Calculate the WACC for Tenant Healthcare and Surgery Partners

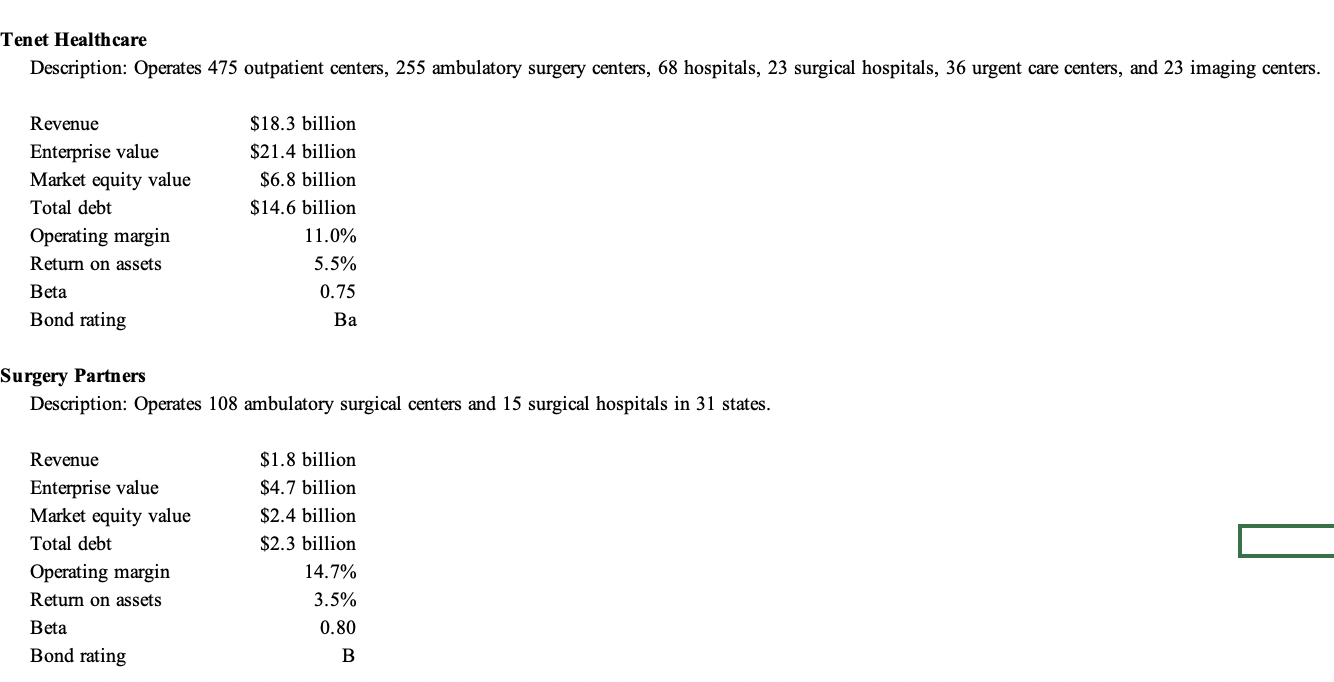

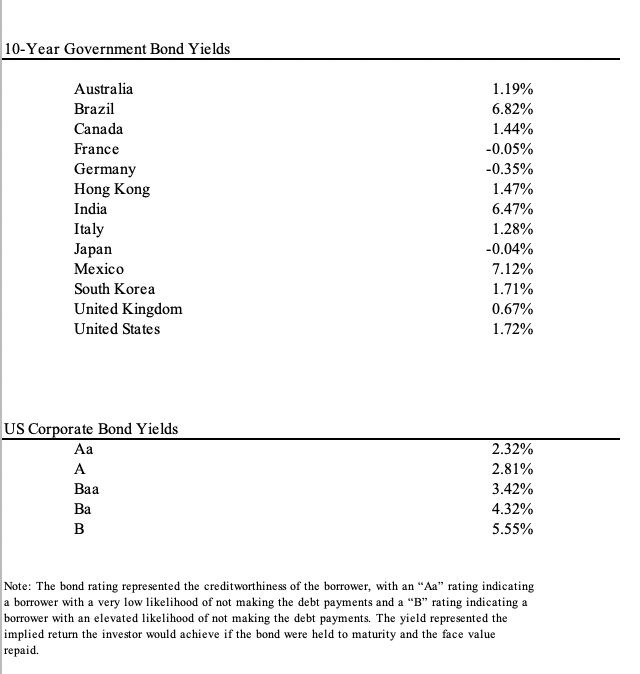

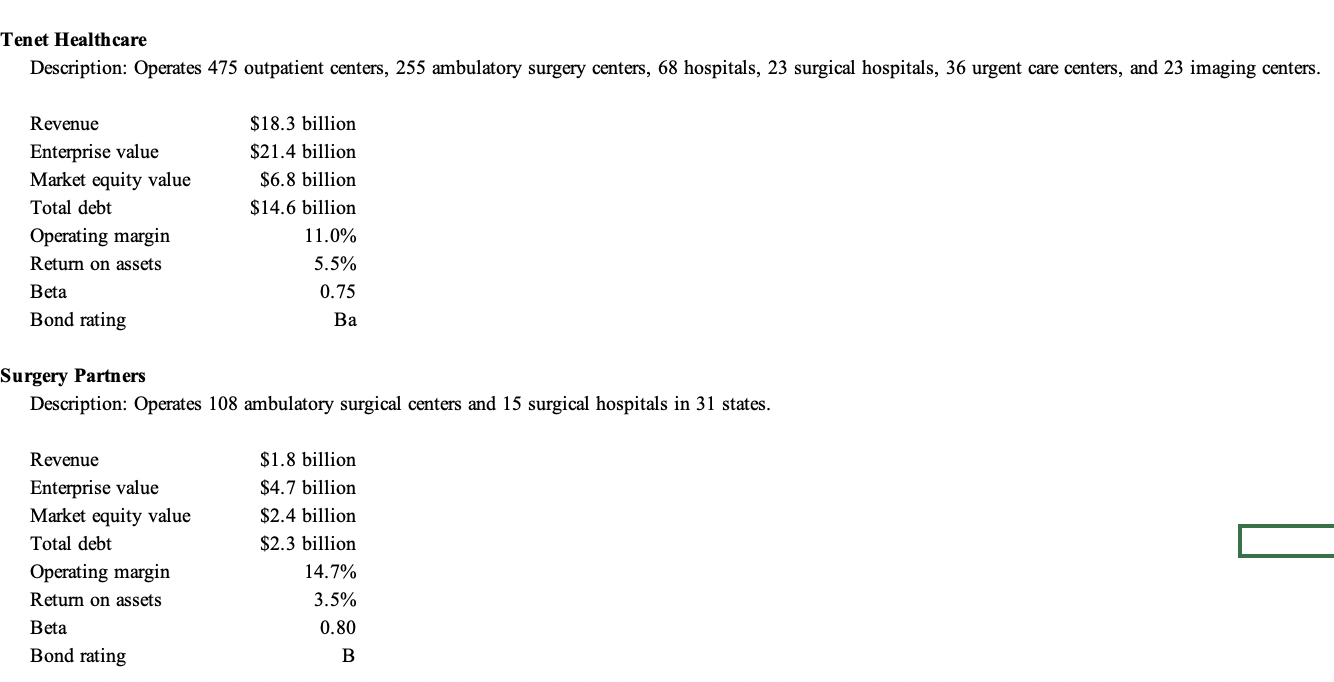

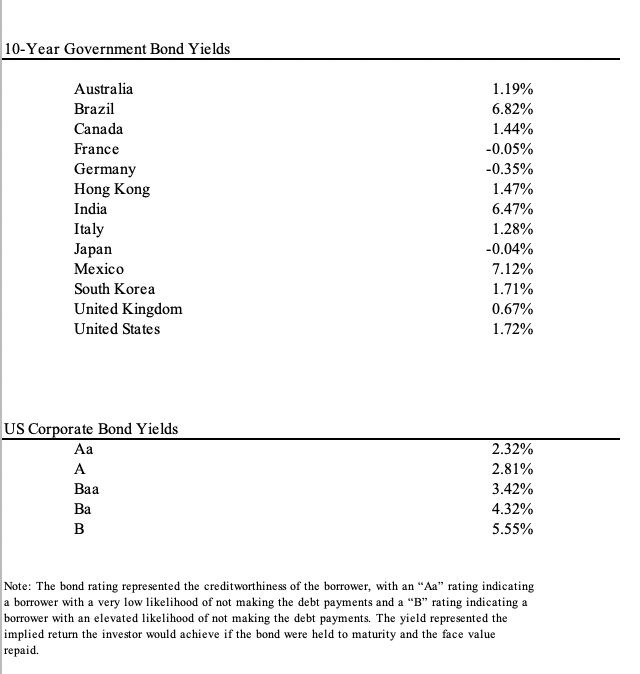

Tenet Health care Description: Operates 475 outpatient centers, 255 ambulatory surgery centers, 68 hospitals, 23 surgical hospitals, 36 urgent care centers, and 23 imaging centers. Revenue Enterprise value Market equity value Total debt Operating margin Return on assets Beta Bond rating $18.3 billion $21.4 billion $6.8 billion $14.6 billion 11.0% 5.5% 0.75 Ba Surgery Partners Description: Operates 108 ambulatory surgical centers and 15 surgical hospitals in 31 states. Revenue Enterprise value Market equity value Total debt Operating margin Return on assets Beta Bond rating $1.8 billion $4.7 billion $2.4 billion $2.3 billion 14.7% 3.5% 0.80 B 10-Year Government Bond Yields Australia Brazil Canada France Germany Hong Kong India Italy