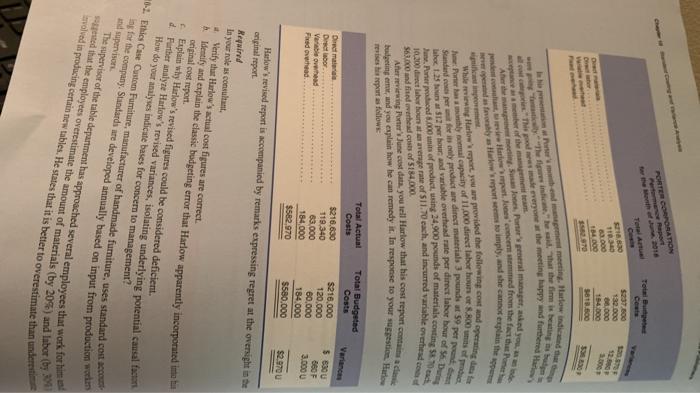

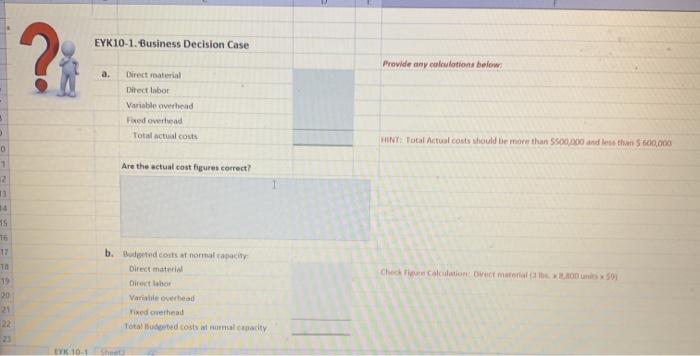

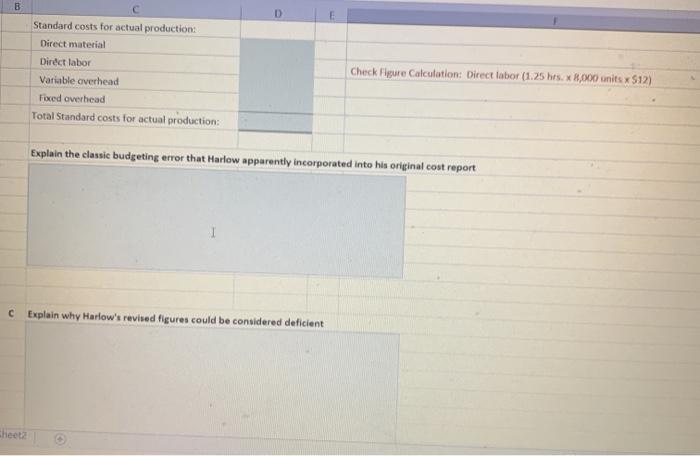

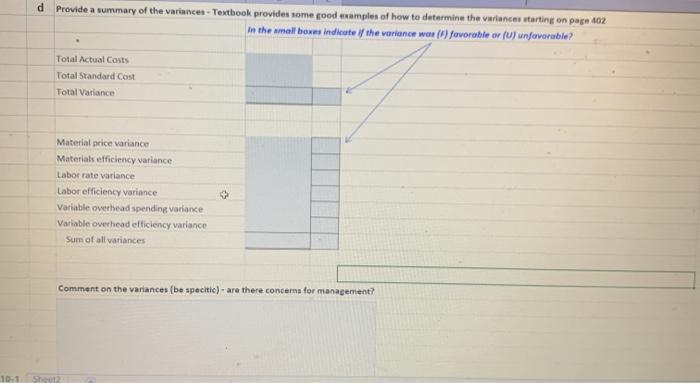

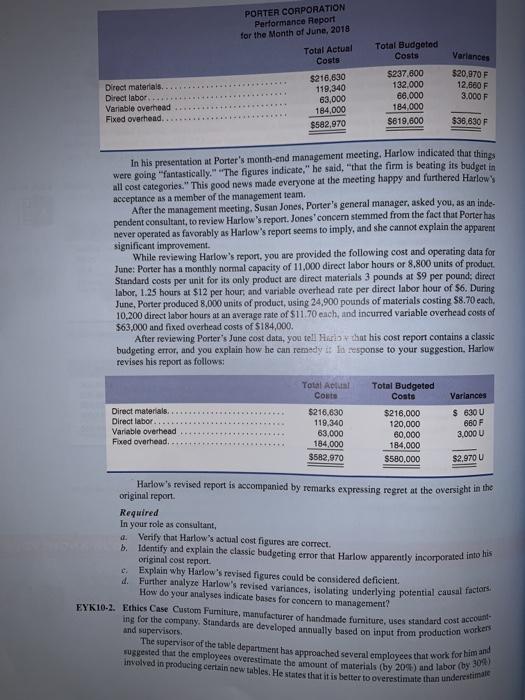

Calculate the variances for materials, labor, and variable overhead. b. Does the difference between total actual costs and total standard costs equal the sum of all of the EKIO-L. Business Decision Case Porter Corporation has just hired Bill Harlow as its new controller. Al- Require variances? Explain. EXTENDING YOUR KNO though Harlow has had little formal accounting training, he professes to be highly experienced. having learned accounting the hard way" in the field. At the end of his first month's work, Harlow prepared the following performance report: PORTER CORPORATION Report $27.000 132.000 0.000 164 000 3818.500 12.30 000 brother agenteam 562000 and find overhead costs of 5184,000 revises his report as follow Total Actual Costs Variances Direct man Director Variable overhead Fixed overhead $216,630 119.340 63.000 184,000 $582.970 Total Budgeted Costs $216,000 120.000 60.000 184.000 $580.000 $6300 660F 3.000 $2.9700 Harlow's revised report is accompanied by remarks expressing regret at the oversight in original report Required In your role as consultant Verify that Harlow's actual cost figures are correct. Identify and explain the classic budgeting error that Harlow apparently incorpotuted in a original cost report Explain why Harlow's revised figures could be considered deficient. 4. Faniher analyse Harlow's revised variances , isolating underlying potential causal fom How do your analyses indicate bases for concern to management? 6.2. Ethics Case Custom Furniture, manufacturer of handmade furniture, uses standard coco and supervisors between the was the ting happy and fund Hans Jarmd from the Ithat Ahon Palmager and you afya Herrera impecane plainthe When Hawort you are provided the following cost and operating to Sed conserinnlyduct are direct materials 3 pounds at 59 per part har Panery capacity of ladingslabor house Jan Perpad.00 min of product, using 24,900 pounds of materials contine 50 het hour and are overdre per direct lahar hours Ar viewing Portretat you How that his cost report contact budgeting, and you explain how he can remedy it. In response to your suggestion. Her The supervisor of the table department has approached several employees that work for sted that the comployees overestimate the amount of materials (by 205) and lahti where of $11.70 each and insured variable overhed ing for the company. Standards are developed annually based on input from production work Evolved in producing certain new tables. He states that it is better to overestimate than under EYK10-1. Business Decision Case ? Provide any calculation below Direct material Direct labor Variable overhead Fixed overhead Total actual costs HINT: Total Actual costs should be more than $500.000 and less than 5 600,000 0 1 Are the actual con figures correct? 2 13 4 15 16 17 TO 19 20 Che calculation material. 