Answered step by step

Verified Expert Solution

Question

1 Approved Answer

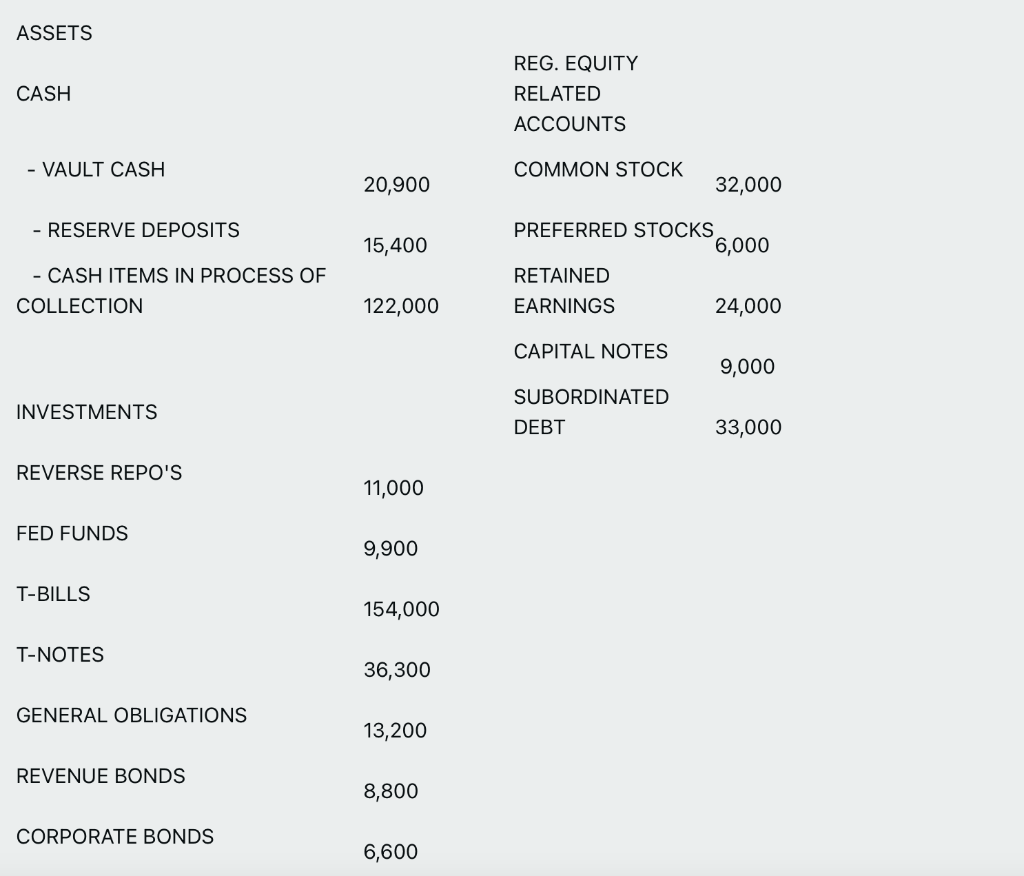

Calculate Tier 2 help pls ASSETS CASH - VAULT CASH - RESERVE DEPOSITS - CASH ITEMS IN PROCESS OF COLLECTION INVESTMENTS REVERSE REPO'S FED FUNDS

