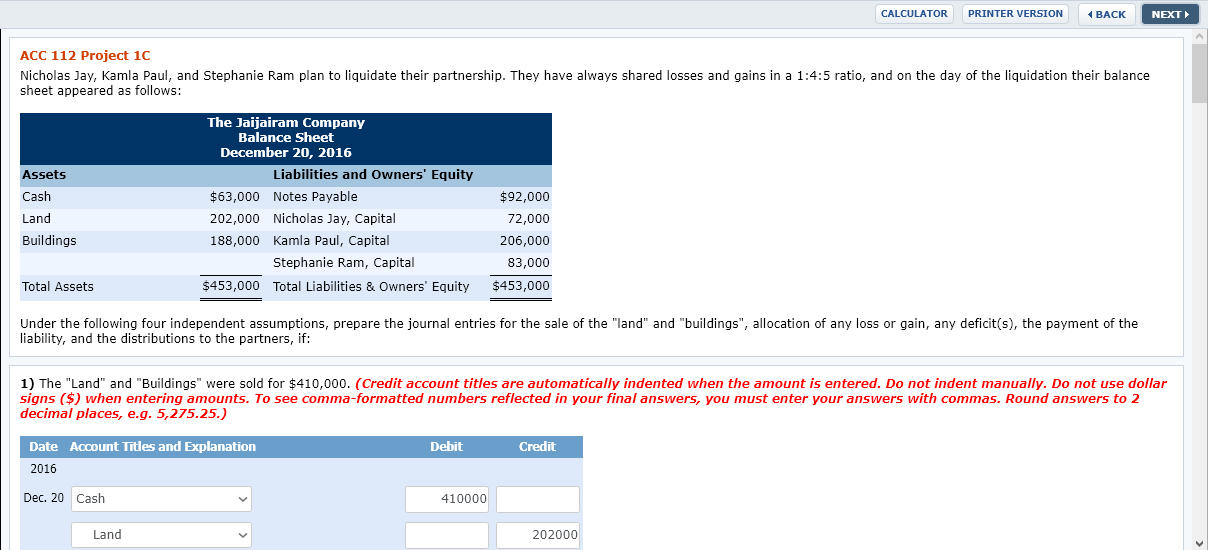

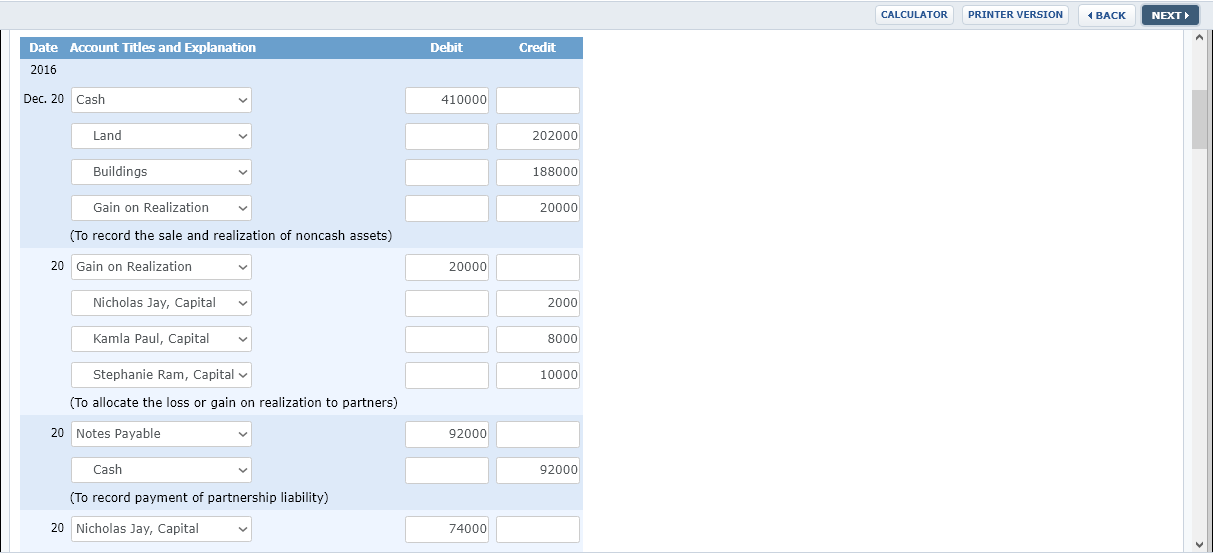

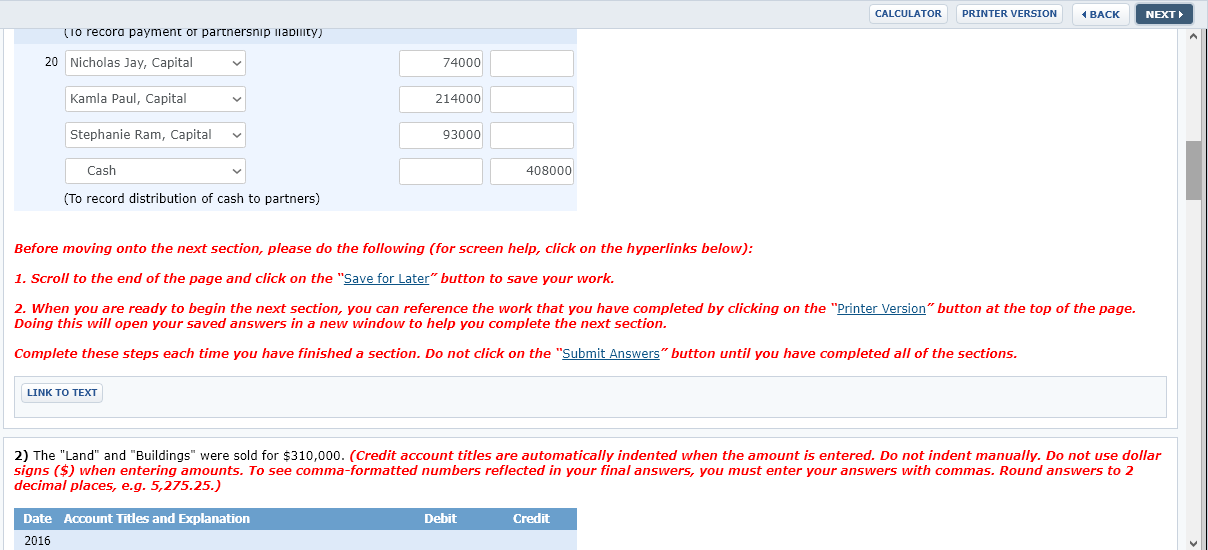

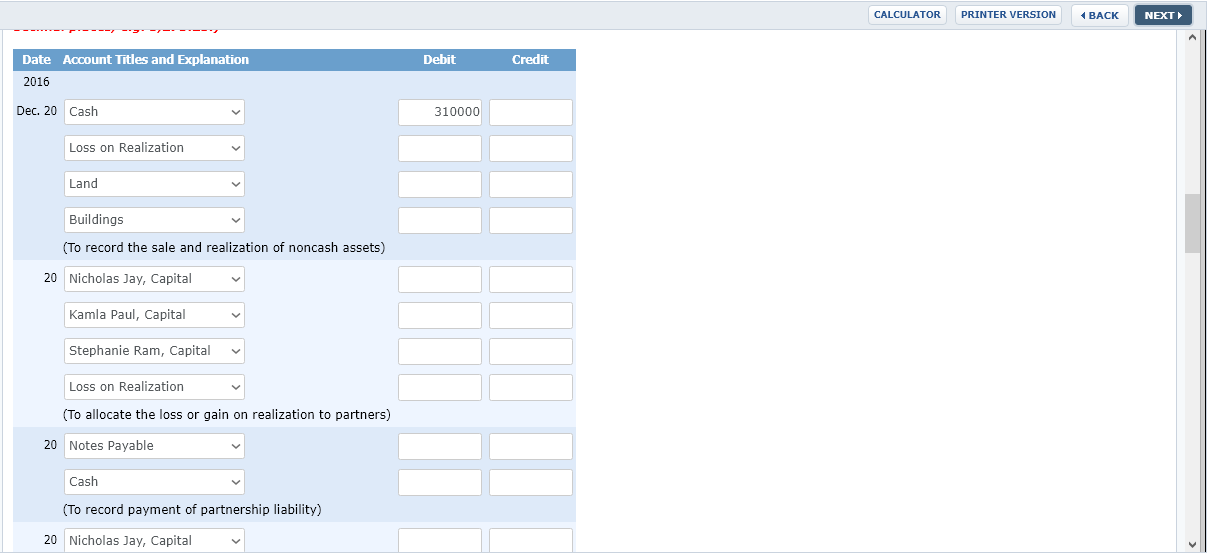

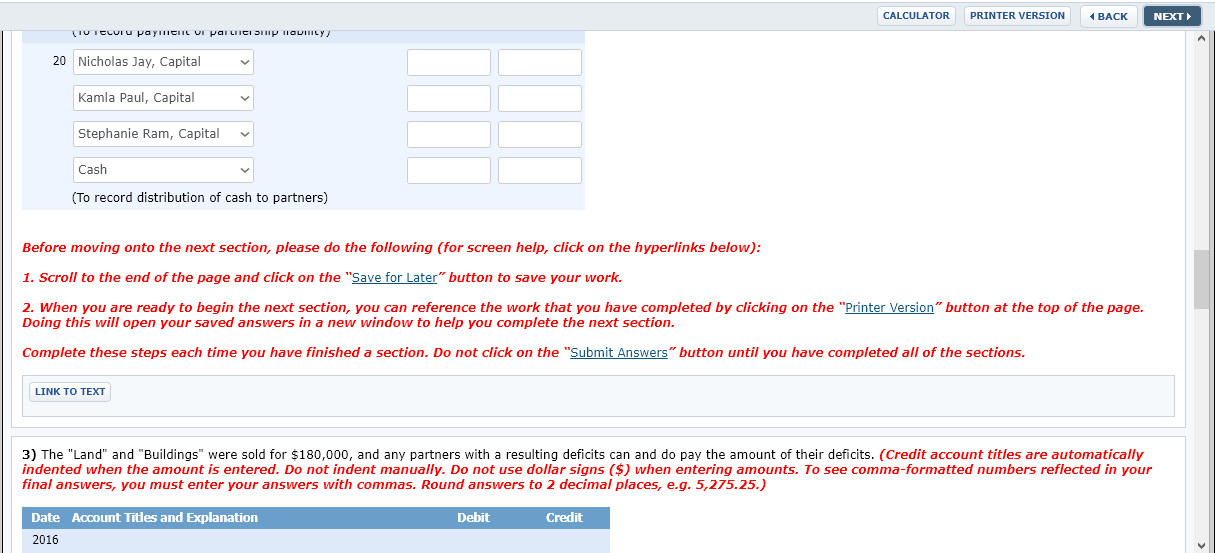

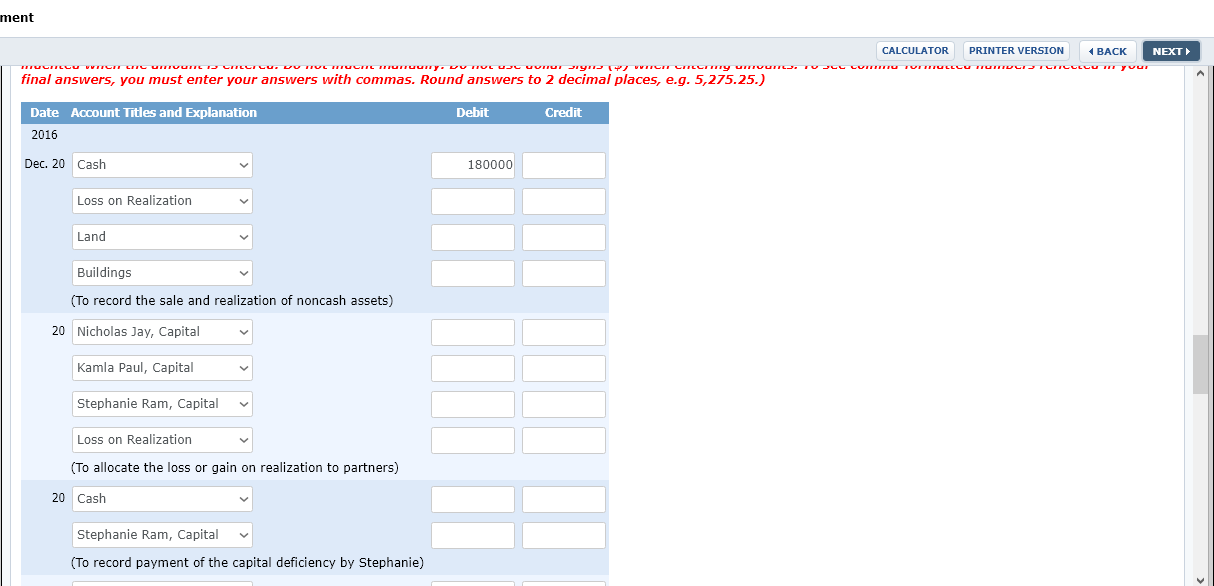

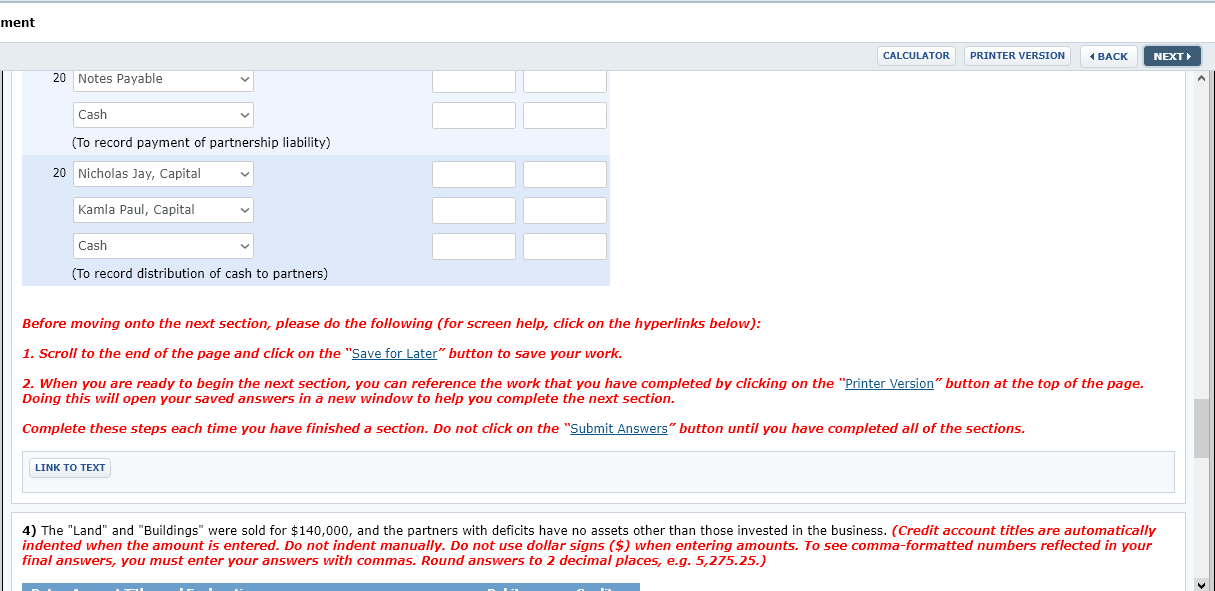

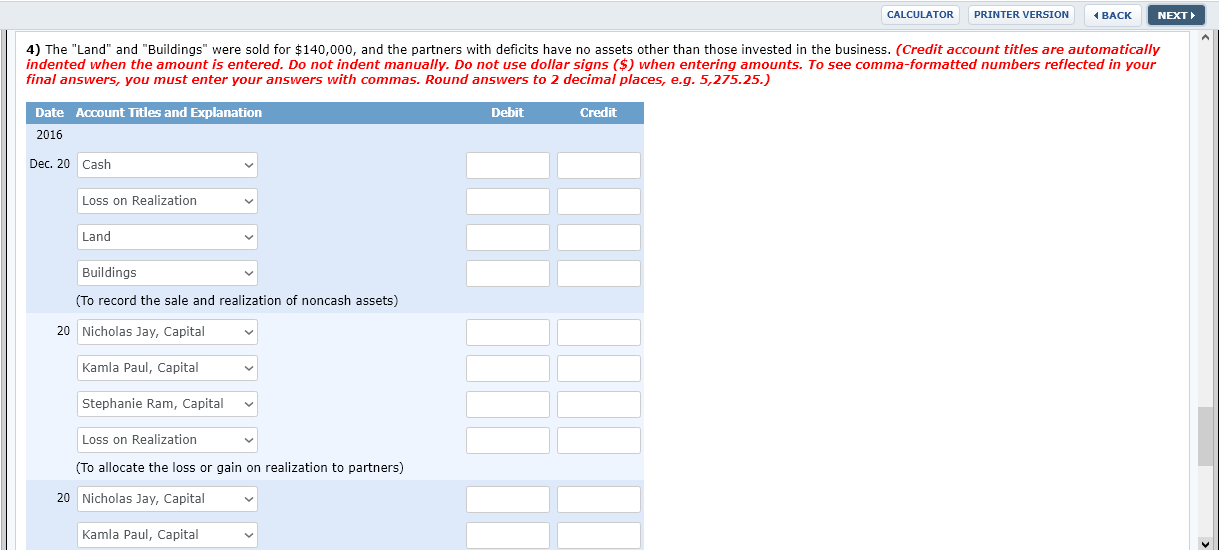

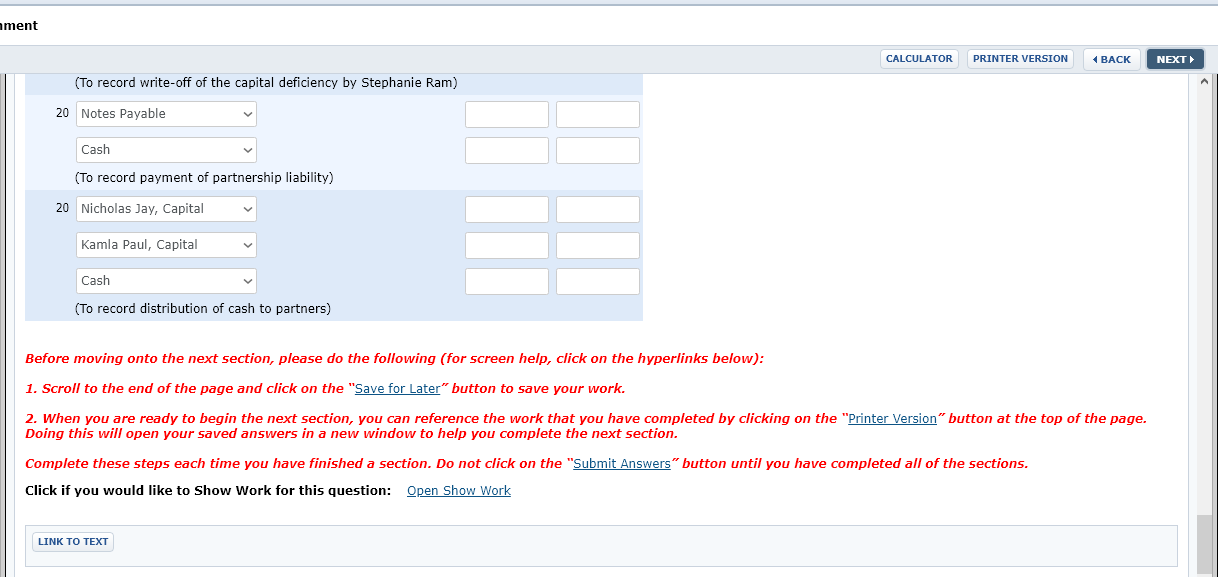

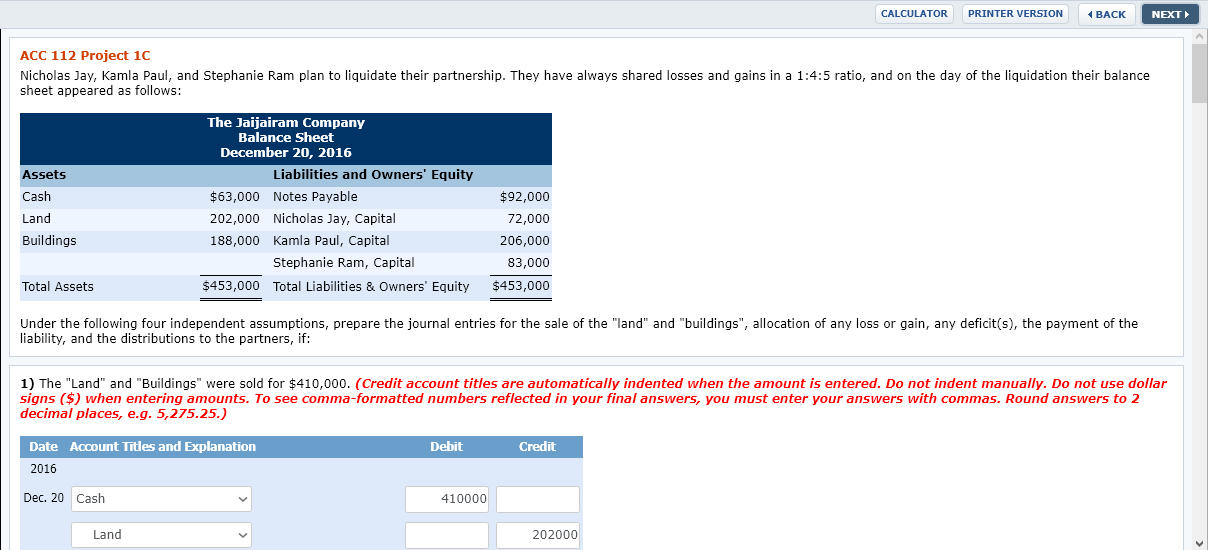

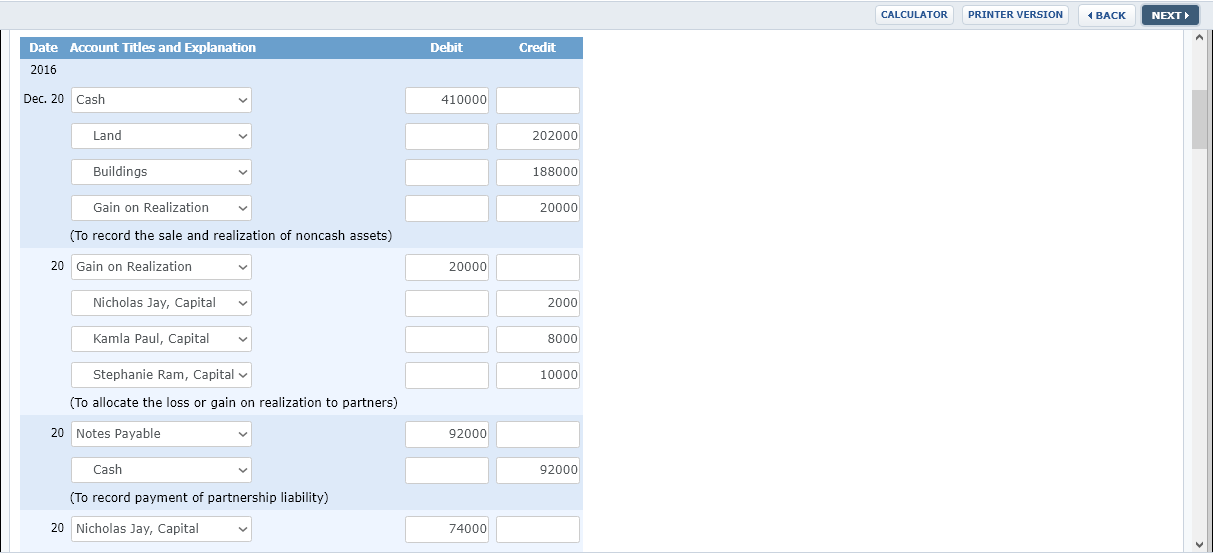

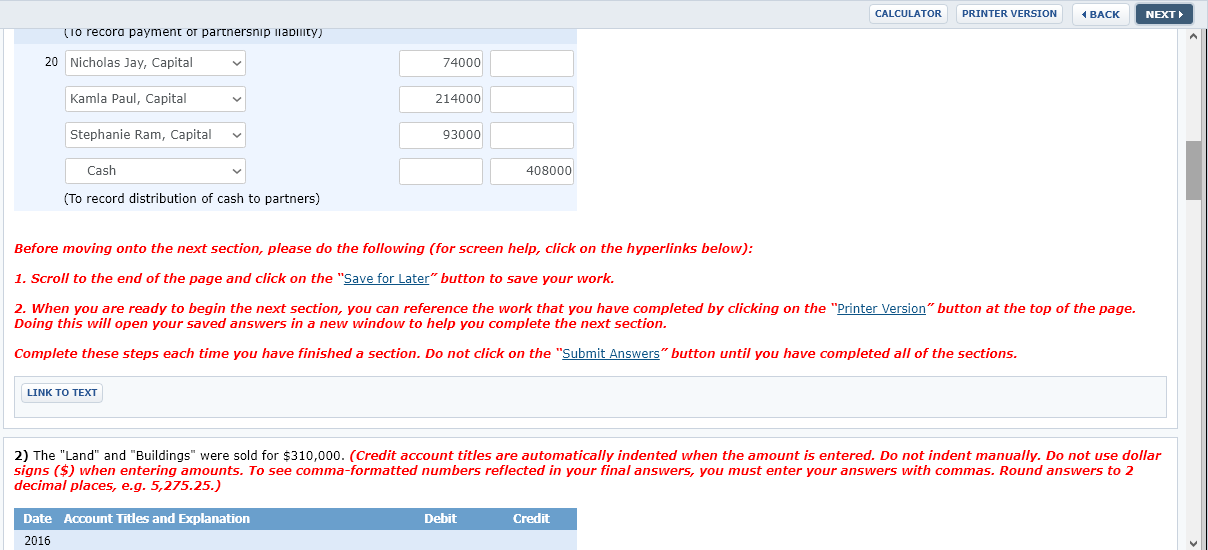

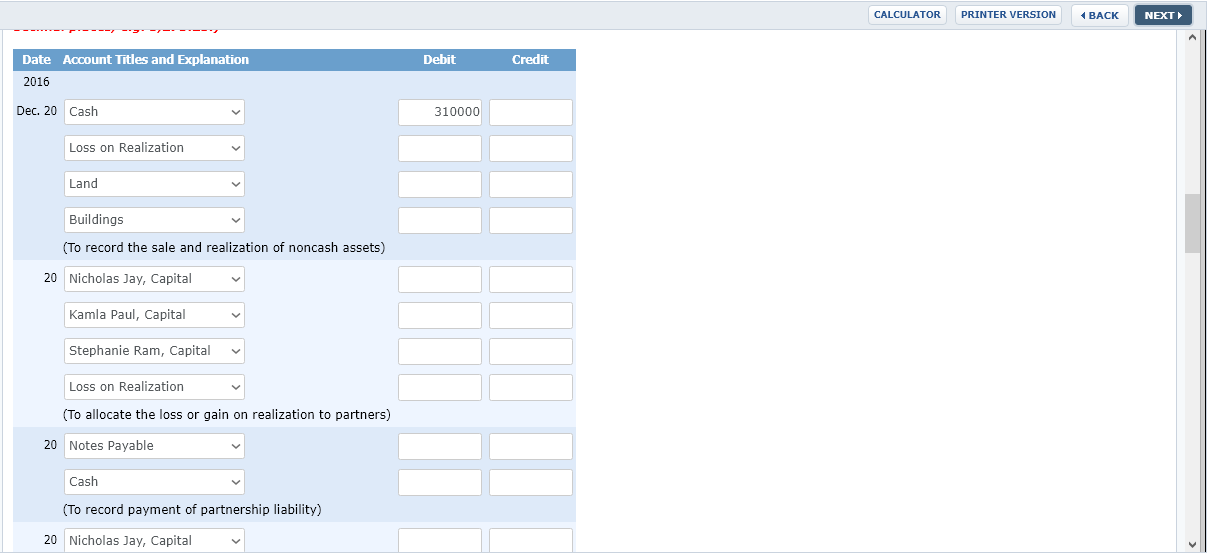

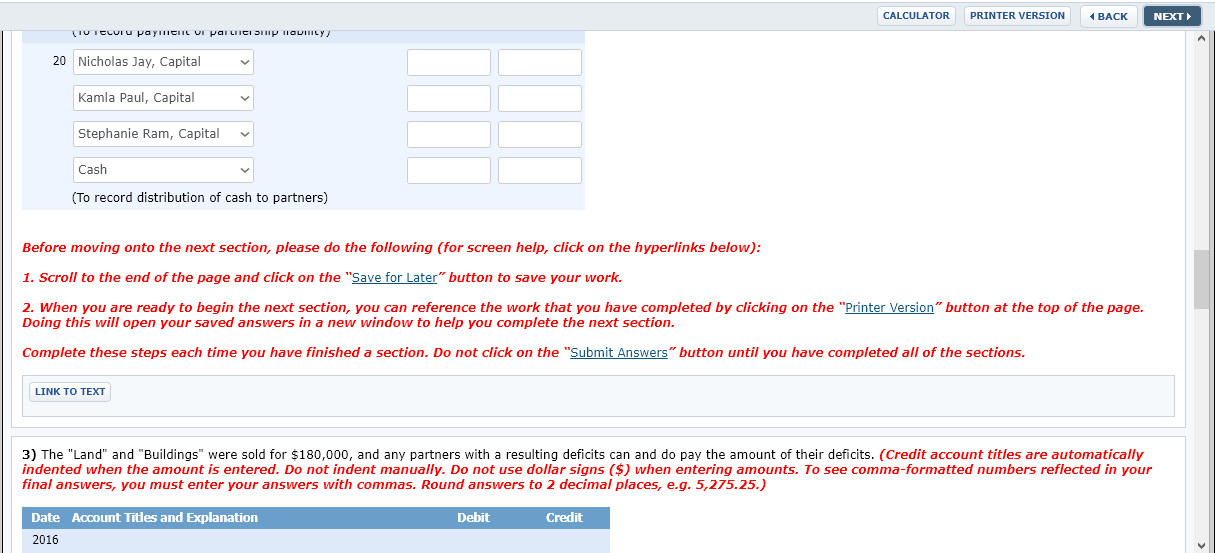

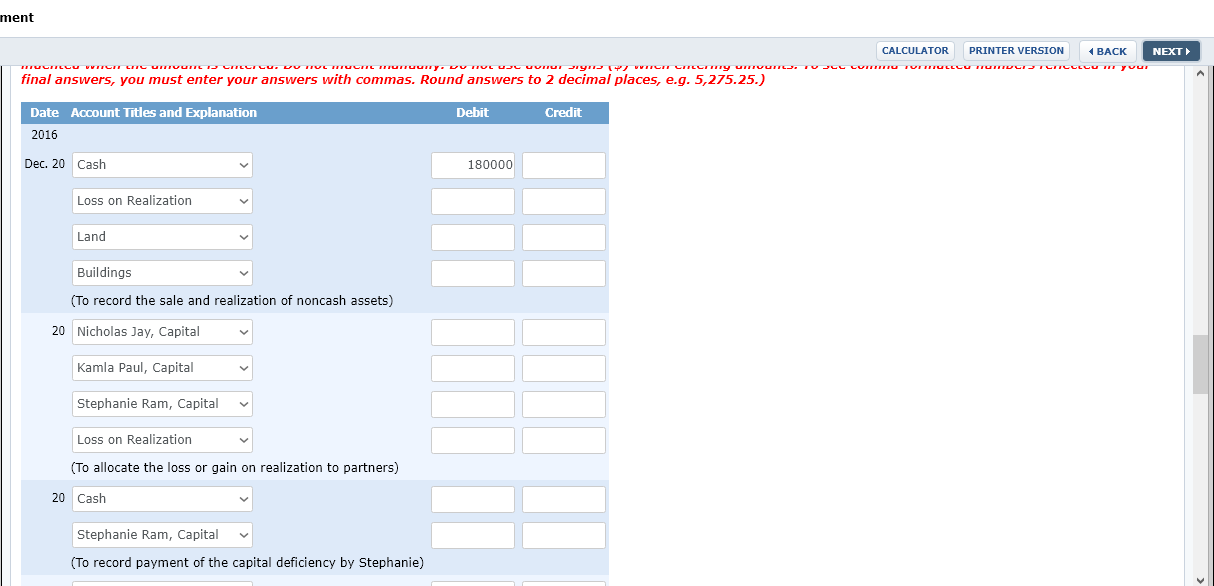

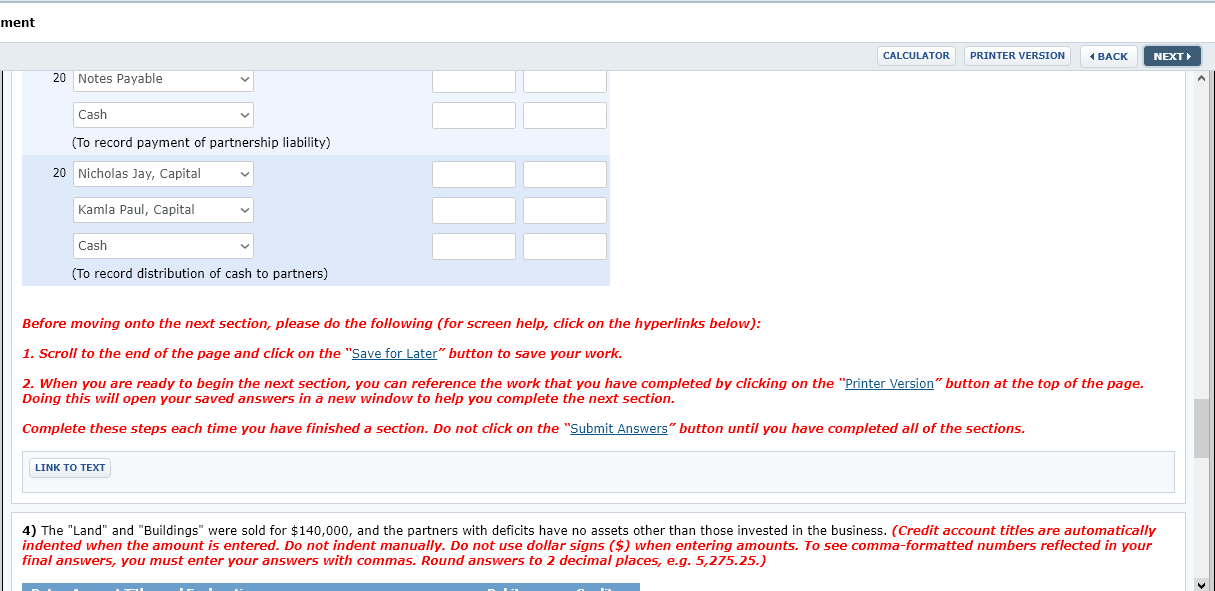

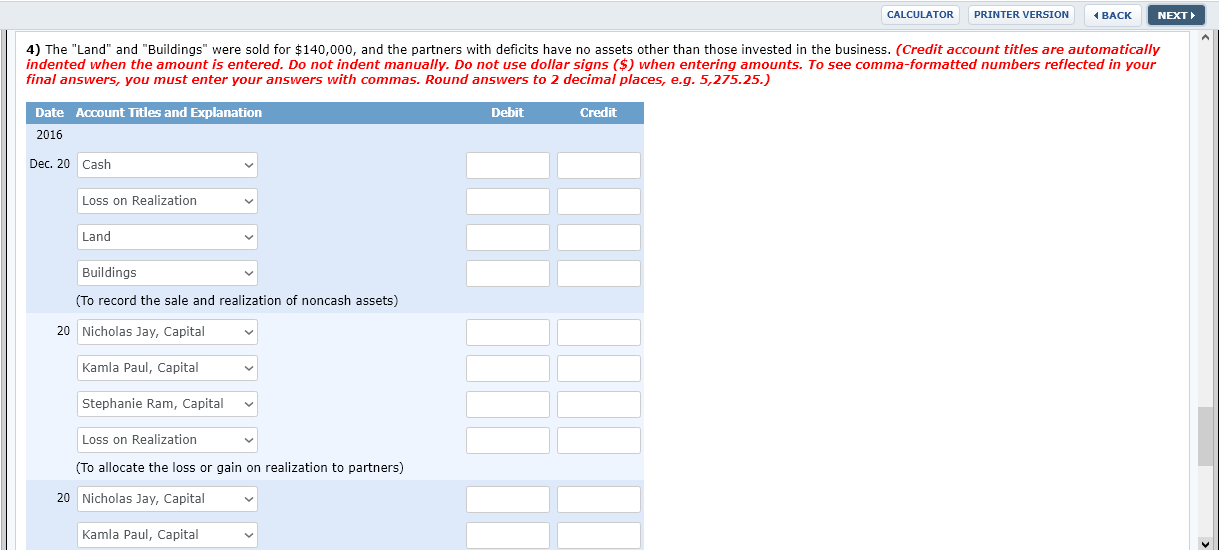

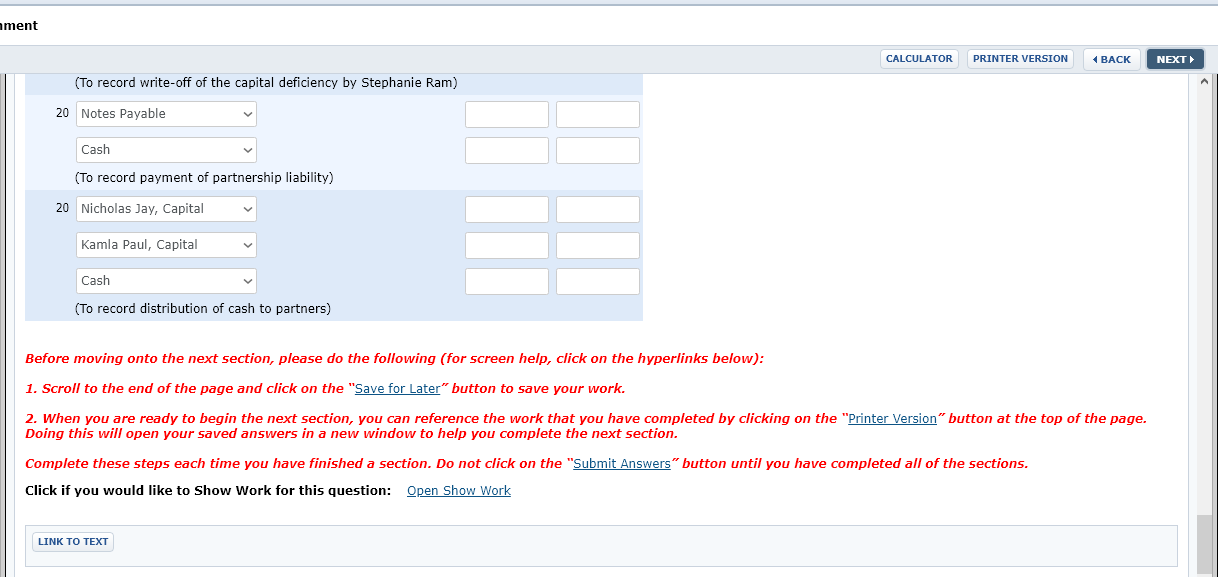