501 b. Budgeted costs anomalocity Direct material Direct labor Variable overhead Fixed overhead Totalted costs at normal nacity 22 10.1 Sh B D Standard costs for actual production Direct material Direct labor Variable overhead Fixed overhead Total Standard costs for actual production: Check Figure Calculation Direct labor (1.25 hrs. * 8,000 units x 512) Explain the classic budgeting error that Harlow apparently incorporated into his original cost report Explain why Harlow's revised figures could be considered deficient sheet? d Provide a summary of the variances - Textbook provides some good example of how to determine the variances starting on page 402 in the small boxes indicate the variance was (1) favorable or (u) unfavorable? Total Actual Costs Total Standard Cost Total Variance Material price variance Materials efficiency variance Labor rate variance Labor efficiency variance Variable overhead spending variance Variable overhead efficiency variance Sum of all variances Comment on the variances (be spacitie) - are there concema for management? 10:1 ing for the company. Standards are developed annually based on input from production workers The supervisor of the table department has approached several employees that work for him and involved in producing certain now tables. He states that it is better to overestimate than underestimate suggested that the employees overestimate the amount of materials (by 209) and labor (by 30%) PORTER CORPORATION Performance Report for the Month of June, 2018 Total Actual Costs $216,630 119,340 63,000 184,000 $582,970 Total Budgeted Costs $237,800 132.000 66.000 184,000 $619,600 Variances $20,970 F 12.680 F 3.000 F Direct materials. Direct labor Variable overhead Fixed overhead. $36.630 F In his presentation at Porter's month-end management meeting, Harlow indicated that things were going "fantastically." "The figures indicate," he said, "that the firm is beating its budget in all cost categories." This good news made everyone at the meeting happy and furthered Harlows acceptance as a member of the management team. After the management meeting, Susan Jones, Porter's general manager, asked you, as an inde- pendent consultant, to review Harlow's report. Jones concern stemmed from the fact that Porter has never operated as favorably as Harlow's report seems to imply, and she cannot explain the apparent significant improvement. While reviewing Harlow's report, you are provided the following cost and operating data for June: Porter has a monthly normal capacity of 11,000 direct labor hours or 8,800 units of product. Standard costs per unit for its only product are direct materials 3 pounds at 59 per pound: direct labor, 1.25 hours at $12 per hour, and variable overhead rate per direct labor hour of $6. During June, Porter produced 8,000 units of product, using 24,900 pounds of materials costing $8.70 each 10.200 direct labor hours at an average rate of $11.70 each, and incurred variable overhead costs of $63,000 and fixed overhead costs of $184,000. After reviewing Porter's Jane cost data, you tell her that his cost report contains a classic budgeting error, and you explain how he cun remedy it in response to your suggestion, Harlow revises his report as follows: Variances $ 630 U Direct materials Direct labor Variable overhead Fixed overhead Total Acil Costs $216,630 119,340 63.000 184.000 $582,970 Total Budgeted Costa $216.000 120,000 60,000 184,000 $580.000 660 F 3,000 U $2,970 u Harlow's revised report is accompanied by remarks expressing regret at the oversight in the original report Required In your role as consultant, Verify Identify and explain the classic budgeting error that Harlow apparently incorporated into his original cost report c. Explain why Harlow's revised figures could be considered deficient. 