Answered step by step

Verified Expert Solution

Question

1 Approved Answer

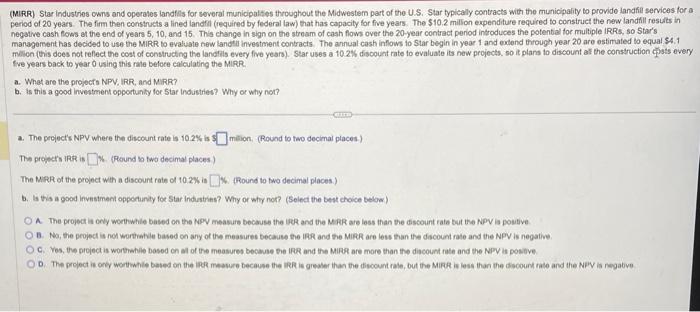

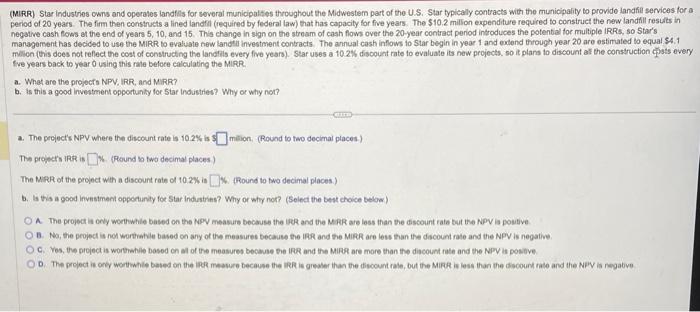

Calculating MIRR Urgent!! Please include all parts (MiRR) Star industries cons and operales landils for several municipaltes throughout the Midwestem part of the U.S. Star

Calculating MIRR Urgent!! Please include all parts

(MiRR) Star industries cons and operales landils for several municipaltes throughout the Midwestem part of the U.S. Star typicaly contracts with the municipality to provide iandfil services for a period of 20 years. The firm then constructs a lined landfil (required by federal law) that has capacity for five years. The $10.2 million expenditure required to construct the nerw landfill restits in negative cash fooss at the end of years 5,10 , and 15 . This change in sign on the stream of cash flows over the 20 -year contract period introduces the potential for multiple IRRs, so Star's mansgoment has decided to use the MIRR to evaluate new landetl inyestment contracts. The annual cash inflows to $ tar begin in year 1 and extend through year 20 are estimated to equal $4.1 milion (this does not reflect the cost of constructing the lanatils every five years). Star uses a 10.2% discount rate to evaluate its new projects. so it plars to discount at the construction chists every five years back to year 0 using this rale beloce calculating the MiRR. a. What are the projects NPV, IRR, and MRRR? b. is this a good investment opportunity for 5 tar industifes? Why or why not? a. The project's NPV where the discount rate is 10.2% is 1 mition, (Round to two decimal places) The project ing is 6. (Round to two decimal places) The MieR of the propect with a discount rate of 10.2W is K. (Roound to two decimal places.) b. Is this a good investment oppeturity for Star indiatinis? Why or why not? (Select the best choice below)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started