Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate wacc please show steps i got this info fron 2016 would it help ? Grounded on a 3.2% after-tax cost of debt, and a

calculate wacc

please show steps

i got this info fron 2016 would it help ?

Grounded on a 3.2% after-tax cost of debt, and a 5.5% cost of equity, we were able to attain a 4.2% weighted average cost of debt (WACC) for NADEC, our target company. Correspondingly, we arrived at a 55.69% of debt-to-total capitalization and a 44.3% equity-to-capitalization ratio, which makes up the companys capital structure. In order to compute the companys cost of equity, we used the capital asset pricing model (CAPM). We collected the information from equity reports of analysts in the industry itself, where we were able to find out the market risk-premium of 1% and a risk-free rate of 3.8%. NADEC turned out to have a 6% cost of debt according to the companys financial statements, however, based on our calculations and findings

i want only solvency ratios and profitability ratios and efficiency ratios no need to calculate wacc just please show the equations for three years

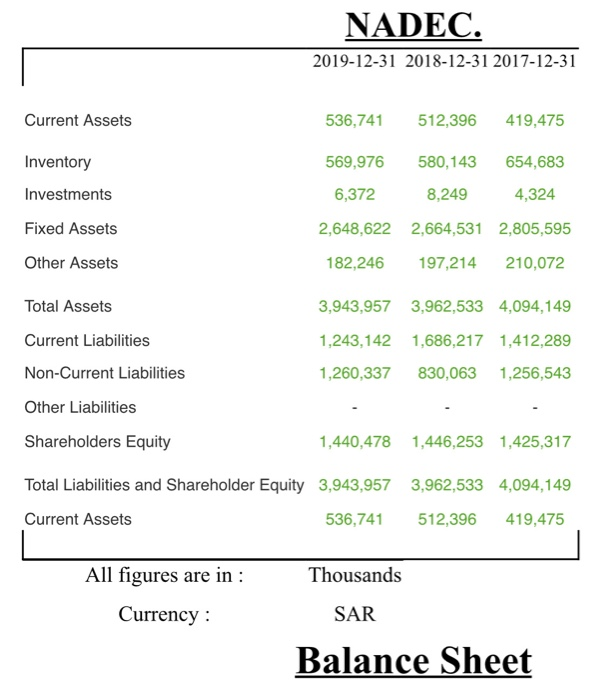

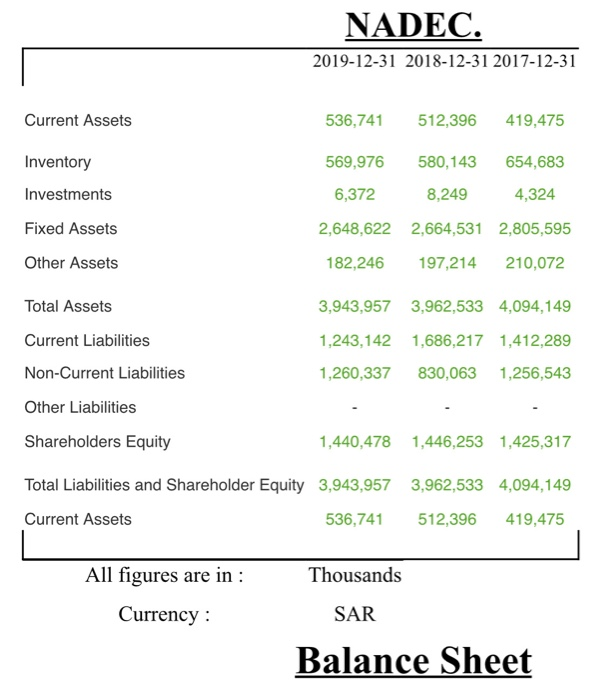

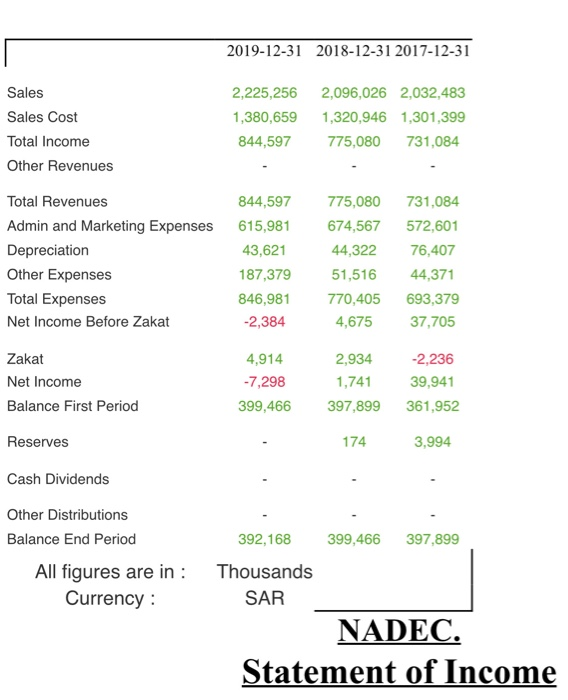

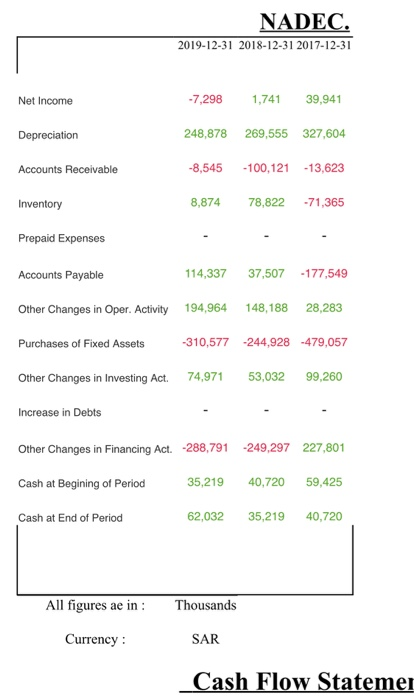

NADEC. 2019-12-31 2018-12-31 2017-12-31 Current Assets 536,741 512,396 419,475 Inventory Investments 569,976 6,372 2,648,622 182,246 580,143 654,683 8,249 4,324 2,664,531 2,805,595 197,214 210,072 Fixed Assets Other Assets Total Assets Current Liabilities 3,943,957 1,243,142 1,260,337 3,962,533 4,094,149 1,686,217 1,412,289 