4. Further analyze Harlow's revised variances, isolating underlying potential causal factors How do your analyses indicate bases for concem to management? EYK10-2. Ethics Case Custom Furniture manufacturer of handmade furniture, uses standard cost account and supervisors Calculate the variances for materials, labor, and variable overhead. b. Does the difference between total actual costs and total standard costs equal the sum of all of the EKIO-L. Business Decision Case Porter Corporation has just hired Bill Harlow as its new controller. Al- Require variances? Explain. EXTENDING YOUR KNO though Harlow has had little formal accounting training, he professes to be highly experienced. having learned accounting the hard way" in the field. At the end of his first month's work, Harlow prepared the following performance report: PORTER CORPORATION Report $27.000 132.000 0.000 164 000 3818.500 12.30 000 brother agenteam 562000 and find overhead costs of 5184,000 revises his report as follow Total Actual Costs Variances Direct man Director Variable overhead Fixed overhead $216,630 119.340 63.000 184,000 $582.970 Total Budgeted Costs $216,000 120.000 60.000 184.000 $580.000 $6300 660F 3.000 $2.9700 Harlow's revised report is accompanied by remarks expressing regret at the oversight in original report Required In your role as consultant Verify that Harlow's actual cost figures are correct. Identify and explain the classic budgeting error that Harlow apparently incorpotuted in a original cost report Explain why Harlow's revised figures could be considered deficient. 4. Faniher analyse Harlow's revised variances , isolating underlying potential causal fom How do your analyses indicate bases for concern to management? 6.2. Ethics Case Custom Furniture, manufacturer of handmade furniture, uses standard coco and supervisors between the was the ting happy and fund Hans Jarmd from the Ithat Ahon Palmager and you afya Herrera impecane plainthe When Hawort you are provided the following cost and operating to Sed conserinnlyduct are direct materials 3 pounds at 59 per part har Panery capacity of ladingslabor house Jan Perpad.00 min of product, using 24,900 pounds of materials contine 50 het hour and are overdre per direct lahar hours Ar viewing Portretat you How that his cost report contact budgeting, and you explain how he can remedy it. In response to your suggestion. Her The supervisor of the table department has approached several employees that work for sted that the comployees overestimate the amount of materials (by 205) and lahti where of $11.70 each and insured variable overhed ing for the company. Standards are developed annually based on input from production work Evolved in producing certain new tables. He states that it is better to overestimate than under EYK10-1. Business Decision Case ? Provide any calculation below Direct material Direct labor Variable overhead Fixed overhead Total actual costs HINT: Total Actual costs should be more than $500.000 and less than 5 600,000 0 1 Are the actual con figures correct? 2 13 4 15 16 17 TO 19 20 Che calculation material. 501 b. Budgeted costs anomalocity Direct material Direct labor Variable overhead Fixed overhead Totalted costs at normal nacity 22 10.1 Sh B D Standard costs for actual production Direct material Direct labor Variable overhead Fixed overhead Total Standard costs for actual production: Check Figure Calculation Direct labor (1.25 hrs. * 8,000 units x 512) Explain the classic budgeting error that Harlow apparently incorporated into his original cost report Explain why Harlow's revised figures could be considered deficient sheet? d Provide a summary of the variances - Textbook provides some good example of how to determine the variances starting on page 402 in the small boxes indicate the variance was (1) favorable or (u) unfavorable? Total Actual Costs Total Standard Cost Total Variance Material price variance Materials efficiency variance Labor rate variance Labor efficiency variance Variable overhead spending variance Variable overhead efficiency variance Sum of all variances Comment on the variances (be spacitie) - are there concema for management? 