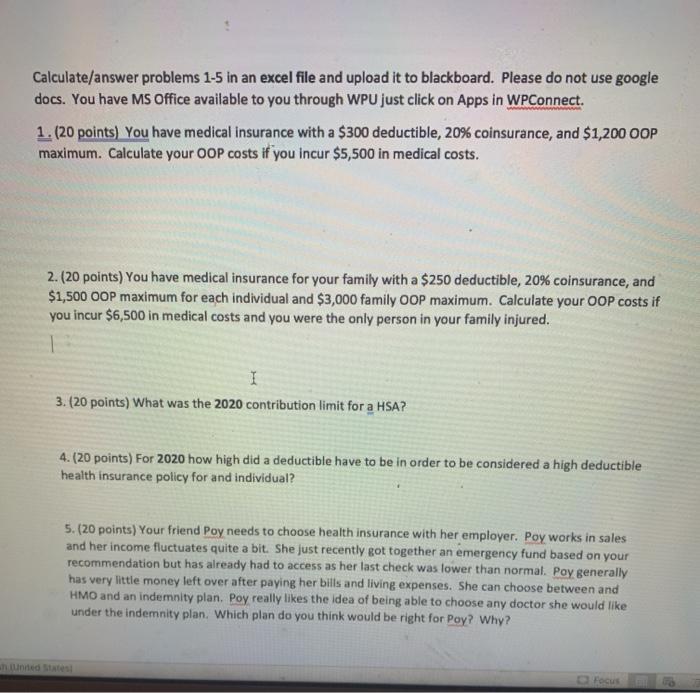

Calculate/answer problems 1-5 in an excel file and upload it to blackboard. Please do not use google docs. You have MS Office available to you through WPU just click on Apps in WPConnect. 1. (20 points) You have medical insurance with a $300 deductible, 20% coinsurance, and $1,200 OOP maximum. Calculate your OOP costs if you incur $5,500 in medical costs. 2. (20 points) You have medical insurance for your family with a $250 deductible, 20% coinsurance, and $1,500 OOP maximum for each individual and $3,000 family OOP maximum. Calculate your OOP costs if you incur $6,500 in medical costs and you were the only person in your family injured. 1 3. (20 points) What was the 2020 contribution limit for a HSA? 4.(20 points) For 2020 how high did a deductible have to be in order to be considered a high deductible health insurance policy for and individual? 5. (20 points) Your friend Poy needs to choose health insurance with her employer. Poy works in sales and her income fluctuates quite a bit. She just recently got together an emergency fund based on your recommendation but has already had to access as her last check was lower than normal. Pay generally has very little money left over after paying her bills and living expenses. She can choose between and HMO and an indemnity plan. Poy really likes the idea of being able to choose any doctor she would like under the indemnity plan. Which plan do you think would be right for Poy? Why? Calculate/answer problems 1-5 in an excel file and upload it to blackboard. Please do not use google docs. You have MS Office available to you through WPU just click on Apps in WPConnect. 1. (20 points) You have medical insurance with a $300 deductible, 20% coinsurance, and $1,200 OOP maximum. Calculate your OOP costs if you incur $5,500 in medical costs. 2. (20 points) You have medical insurance for your family with a $250 deductible, 20% coinsurance, and $1,500 OOP maximum for each individual and $3,000 family OOP maximum. Calculate your OOP costs if you incur $6,500 in medical costs and you were the only person in your family injured. 1 3. (20 points) What was the 2020 contribution limit for a HSA? 4.(20 points) For 2020 how high did a deductible have to be in order to be considered a high deductible health insurance policy for and individual? 5. (20 points) Your friend Poy needs to choose health insurance with her employer. Poy works in sales and her income fluctuates quite a bit. She just recently got together an emergency fund based on your recommendation but has already had to access as her last check was lower than normal. Pay generally has very little money left over after paying her bills and living expenses. She can choose between and HMO and an indemnity plan. Poy really likes the idea of being able to choose any doctor she would like under the indemnity plan. Which plan do you think would be right for Poy? Why