CALCULATOR PRINTER VERSION BACK NEXT ACC 112 Project 1C Nicholas Jay, Kamla Paul, and Stephanie Ram plan to liquidate their partnership. They have always shared losses and gains in a 1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Assets Cash Land The Jaijairam Company Balance Sheet December 20, 2016 Liabilities and Owners' Equity $63,000 Notes Payable 202,000 Nicholas Jay, Capital 188,000 Kamla Paul, Capital Stephanie Ram, Capital $453,000 Total Liabilities & Owners' Equity Buildings $92,000 72,000 206,000 83,000 $453,000 Total Assets Under the following four independent assumptions, prepare the journal entries for the sale of the "land" and "buildings", allocation of any loss or gain, any deficit (s), the payment of the liability, and the distributions to the partners, if: 1) The "Land" and "Buildings" were sold for $410,000. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 Dec. 20 Cash 410000 Land 202000 CALCULATOR PRINTER VERSION BACK NEXT Debit Credit Date Account Titles and Explanation 2016 Dec. 20 Cash 410000 Land 202000 Buildings 188000 20000 Gain on Realization - (To record the sale and realization of noncash assets) 20 Gain on Realization 20000 Nicholas Jay, Capital 2000 Kamla Paul, Capital 8000 10000 Stephanie Ram, Capital (To allocate the loss or gain on realization to partners) 20 Notes Payable 92000 Cash 92000 (To record payment of partnership liability) 20 Nicholas Jay, Capital 74000 CALCULATOR PRINTER VERSION BACK NEXT (10 recora payment of partnersnip liability) 20 Nicholas Jay, Capital 74000 Kamla Paul, Capital 214000 Stephanie Ram, Capital 93000 Cash 408000 (To record