Japan Mexico South Korea United Kingdom United States 1.19% 6.82% 1.44% -0.05% -0.35% 1.47% 6.47% 1.28% -0.04% 7.12% 1.71% 0.67% 1.72% US Corporate Bond Yields A Baa 2.32% 2.81% 3.42% 4.32% 5.55% Ba B Note: The bond rating represented the creditworthiness of the borrower, with an "Aa" rating indicating a borrower with a very low likelihood of not making the debt payments and a B rating indicating a borrower with an elevated likelihood of not making the debt payments. The yield represented the implied return the investor would achieve if the bond were held to maturity and the face value repaid. Tenet Health care Description: Operates 475 outpatient centers, 255 ambulatory surgery centers, 68 hospitals, 23 surgical hospitals, 36 urgent care centers, and 23 imaging centers. Revenue Enterprise value Market equity value Total debt Operating margin Return on assets Beta Bond rating $18.3 billion $21.4 billion $6.8 billion $14.6 billion 11.0% 5.5% 0.75 Ba Surgery Partners Description: Operates 108 ambulatory surgical centers and 15 surgical hospitals in 31 states. Revenue Enterprise value Market equity value Total debt Operating margin Return on assets Beta Bond rating $1.8 billion $4.7 billion $2.4 billion $2.3 billion 14.7% 3.5% 0.80 B 10-Year Government Bond Yields Australia Brazil Canada France Germany Hong Kong India Italy Japan Mexico South Korea United Kingdom United States 1.19% 6.82% 1.44% -0.05% -0.35% 1.47% 6.47% 1.28% -0.04% 7.12% 1.71% 0.67% 1.72% US Corporate Bond Yields A Baa 2.32% 2.81% 3.42% 4.32% 5.55% Ba B Note: The bond rating represented the creditworthiness of the borrower, with an "Aa" rating indicating a borrower with a very low likelihood of not making the debt payments and a B rating indicating a borrower with an elevated likelihood of not making the debt payments. The yield represented the implied return the investor would achieve if the bond were held to maturity and the face value repaid