Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CalculationsandJournalEntriesfortheAllocationofPartnershipProfitorLoss Net income for Levin-Tom partner ship for 20X9 was $125,000. Levin and Tom have agreed to distribute partner ship net income according to the

CalculationsandJournalEntriesfortheAllocationofPartnershipProfitorLoss Net income for Levin-Tom partner ship for 20X9 was $125,000. Levin and Tom have agreed to distribute partner ship net income according to the following plan:

Additional information for 20X9 follows:

- Levin began they ear with a capital balance of $75,000.

- Tom began the year with a capital balance of $100,000.

- On March 1,Levin invested an additional $25,000 into the partnership.

- On October 1,Tom invested an additional $20,000 into the partnership.

- Throughout 20X9, each partner withdrew $200 per week in anticipation of partnership net income. The partners agreed thatthesewithdrawalsarenottobeincludedinthecomputationofaveragecapitalbalancesforpurposesofincomedistributions.

Required:

- Prepareaschedulethatdisclosesthedistributionofpartnershipnetincomefor20X9.Showsupportingcomputationsingood form.

- Prepare the statement of partners' capital at December 31, 20X9.

- Howwouldyouranswertopartachangeifalloftheprovisionsoftheincomedistributionplanwerethesameexceptthatthesalarieswere$45,000 to Levin and $60,000 to Tom?

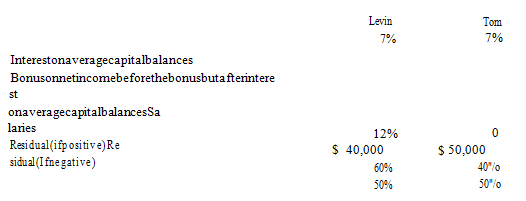

Interestonaveragecapitalbalances Bonusonnetincomebeforethebonusbuta fterintere st onaveragecapitalbalances Sa Residual(ifpositive) Re sidual (Ifnegative) laries Levin 7% 12% $ 40,000 60% 50% Tom 7% $ 50,000 0 40%/ 50%

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Prepare a schedule that discloses the distribution of partnership net income for 20X9 Show supporting computations in good form Distributio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started