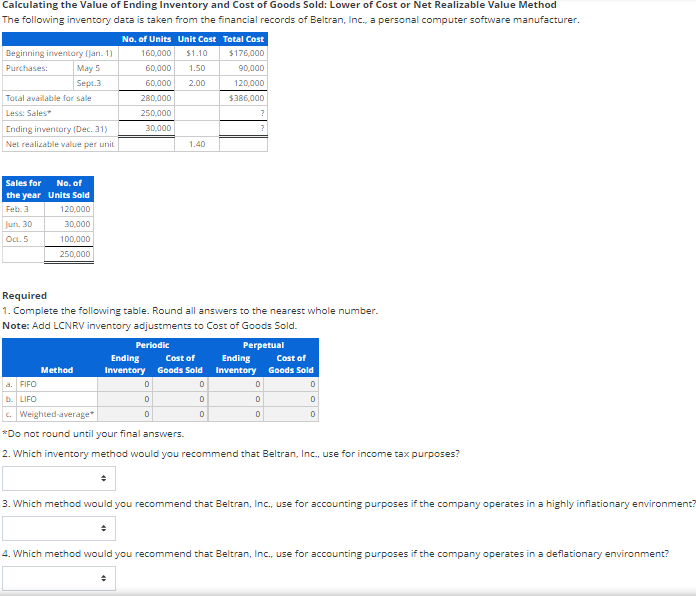

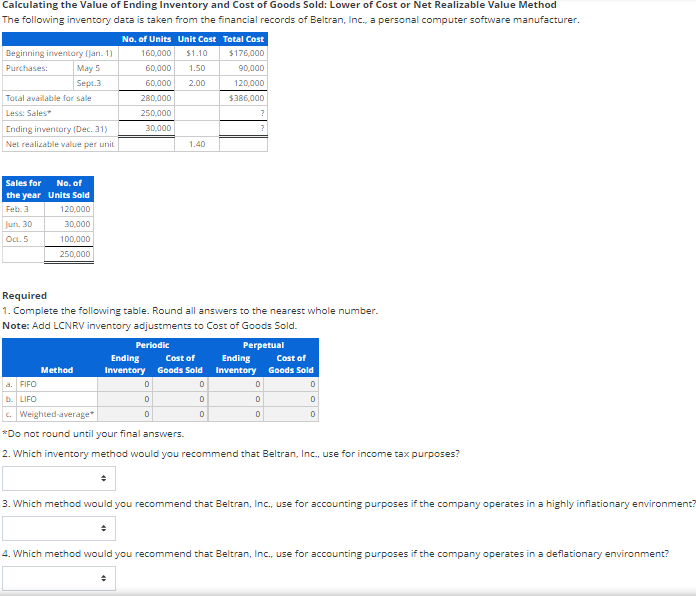

Calculating the value of Ending Inventory and Cost of Goods Sold: Lower of Cost or Net Realizable Value Method The following inventory data is taken from the financial records of Beltran, Inc., a personal computer software manufacturer. No. of Units Unit Cost Total Cost Beginning inventory (Jan. 1) 160,000 $1.10 $176,000 Purchases: May 5 60,000 1.50 90,000 Sept.3 60,000 2.00 120,000 Total available for sale 280,000 $386,000 Less: Sales 250,000 Ending inventory (Dec. 31) 30,000 Nel realizable value per unit 1.40 Sales for No. of the year Units Sold Feb. 3 120,000 Jun 30 30,000 Oct. 5 100,000 250,000 Required 1. Complete the following table. Round all answers to the nearest whole number. Note: Add LCNRV inventory adjustments to Cost of Goods Sold. Periodic Perpetual Ending Cost of Ending Cost of Method Inventory Goods Sold Inventory Goods Sold a FIFO 0 . LIFO 0 Weighted average 0 0 0 0 *Do not round until your final answers. 2. Which inventory method would you recommend that Beltran, Inc., use for income tax purposes? 0 0 0 3. Which method would you recommend that Beltran, Inc., use for accounting purposes if the company operates in a highly inflationary environment? 4. Which method would you recommend that Beltran, Inc., use for accounting purposes if the company operates in a deflationary environment? Calculating the value of Ending Inventory and Cost of Goods Sold: Lower of Cost or Net Realizable Value Method The following inventory data is taken from the financial records of Beltran, Inc., a personal computer software manufacturer. No. of Units Unit Cost Total Cost Beginning inventory (Jan. 1) 160,000 $1.10 $176,000 Purchases: May 5 60,000 1.50 90,000 Sept.3 60,000 2.00 120,000 Total available for sale 280,000 $386,000 Less: Sales 250,000 Ending inventory (Dec. 31) 30,000 Nel realizable value per unit 1.40 Sales for No. of the year Units Sold Feb. 3 120,000 Jun 30 30,000 Oct. 5 100,000 250,000 Required 1. Complete the following table. Round all answers to the nearest whole number. Note: Add LCNRV inventory adjustments to Cost of Goods Sold. Periodic Perpetual Ending Cost of Ending Cost of Method Inventory Goods Sold Inventory Goods Sold a FIFO 0 . LIFO 0 Weighted average 0 0 0 0 *Do not round until your final answers. 2. Which inventory method would you recommend that Beltran, Inc., use for income tax purposes? 0 0 0 3. Which method would you recommend that Beltran, Inc., use for accounting purposes if the company operates in a highly inflationary environment? 4. Which method would you recommend that Beltran, Inc., use for accounting purposes if the company operates in a deflationary environment