Answered step by step

Verified Expert Solution

Question

1 Approved Answer

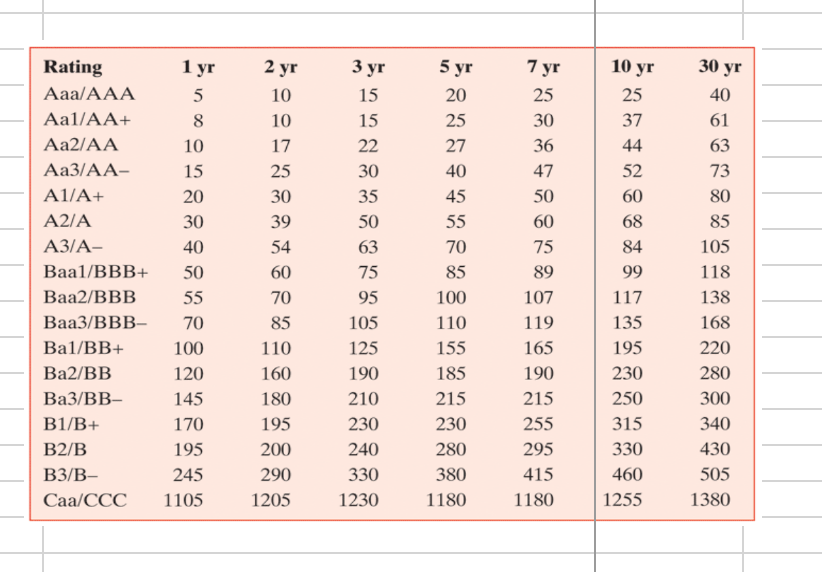

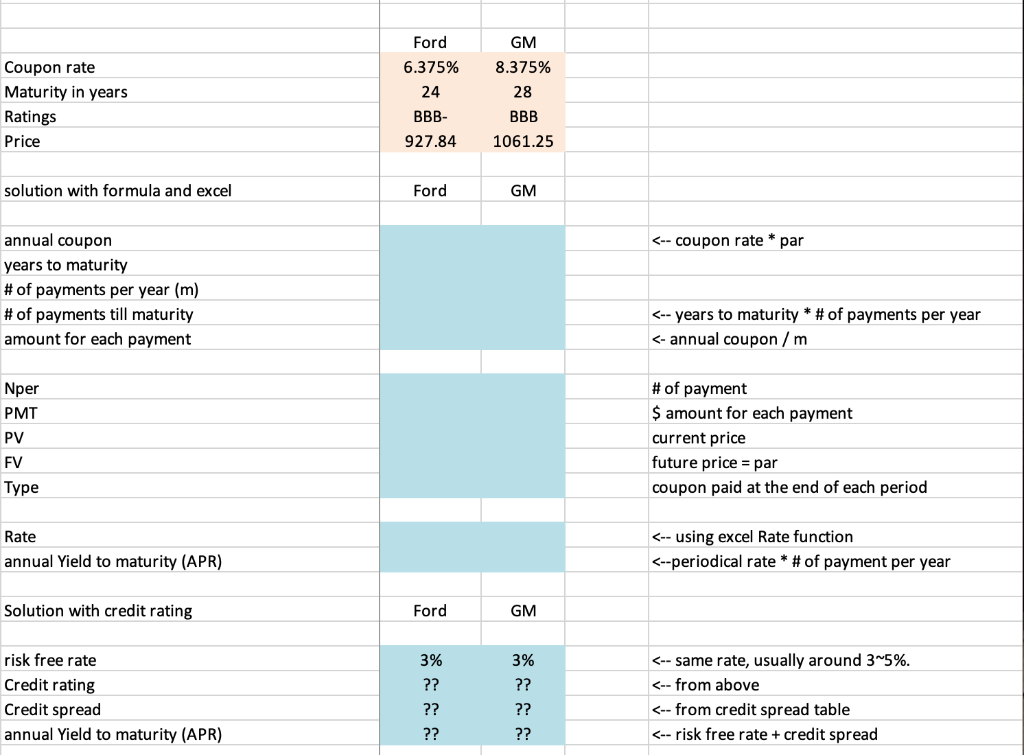

Calculating the Promised YTM Evaluate the promised YTM for the bonds issued by Ford (F) and General Motors (GM). You may assume that interest is

Calculating the Promised YTM Evaluate the promised YTM for the bonds issued by Ford (F) and General Motors (GM). You may assume that interest is paid semiannually. Also, round the number of compounding periods to the nearest six months.

Calculating the Promised YTM Evaluate the promised YTM for the bonds issued by Ford (F) and General Motors (GM). You may assume that interest is paid semiannually. Also, round the number of compounding periods to the nearest six months.

Please help me fill out the excel portion in blue

30 yr 1 yr 5 8 10 2 yr 10 10 17 25 30 39 54 60 7 yr 25 30 36 47 50 60 15 75 Rating Aaa/AAA Aal/AA+ Aa2/AA Aa3/AA- A1/A+ A2/A A3/A- Baal/BBB+ Baa2/BBB Baa3/BBB- Bal/BB+ Ba2/BB Ba3/BB- B1/B+ B2/B B3/B- Caa/CCC 3 yr 15 15 22 30 35 50 63 75 95 105 125 190 210 230 240 330 1230 20 30 40 50 55 70 100 120 145 170 195 245 1105 5 yr 20 25 27 40 45 55 70 85 100 110 155 185 215 230 280 380 1180 70 10 yr 25 37 44 52 60 68 84 99 117 135 195 230 250 315 330 460 1255 89 107 119 165 190 215 255 295 415 1180 40 61 63 73 80 85 105 118 138 168 220 280 300 340 430 505 1380 85 110 160 180 195 200 290 1205 GM Ford 6.375% 24 BBB- 927.84 Coupon rate Maturity in years Ratings Price 8.375% 28 BBB 1061.25 solution with formula and excel Ford GMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started