Question

Calculate + write the illustration Net Profit Margin: (net profit after interest and tax / sales) * 100 Net income: (the value of net profit

Calculate + write the illustration

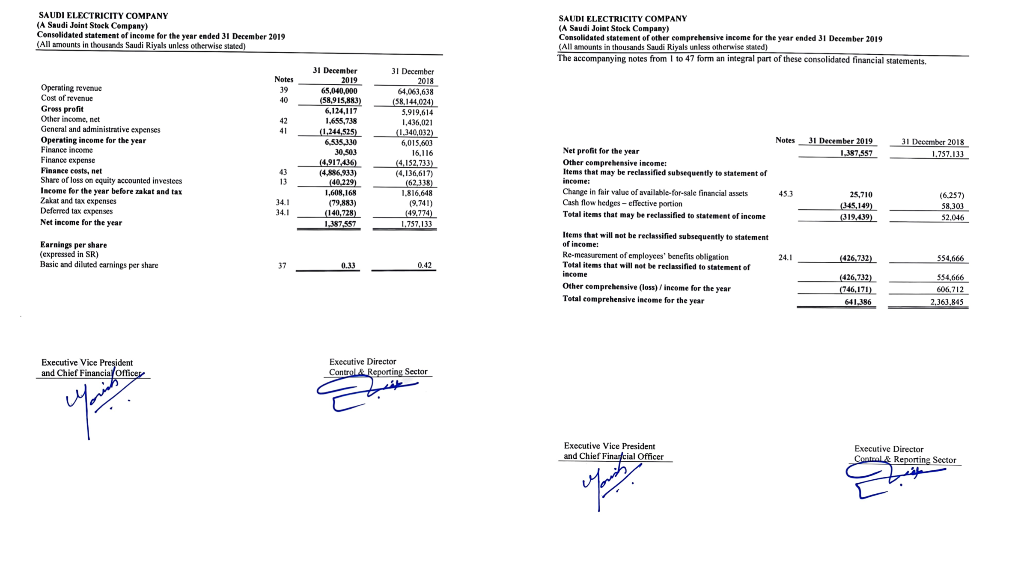

Net Profit Margin: (net profit after interest and tax / sales) * 100

Net income: (the value of net profit after interest and taxes)

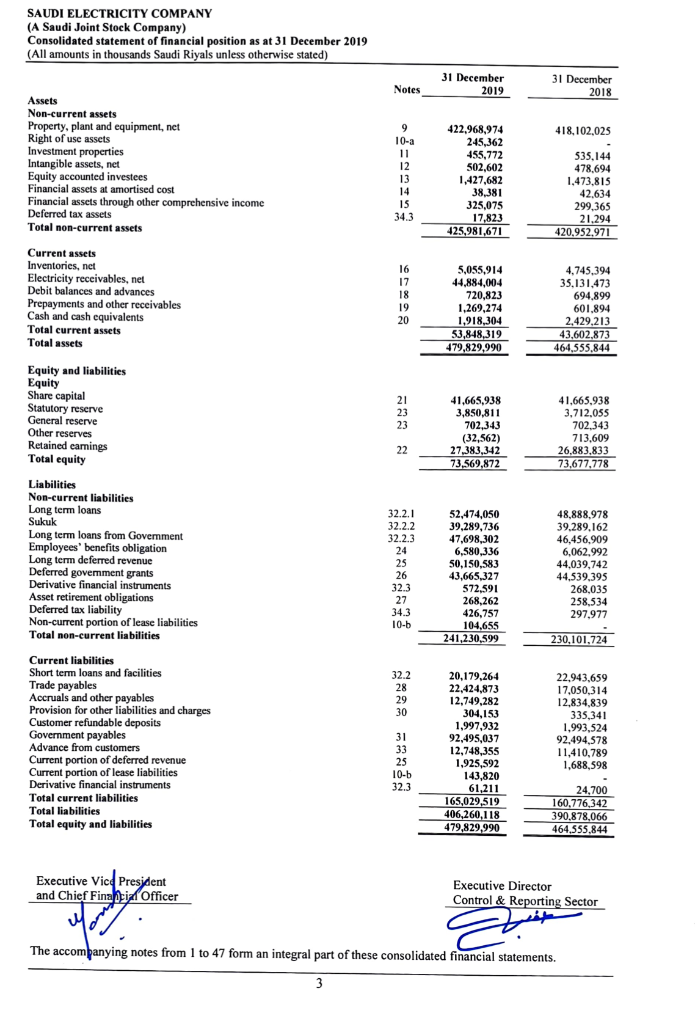

Rate of return on assets: (net profit after tax + interest (1- tax rate)) / average assets

Profit before tax margin: (net profit before tax / sales) * 100

Rate of Return on Equity: (Net Profit Available to Common Equity Holders / Average Shareholder Equity) * 100

Revenue power: (net operating profit before interest and taxes / net tangible assets) * 100

