Question

(Calculating changes in net operating working capital) Duncan Motors is introducing a new product and has an expected change in net operating income of

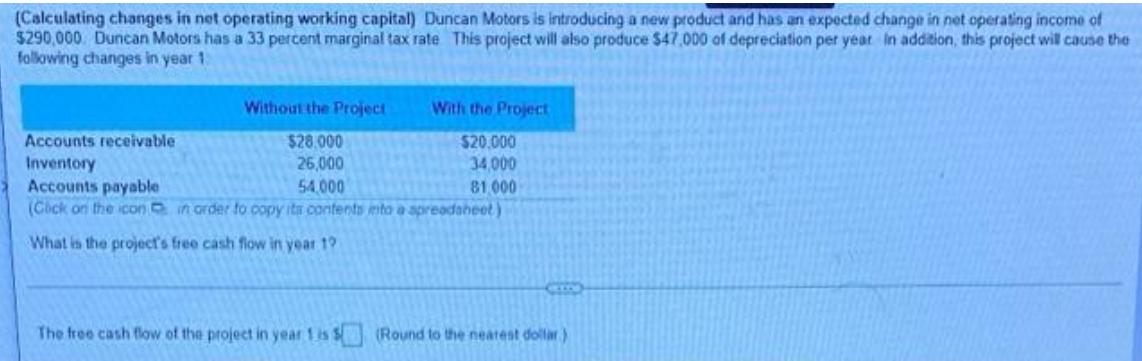

(Calculating changes in net operating working capital) Duncan Motors is introducing a new product and has an expected change in net operating income of $290,000 Duncan Motors has a 33 percent marginal tax rate This project will also produce $47,000 of depreciation per year in addition, this project will cause the following changes in year 1 Accounts receivable Inventory Accounts payable Without the Project With the Project $28.000 $20,000 26,000 34,000 54,000 81,000 (Cick on the icon in order to copy its contents into a spreadsheet) What is the project's free cash flow in year 19 The free cash flow of the project in year 1 is $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur Keown, John Martin

12th edition

133423824, 978-0133423822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App