830,063 1,256,543 Non-Current Liabilities Other Liabilities Shareholders Equity 1,440,478 1,446,253 1,425,317 Total Liabilities and Shareholder Equity 3,943,957 Current Assets 536,741 3,962,533 4,094,149 512,396 419,475 All figures are in : Thousands Currency: SAR Balance Sheet 2019-12-31 2018-12-31 2017-12-31 Sales Sales Cost Total Income Other Revenues 2,225,256 2,096,026 2,032,483 1,380,6591,320,946 1,301,399 844,597775,080 731,084 Total Revenues Admin and Marketing Expenses Depreciation Other Expenses Total Expenses Net Income Before Zakat 844,597 615,981 43,621 187,379 846,981 -2,384 775,080 674,567 44,322 51,516 770,405 4,675 731.084 572,601 76,407 44,371 693,379 37,705 Zakat Net Income Balance First Period 4,914 -7,298 399,466 2,934 -2,236 1,741 39,941 397,899361,952 Reserves 174 3,994 Cash Dividends Other Distributions Balance End Period All figures are in: Currency: 392,168 399,466 397,899 Thousands SAR NADEC. Statement of Income NADEC. 2019-12-31 2018-12-31 2017-12-31 Net Income -7,298 1,741 39,941 Depreciation 248,878 269,555 327,604 Accounts Receivable -8,545 -100,121 -13,623 Inventory 8,874 78,822 -71,365 Prepaid Expenses Accounts Payable 114,337 37,507 177,549 Other Changes in Oper. Activity 194,964 148,188 28,283 Purchases of Fixed Assets - 310,577 244,928 -479,057 Other Changes in Investing Act. 74,971 5 3,032 99,260 Increase in Debts Other Changes in Financing Act. -288,791 -249,297 227,801 Cash at Begining of Period 35,21940,720 59,425 Cash at End of Period 62,032 35,21940,720 All figures ae in: Thousands Currency: SAR Cash Flow Statemer Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started