Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 25 minutes please urgently... I'll give you up thumb definitely 8. Suppose you plan to buy a house. You made a

please do it in 25 minutes please urgently... I'll give you up thumb definitely

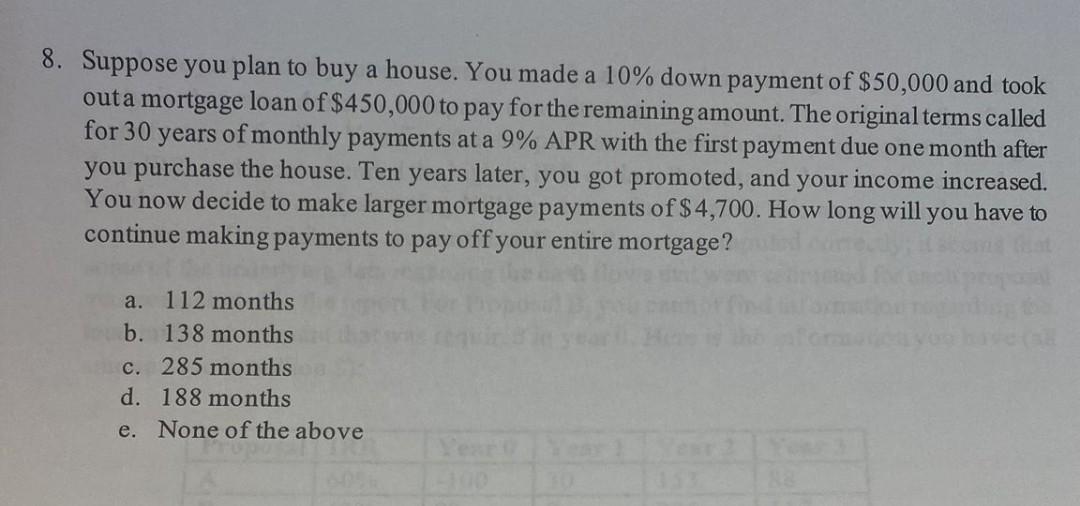

8. Suppose you plan to buy a house. You made a 10% down payment of $50,000 and took outa mortgage loan of $450,000 to pay for the remaining amount. The original terms called for 30 years of monthly payments at a 9% APR with the first payment due one month after you purchase the house. Ten years later, you got promoted, and your income increased. You now decide to make larger mortgage payments of $4,700. How long will you have to continue making payments to pay off your entire mortgage? a. 112 months b. 138 months c. 285 months d. 188 months e. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started