Answered step by step

Verified Expert Solution

Question

1 Approved Answer

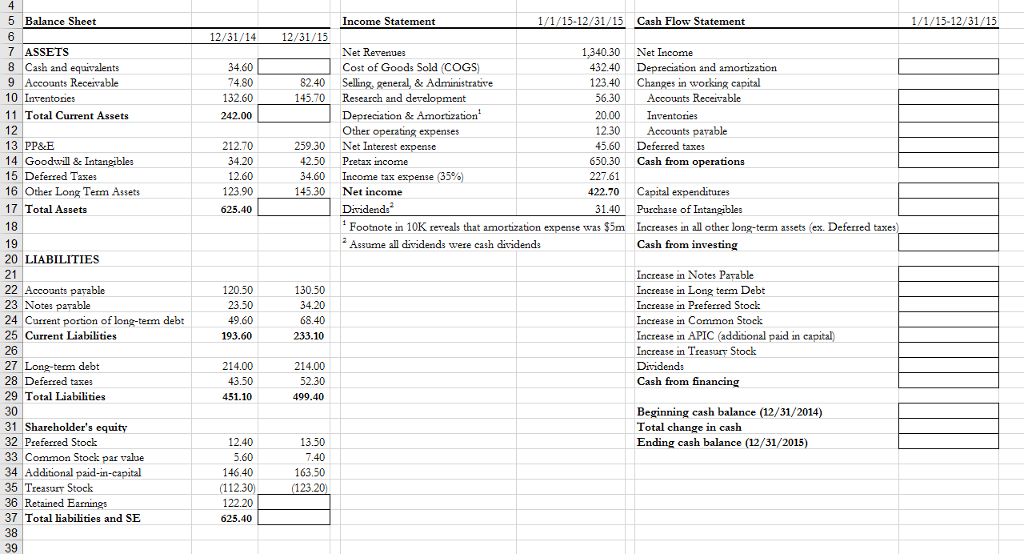

Calculate total cash from operations for the year ended 12/31/15. The correct answer is: a. 401.2 b. 418.8 c. 440.2 d. 462.8 5 Balance Sheet

Calculate total cash from operations for the year ended 12/31/15. The correct answer is:

a. 401.2

b. 418.8

c. 440.2

d. 462.8

5 Balance Sheet 1/1/15-12/31/15 Cash Flow Statement 12, 14 12/3/15 ASSETS Net Revenues 1.340.30 Net Income 7 8 Cash and equivalents Cost of Goods sold (COGS) 432.40 Depreciation and amortization 123.40 Changes in working capital 9 Accounts Receivable 82.40 Selling, general, & Administrative 14370 Research and development 56.30 Accounts Receivable 2000 Inventories 11 Total Current Assets Depreciation & Amortization Other operating expenses 12.30 Accounts payable 3 PP&E 259.30 Net Interest expense 34.20 14 Goodwill & Intangibles 42.50 Pretax income 650.30 Cash from operations 15 Deferred Taxes 12.60 34.60 Income tax expense (35%) 422.70 Capital expenditures 12390 14530 Net income 16 Other Long Term Assets 625.40 17 Total Assets Dividends 31.40 Purchase of Intangibles Footnote in 10K reveals that amortization espense was $5m Increases in all other long-term assets (ex. Deferred taxes Cash from investing Assume all dividends were cash dividends 20 LIABILITIES 21 Accounts payable 120.50 130.50 Increase in Long term Debt 22 23 Notes parable 23.50 34.20 Increase in Preferred Stock 24 Current portion of long-term debt 25 Current Liabilities Increase in APIC (additional paid in capital Long-term debt 214.00 214.00 Dividends 27 28 Deferred taxes Cash from financing 29 Total Liabilities 31 Shareholder's equity otal c 12.40 13.30 32 Preferred Stock Ending cash balance (12/31/2015) 33 Common Stock par value 34 Additional paid-in-capital (112300 123.20 Treasur Stock 35 36 Retained Earnings 625.40 37 Total liabilities and SE 1/1/15-12/31/15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started