Gross Profit Margin (Gross Profit / Sales) * 100

EBIT margin: (net profit before interest and tax / sales) * 100

SAUDI ELECTRICITY COMPANY (A Saudi Joint Stock Company) Consolidated statement of income for the year ended 31 December 2019 (All amounts in thousands Saudi Riyals unless otherwise stated) SAUDI ELECTRICITY COMPANY (A Saudi Joint Stock Company) Consolidated statement of other comprehensive income for the year ended 31 December 2019 (All amounts in thousands Saudi Riyals unless otherwise stated) The accompanying notes from 1 to 47 form an integral part of these consolidated financial statements DE Notes 39 40 42 41 31 December 2019 65,040,000 (58,915,883) 6,124,117 1,655,736 () (1,244,525) 6.535,330 30,503 (4.917.436 (4.886,933) (40.229) Operating revenue Cost of revenue Gross profit Other income, net General and administrative expenses Operating income for the year Finance income Finance expense Finance costs, net Share of loss on equity accounted investees Income for the year before zakat and tax Zakat and tax expenses Deferred tax expenses Net income for the year Notes 31 December 2018 64.063,638 (58,144,024) 5,919,614 1,436,021 (1.340,032) 6,015,600 16,116 (4,152,733) (4,136,617) ( (62,338) 1.816.648 (9.741) (49,774) 1.757,133 31 December 2019 1.387.557 31 December 2018 1.757.13] 13 1,605,168 453 34.1 34.1 25,710 (345,149) (319,439) (6.257) 58.303 (79,883) (140,728) 1.197,557 52.046 Net profit for the year Other comprehensive income: Items that may be reclassified subsequently to statement of income: Change in fair value of available for sale financial assets Cash flow hedges-effective portion Total items that may be reclassified to statement of income Items that will not be reclassified subsequently to statement of income: Re-measurement of employees' benefits obligion Total items that will not be reclassified to statement of income Other comprehensive (loss) /income for the year Total comprehensive Income for the year Earnings per share (expressed in SR) Basic and diluted earnings per share 24.1 (426.732) 554,666 0.13 0.42 (426,732) (746,171) 641.386 554,666 606,712 2.363,845 Executive Vice President and Chief Financial Officer Executive Director Control Reporting Sector Executive Vice President and Chief Financial Officer Executive Director Contual Reporting Sector opas SAUDI ELECTRICITY COMPANY (A Saudi Joint Stock Company) Consolidated statement of financial position as at 31 December 2019 (All amounts in thousands Saudi Riyals unless otherwise stated) 31 December 2019 31 December 2018 Notes 418,102,025 Assets Non-current assets Property, plant and equipment, net Right of use assets Investment properties Intangible assets, net Equity accounted investees Financial assets at amortised cost Financial assets through other comprehensive income Deferred tax assets Total non-current assets 9 10-a 11 12 13 14 15 343 422,968,974 245,362 455,772 502,602 1,427,682 38.381 325,075 17,823 425,981,671 535,144 478,694 1,473,815 42.634 299,365 21,294 420.952,971 Current assets Inventories, net Electricity receivables, net Debit balances and advances Prepayments and other receivables Cash and cash equivalents Total current assets Total assets 16 17 18 19 20 5,055,914 44,884,004 720,823 1,269,274 1,918,304 53,848,319 479,829,990 4,745,394 35,131,473 694.899 601,894 2,429.213 43,602,873 464,555.844 Equity and liabilities Equity Share capital Statutory reserve General reserve Other reserves Retained earnings Total equity 21 23 23 41,665,938 3,850,811 702,343 (32,562) 27,383,342 73,569.872 41,665.938 3.712.055 702343 713,609 26,883,833 73,677,778 22 Liabilities Non-current liabilities Long term loans Sukuk Long term loans from Government Employees' benefits obligation Long term deferred revenue Deferred goverment grants Derivative financial instruments Asset retirement obligations Deferred tax liability Non-current portion of lease liabilities Total non-current liabilities 32.2.1 32.2.2 32.2.3 24 25 26 32.3 27 34.3 10-b 52,474,050 39,289,736 47,698,302 6,580,336 50,150,583 43,665,327 572,591 268,262 426,757 104,655 241,230,599 48,888,978 39.289,162 46,456,909 6,062,992 44,039,742 44,539,395 268,035 258,534 297.977 230,101.724 32.2 28 29 30 Current liabilities Short term loans and facilities Trade payables Accruals and other payables Provision for other liabilities and charges Customer refundable deposits Government payables Advance from customers Current portion of deferred revenue Current portion of lease liabilities Derivative financial instruments Total current liabilities Total liabilities Total equity and liabilities 20,179,264 22,424,873 12,749,282 304,153 1,997,932 92,495,037 12,748,355 1,925,592 143,820 61,211 165,029,519 406,260,118 479,829,990 22,943,659 17,050,314 12,834,839 335.341 1,993,524 92.494,578 11,410,789 1,688,598 31 33 25 10-b 32.3 24,700 160,776,342 390.878,066 464.555.844 Executive Vice President and Chief Fina til Officer Executive Director Control & Reporting Sector The accompanying notes from 1 to 47 form an integral part of these consolidated financial statements. 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started