Calculate Tier 2

help pls

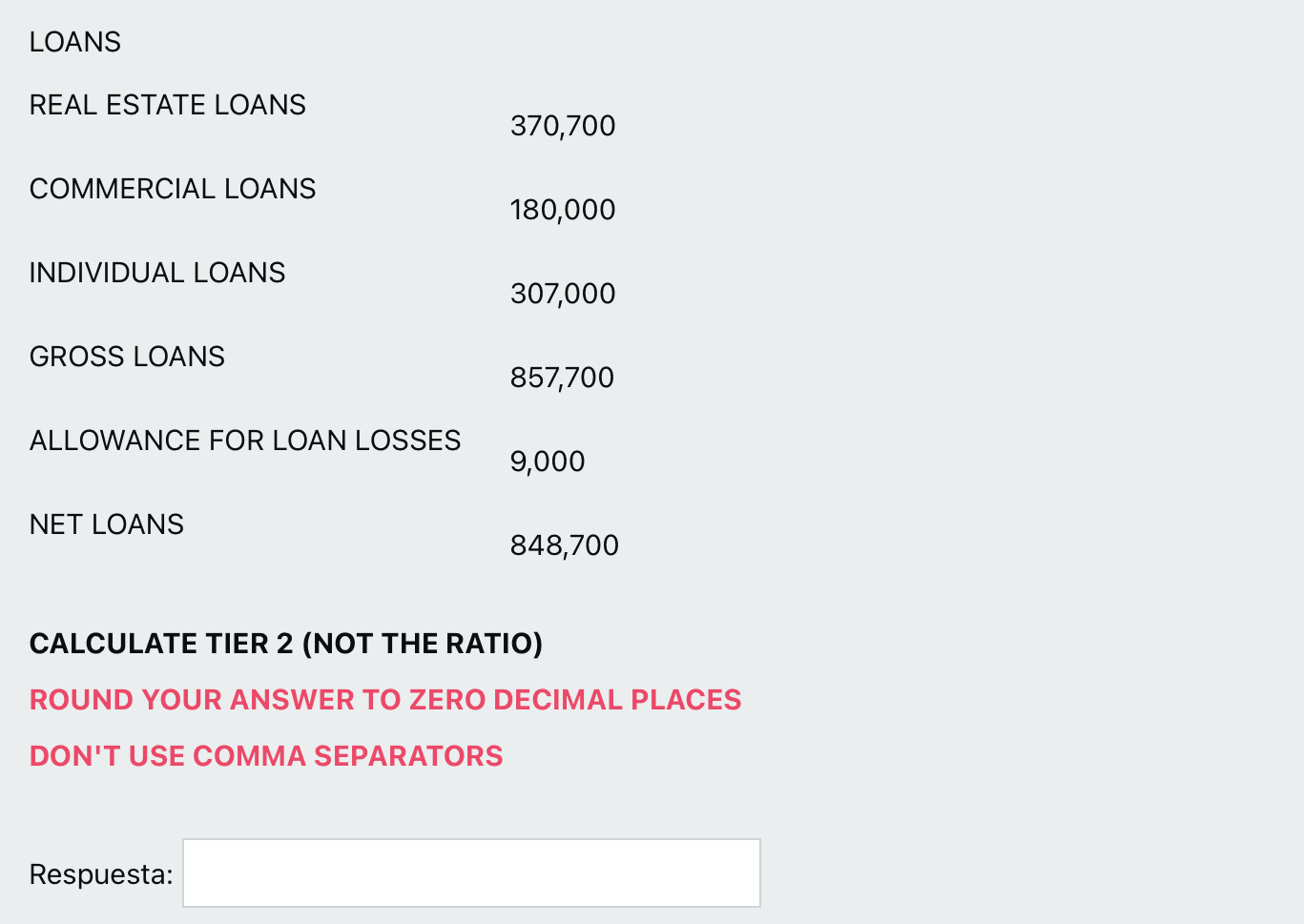

ASSETS CASH - VAULT CASH - RESERVE DEPOSITS - CASH ITEMS IN PROCESS OF COLLECTION INVESTMENTS REVERSE REPO'S FED FUNDS T-BILLS T-NOTES GENERAL OBLIGATIONS REVENUE BONDS CORPORATE BONDS 20,900 15,400 122,000 11,000 9,900 154,000 36,300 13,200 8,800 6,600 REG. EQUITY RELATED ACCOUNTS COMMON STOCK PREFERRED STOCKS RETAINED EARNINGS CAPITAL NOTES SUBORDINATED DEBT 32,000 6,000 24,000 9,000 33,000 LOANS REAL ESTATE LOANS COMMERCIAL LOANS INDIVIDUAL LOANS GROSS LOANS ALLOWANCE FOR LOAN LOSSES NET LOANS 370,700 Respuesta: 180,000 307,000 857,700 9,000 848,700 CALCULATE TIER 2 (NOT THE RATIO) ROUND YOUR ANSWER TO ZERO DECIMAL PLACES DON'T USE COMMA SEPARATORS ASSETS CASH - VAULT CASH - RESERVE DEPOSITS - CASH ITEMS IN PROCESS OF COLLECTION INVESTMENTS REVERSE REPO'S FED FUNDS T-BILLS T-NOTES GENERAL OBLIGATIONS REVENUE BONDS CORPORATE BONDS 20,900 15,400 122,000 11,000 9,900 154,000 36,300 13,200 8,800 6,600 REG. EQUITY RELATED ACCOUNTS COMMON STOCK PREFERRED STOCKS RETAINED EARNINGS CAPITAL NOTES SUBORDINATED DEBT 32,000 6,000 24,000 9,000 33,000 LOANS REAL ESTATE LOANS COMMERCIAL LOANS INDIVIDUAL LOANS GROSS LOANS ALLOWANCE FOR LOAN LOSSES NET LOANS 370,700 Respuesta: 180,000 307,000 857,700 9,000 848,700 CALCULATE TIER 2 (NOT THE RATIO) ROUND YOUR ANSWER TO ZERO DECIMAL PLACES DON'T USE COMMA SEPARATORSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started