10:1 ing for the company. Standards are developed annually based on input from production workers The supervisor of the table department has approached several employees that work for him and involved in producing certain now tables. He states that it is better to overestimate than underestimate suggested that the employees overestimate the amount of materials (by 209) and labor (by 30%) PORTER CORPORATION Performance Report for the Month of June, 2018 Total Actual Costs $216,630 119,340 63,000 184,000 $582,970 Total Budgeted Costs $237,800 132.000 66.000 184,000 $619,600 Variances $20,970 F 12.680 F 3.000 F Direct materials. Direct labor Variable overhead Fixed overhead. $36.630 F In his presentation at Porter's month-end management meeting, Harlow indicated that things were going "fantastically." "The figures indicate," he said, "that the firm is beating its budget in all cost categories." This good news made everyone at the meeting happy and furthered Harlows acceptance as a member of the management team. After the management meeting, Susan Jones, Porter's general manager, asked you, as an inde- pendent consultant, to review Harlow's report. Jones concern stemmed from the fact that Porter has never operated as favorably as Harlow's report seems to imply, and she cannot explain the apparent significant improvement. While reviewing Harlow's report, you are provided the following cost and operating data for June: Porter has a monthly normal capacity of 11,000 direct labor hours or 8,800 units of product. Standard costs per unit for its only product are direct materials 3 pounds at 59 per pound: direct labor, 1.25 hours at $12 per hour, and variable overhead rate per direct labor hour of $6. During June, Porter produced 8,000 units of product, using 24,900 pounds of materials costing $8.70 each 10.200 direct labor hours at an average rate of $11.70 each, and incurred variable overhead costs of $63,000 and fixed overhead costs of $184,000. After reviewing Porter's Jane cost data, you tell her that his cost report contains a classic budgeting error, and you explain how he cun remedy it in response to your suggestion, Harlow revises his report as follows: Variances $ 630 U Direct materials Direct labor Variable overhead Fixed overhead Total Acil Costs $216,630 119,340 63.000 184.000 $582,970 Total Budgeted Costa $216.000 120,000 60,000 184,000 $580.000 660 F 3,000 U $2,970 u Harlow's revised report is accompanied by remarks expressing regret at the oversight in the original report Required In your role as consultant, Verify Identify and explain the classic budgeting error that Harlow apparently incorporated into his original cost report c. Explain why Harlow's revised figures could be considered deficient. 4. Further analyze Harlow's revised variances, isolating underlying potential causal factors How do your analyses indicate bases for concem to management? EYK10-2. Ethics Case Custom Furniture manufacturer of handmade furniture, uses standard cost account and supervisors