Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculations using excel would be greatly appreciated. Valuing Capital Investment Projects Growth Enterprises, Inc. (GEI) has $40 million that it can invest in any or

calculations using excel would be greatly appreciated.

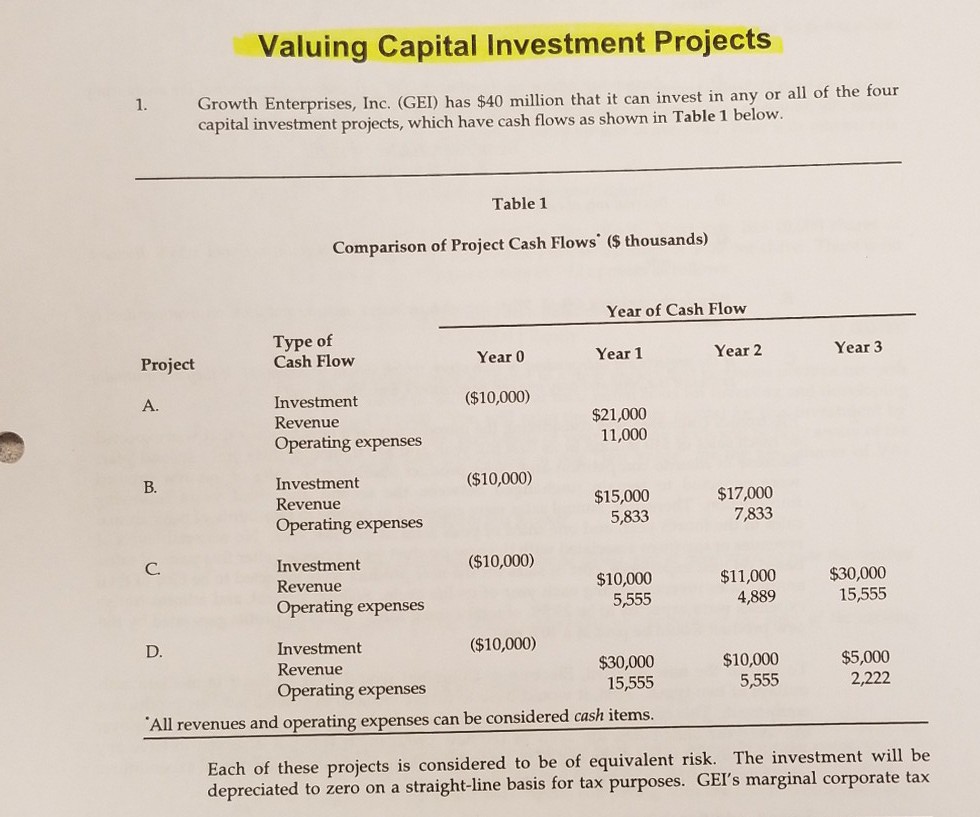

Valuing Capital Investment Projects Growth Enterprises, Inc. (GEI) has $40 million that it can invest in any or all of the four capital investment projects, which have cash flows as shown in Table 1 below. Table 1 Comparison of Project Cash Flows $ thousands) Year of Cash Flow Type of Cash Flow Project Year 0 Year 1 Year 2 Year 3 Investment Revenue Operating expenses A. ($10,000) $21,000 11,000 ($10,000) Investment Revenue Operating expenses B. $15,000 5,833 $17,000 7,833 Investment Revenue Operating expenses C. ($10,000) $10,000 5,555 $11,000 4,889 $30,000 15,555 D. ($10,000) Investment Revenue Operating expenses $30,000 15,555 $10,000 5,555 $5,000 2,222 All revenues and operating expenses can be considered cash items. Each of these projects is considered to be of equivalent risk. The investment will be depreciated to zero on a straight-line basis for tax purposes. GEI's marginal corporate taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started