distribution of cash to partners) Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for Later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Printer Version" button at the top of the page. n your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have completed all of the sections. LINK TO TEXT 2) The "Land" and "Buildings" were sold for $310,000. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 CALCULATOR PRINTER VERSION BACK NEXT Debit Credit Date Account Titles and Explanation 2016 Dec. 20 Cash 310000 Loss on Realization Land Buildings (To record the sale and realization of noncash assets) 20 Nicholas Jay, Capital Kamla Paul, Capital Stephanie Ram, Capital Loss on Realization (To allocate the loss or gain on realization to partners) 20 Notes Payable Cash (To record payment of partnership liability) 20 Nicholas Jay, Capital CALCULATOR PRINTER VERSION BACK NEXT TU TELUIU paymeIIL VI par LIICI SHIP TOUTILY 20 Nie Nicholas Jay, Capital Kamla Paul, Capital Stephanie Ram, Capital Cash (To record distribution of cash to partners) Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for Later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Printer Version" button at the top of the page. Doing this will open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have completed all of the sections. LINK TO TEXT 3) The "Land" and "Buildings" were sold for $180,000, and any partners with a resulting deficits can and do pay the amount of their deficits. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 ment CALCULATOR vuse CALCULATOR PRINTER VERSION BACK NEXT TITLULUU yuu PRINTER VERSION BACK. NEXT LLUITI TUTTIU LLLU TUGILCU VITCH LITE UTVUTTLICITLICU. VU TUL TULI TURUury. VU TULUL Urut Bryn WITH LITLLEmy urVUTT. final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 Dec. 20 Cash 180000 Loss on Realization Land Buildings (To record the sale and realization of noncash assets) 20 Nicholas Jay, Capital v Kamla Paul, Capital Stephanie Ram, Capital Loss on Realization (To allocate the loss or gain on realization to partners) 20 Cash Stephanie Ram, Capital (To record payment of the capital deficiency by Stephanie) ment CALCULATOR PRINTER VERSION BACK NEXT 20 Notes Payable Cash (To record payment of partnership liability) 20 Nicholas Jay, Capital Kamla Paul, Capital Cash (To record distribution of cash to partners) Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for Later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Printer Version" button at the top of the page. Doing this will open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have completed all of the sections. LINK TO TEXT 4) The "Land" and "Buildings" were sold for $140,000, and the partners with deficits have no assets other than those invested in the business. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) CALCULATOR PRINTER VERSION BACK NEXT 4) The "Land" and "Buildings" were sold for $140,000, and the partners with deficits have no assets other than those invested in the business. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 Dec. 20 Cash Loss on Realization Land Buildings (To record the sale and realization of noncash assets) 20 Nicholas Jay, Capital Kamla Paul, Capital Stephanie Ram, Capital Loss on Realization (To allocate the loss or gain on realization to partners) 20 Nicholas Jay, Capital Kamla Paul, Capital ment CALCULATOR PRINTER VERSION BACK NEXT (To record write-off of the capital deficiency by Stephanie Ram) 20 Notes Payable Cash (To record payment of partnership liability) 20 Nicholas Jay, Capital Kamla Paul, Capital Cash (To record distribution of cash to partners) Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for Later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Printer Version" button at the top of the page. Doing this will open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have completed all of the sections. Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT