Answered step by step

Verified Expert Solution

Question

1 Approved Answer

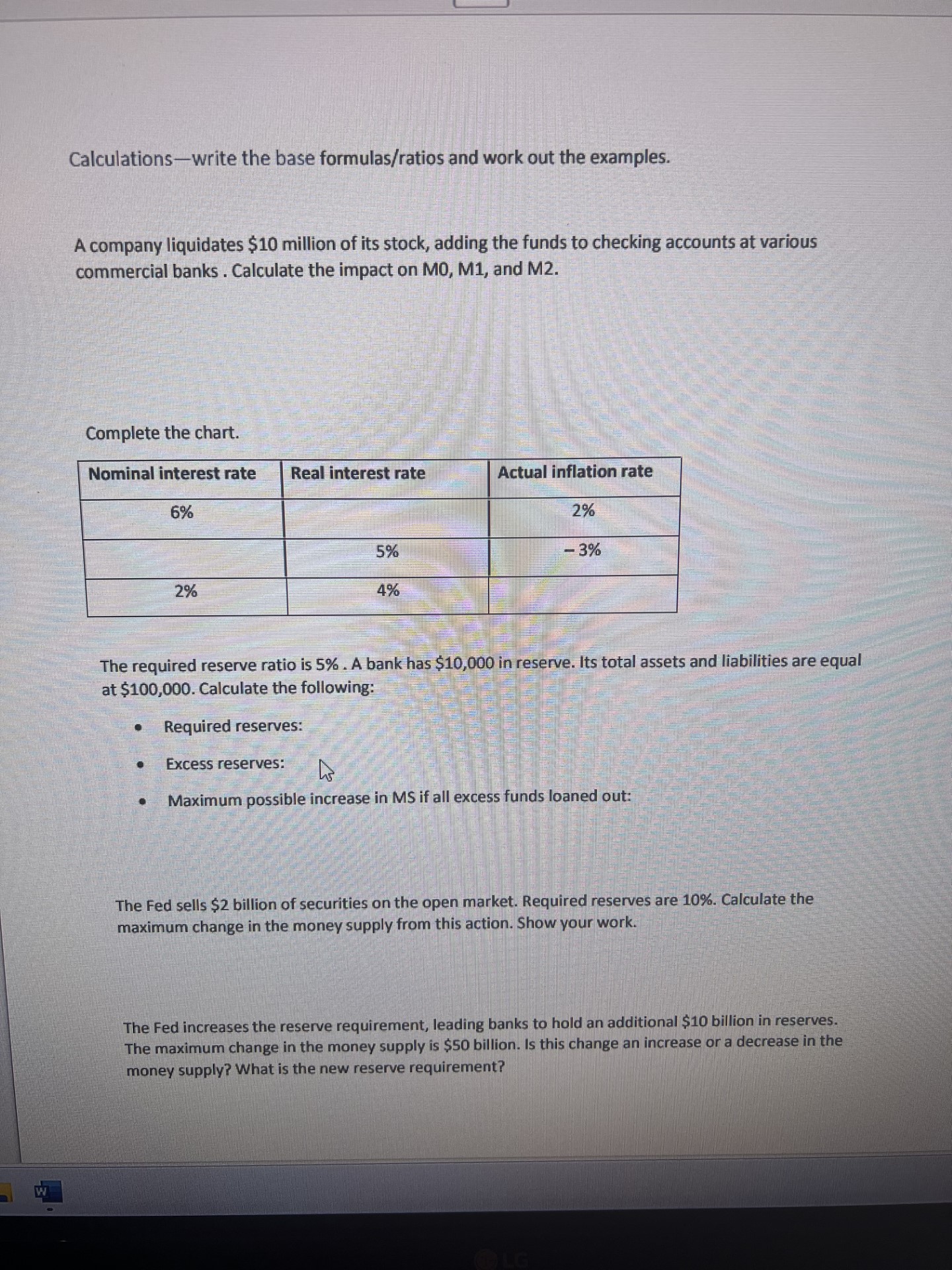

Calculations-write the base formulas/ratios and work out the examples. A company liquidates $10 million of its stock, adding the funds to checking accounts at

Calculations-write the base formulas/ratios and work out the examples. A company liquidates $10 million of its stock, adding the funds to checking accounts at various commercial banks. Calculate the impact on MO, M1, and M2. Complete the chart. Nominal interest rate Real interest rate Actual inflation rate 6% 2% -3% 2% 5% 4% The required reserve ratio is 5%. A bank has $10,000 in reserve. Its total assets and liabilities are equal at $100,000. Calculate the following: Required reserves: Excess reserves: h Maximum possible increase in MS if all excess funds loaned out: The Fed sells $2 billion of securities on the open market. Required reserves are 10%. Calculate the maximum change in the money supply from this action. Show your work. The Fed increases the reserve requirement, leading banks to hold an additional $10 billion in reserves. The maximum change in the money supply is $50 billion. Is this change an increase or a decrease in the money supply? What is the new reserve requirement? Visualizations-draw each model and illustrate market changes by hand. The Money Market Draw a fully labeled money market model in equilibrium. Label the equilibrium point A. Illustrate an increase in money demand. Label the new equilibrium point B and use arrows to show the direction of changes in money demand, equilibrium price, and equilibrium quantity. The economy is in recession. Use side-by-side models of aggregate demand-aggregate supply and the money market to illustrate the impact of a monetary policy change aimed at closing the gap. LG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started