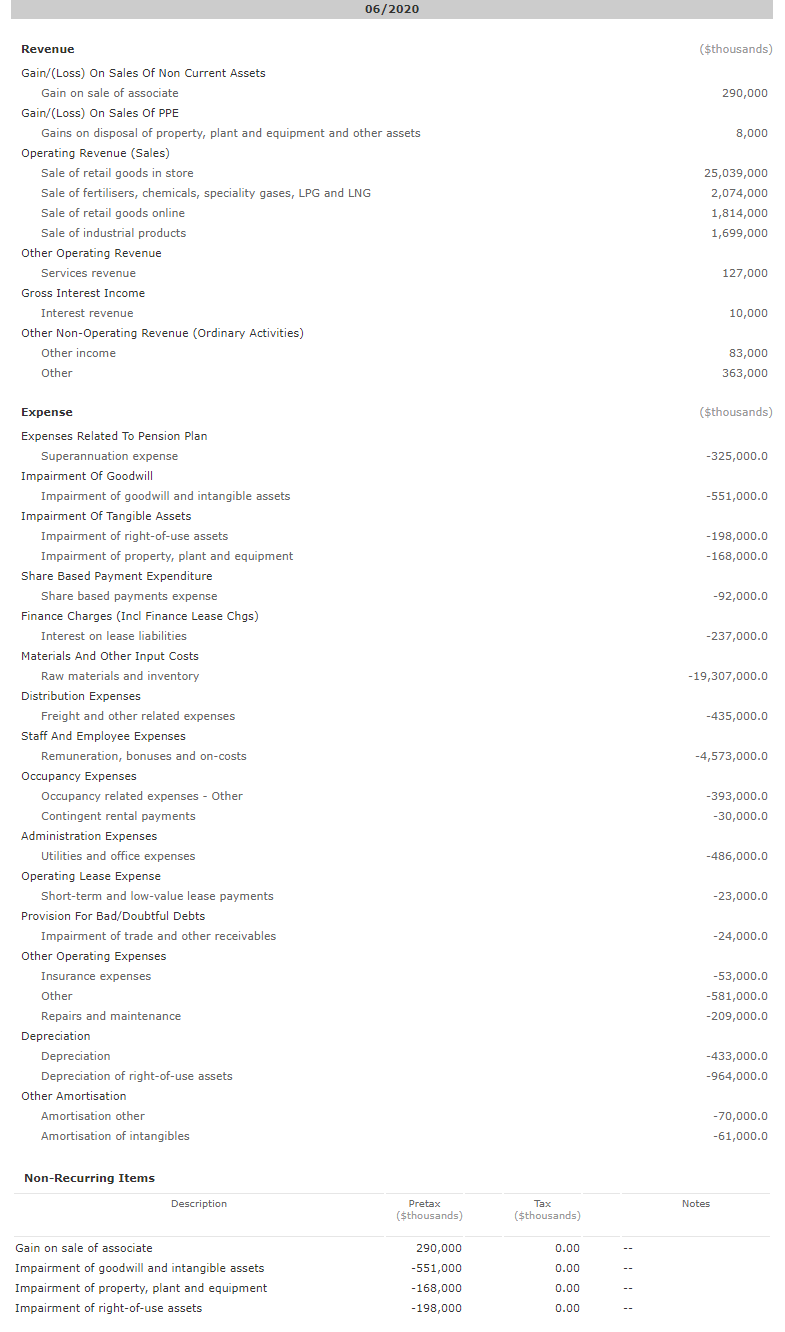

Calculate the values of liquidity ratios of the company

- the overall liquidity

- the liquidity of specific current asset accounts. That is, one ratio relates to the overall liquidity and one ratio relates to the liquidity of specific current asset accounts.

- Raw materials and inventory

View: O Annual O Annual O Interim Interim Year Range: from 2020 to 2020 Go ($millions) 06/20 Current Assets Cash Receivables Prepaid Expenses Inventories Investments NCA Held Sale Other Total Current Assets 2,913.00 1,037.00 0.00 3,844.00 41.00 0.00 229.00 8,064.00 Non-Current Assets Receivables Inventories Investments PP&E Intangibles(ExGW) Goodwill Future Tax Benefit Other Total NCA 0.00 0.00 2,219.00 9,835.00 1,661.00 2,966.00 670.00 10.00 17,361.00 Total Assets 25,425.00 Current Liabilities Account Payable Short-Term Debt Provisions NCL Held Sale Other Total Curr. Liabilities 4,008.00 1,522.00 1,551.00 0.00 189.00 7,270.00 Non-Current Liabilities Account Payable Long-Term Debt Provisions Other Total NCL 0.00 8,376.00 350.00 85.00 8,811.00 Total Liabilities 16,081.00 Shareholders Equity Share Capital Reserves Retained Earnings Other Equity Convertible Equity SE Held Sale Outside Equity Total Equity 15,818.00 -6,229.00 -245.00 0.00 0.00 0.00 9,344.00 06/2020 ($thousands) 290,000 8,000 Revenue Gain/(Loss) On Sales Of Non Current Assets Gain on sale of associate Gain/(Loss) On Sales Of PPE Gains on disposal of property, plant and equipment and other assets Operating Revenue (Sales) Sale of retail goods in store Sale of fertilisers, chemicals, speciality gases, LPG and LNG Sale of retail goods online Sale of industrial products Other Operating Revenue Services revenue Gross Interest Income Interest revenue Other Non-Operating Revenue (Ordinary Activities) Other income 25,039,000 2,074,000 1,814,000 1,699,000 127,000 10,000 83,000 363,000 Other ($thousands) -325,000.0 -551,000.0 -198,000.0 -168,000.0 -92,000.0 -237,000.0 -19,307,000.0 -435,000.0 -4,573,000.0 Expense Expenses Related To Pension Plan Superannuation expense Impairment of Goodwill Impairment of goodwill and intangible assets Impairment Of Tangible Assets Impairment of right-of-use assets Impairment of property, plant and equipment Share Based Payment Expenditure Share based payments expense Finance Charges (Incl Finance Lease Chgs) Interest on lease liabilities Materials And Other Input Costs Raw materials and inventory Distribution Expenses Freight and other related expenses Staff And Employee Expenses Remuneration, bonuses and on-costs Occupancy Expenses Occupancy related expenses - Other Contingent rental payments Administration Expenses Utilities and office expenses Operating Lease Expense Short-term and low-value lease payments Provision For Bad/Doubtful Debts Impairment of trade and other receivables Other Operating Expenses Insurance expenses Other Repairs and maintenance Depreciation Depreciation Depreciation of right-of-use assets Other Amortisation Amortisation other Amortisation of intangibles -393,000.0 -30,000.0 -486,000.0 -23,000.0 -24,000.0 -53,000.0 -581,000.0 -209,000.0 -433,000.0 -964,000.0 -70,000.0 -61,000.0 Non-Recurring Items Description Notes Pretax ($thousands) Tax ($thousands) 0.00 0.00 Gain on sale of associate Impairment of goodwill and intangible assets Impairment of property, plant and equipment Impairment of right-of-use assets 290,000 -551,000 -168,000 -198,000 0.00 0.00