Answered step by step

Verified Expert Solution

Question

1 Approved Answer

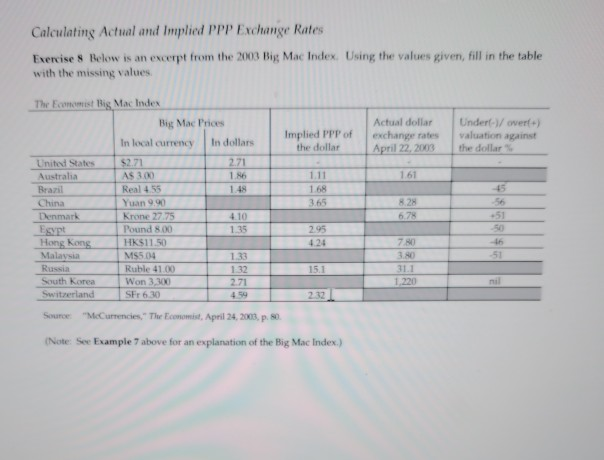

Calculating Actual and Implied PPP Exchange Rates Exercise 8 Below is an excerpt from the 2003 Big Mac Index. Using the values given, fill in

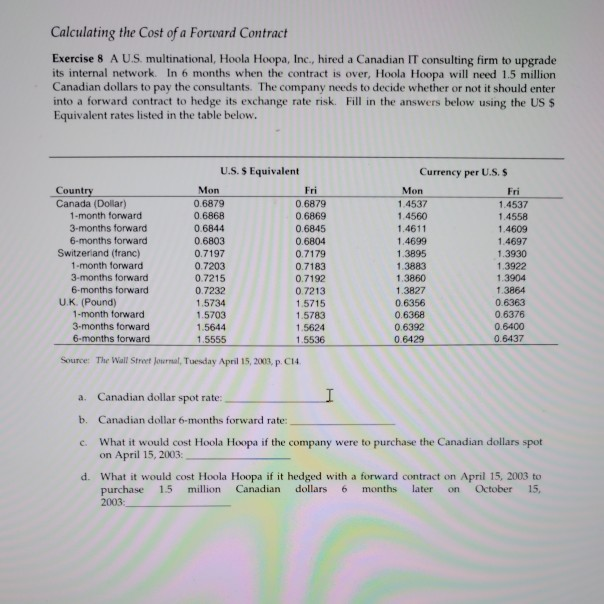

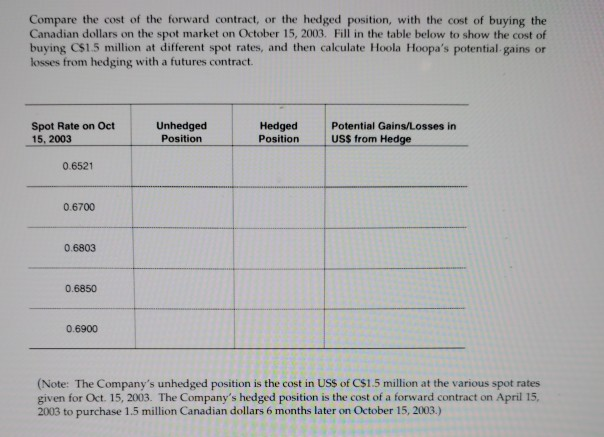

Calculating Actual and Implied PPP Exchange Rates Exercise 8 Below is an excerpt from the 2003 Big Mac Index. Using the values given, fill in the table with the missing values The Economist Big Mac Index Big Mac Prices In local currency In dollars Implied PPP of the dollar Actual dollar exchange rates April 22, 2003 Under-/werf) valuation against the dollar 167 1.48 10 355 Unit Australia Brazil China Thenmark Egypt Hong Kong Malaysia 4 10 135 AS 300 Real 4.55 Yuan Krone 27. 75 Pound 800 HK$11.50 MS504 Ruble 41.00 Won 3.0 SF60 295 424 133 132 271 4.5 15.1 South Korea Swirland 212 Source McCurrencies. The Economist, April 24, 2001, p. (Note: See Example 7 above for an explanation of the Big Mac Index.) Calculating the Cost of a Forward Contract Exercise 8 A U.S. multinational, Hoola Hoopa, Inc., hired a Canadian IT consulting firm to upgrade its internal network. In 6 months when the contract is over, Hoola Hoopa will need 1.5 million Canadian dollars to pay the consultants. The company needs to decide whether or not it should enter into a forward contract to hedge its exchange rate risk. Fill in the answers below using the US$ Equivalent rates listed in the table below. Currency per U.S.S U.S. Equivalent Country Mon Fri Canada (Dollar) 0.6879 0.6879 1-month forward 0.6868 0.6869 3-months forward 0.6844 0.6845 6-months forward 0.6803 0.6804 Switzerland (franc) 0.7197 0.7179 1-month forward 0.7203 0.7183 3-months forward 0.7215 0.7192 6-months forward 0.7232 0.7213 U.K(Pound) 1.5734 1.5715 1-month forward 1.5703 1.5783 3-months forward 1.5644 1.5624 6-months forward 1.5555 1.5536 Source: The Wall Street Journal, Tuesday April 15, 2003, p.14. Mon 1.4537 1.4560 1.4611 1.4699 1.3895 1.3883 1.3860 1.3827 0.6356 0.6368 0.6392 0.6429 1.4537 1.4558 1.4609 1.4697 1.3930 1.3922 1.3904 1.3864 0.6363 0.6376 0.6400 0.6437 a. Canadian dollar spot rate: b. Canadian dollar 6-months forward rate: _ c. What it would cost Hoola Hoopa if the company were to purchase the Canadian dollars spot on April 15, 2003 d. What it would cost Hoola Hoopa if it hedged with a forward contract on April 15, 2003 to purchase 1.5 million Canadian dollars 6 months later on October 15, 2003: Compare the cost of the forward contract, or the hedged position, with the cost of buying the Canadian dollars on the spot market on October 15, 2003. Fill in the table below to show the cost of buying $1.5 million at different spot rates, and then calculate Hoola Hoopa's potential gains or losses from hedging with a futures contract. Spot Rate on Oct 15, 2003 Unhedged Position Hedged Position Potential Gains/Losses in US$ from Hedge 0.6521 0.6700 0.6803 0.6850 0.6900 (Note: The Company's unhedged position is the cost in USS of CS1.5 million at the various spot rates given for Oct 15, 2003. The Company's hedged position is the cost of a forward contract on April 15 2003 to purchase 1,5 million Canadian dollars 6 months later on October 15, 2003.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started