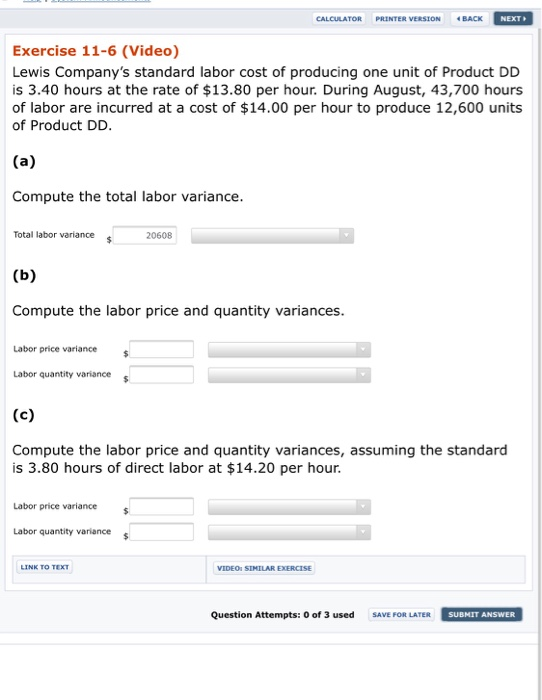

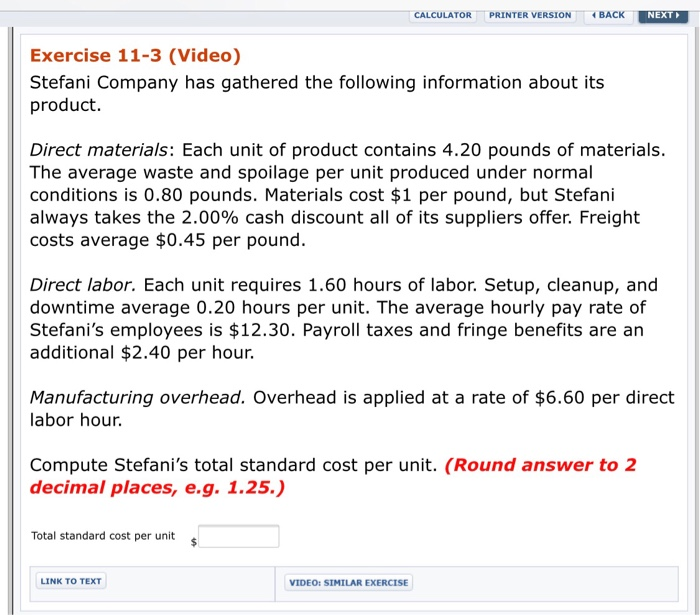

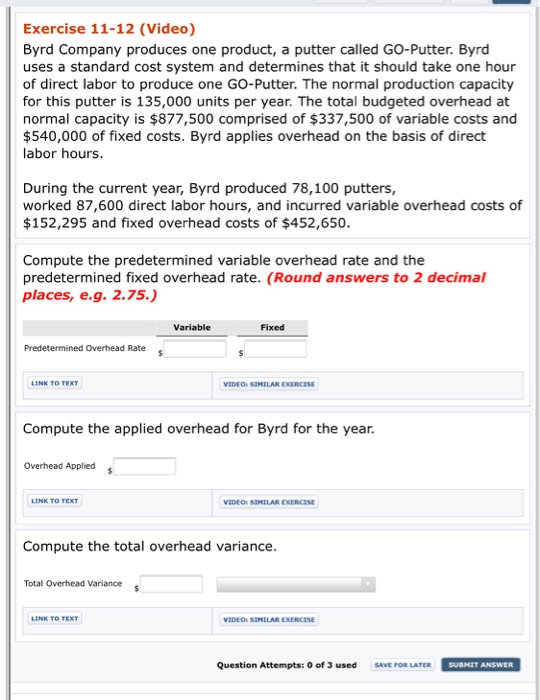

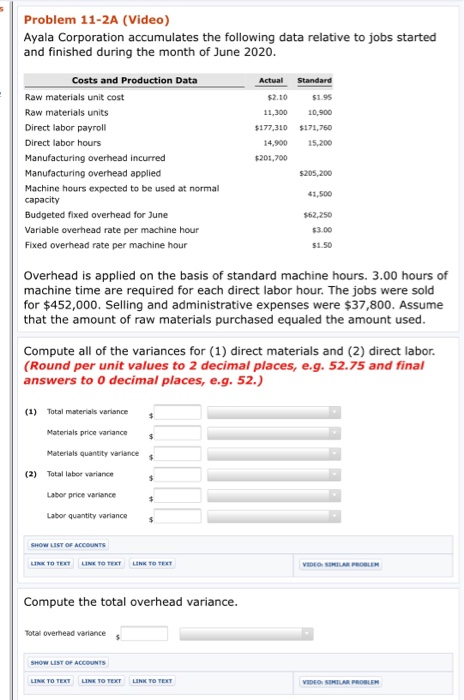

CALCULATOR PRINTER VERSION BACK NEXT Exercise 11-6 (Video) Lewis Company's standard labor cost of producing one unit of Product DD is 3.40 hours at the rate of $13.80 per hour. During August, 43,700 hours of labor are incurred at a cost of $14.00 per hour to produce 12,600 units of Product DD. Compute the total labor variance Total labor variance $20608 Compute the labor price and quantity variances abor price variance Labor quantity variances Compute the labor price and quantity variances, assuming the standarod is 3.80 hours of direct labor at $14.20 per hour. Labor price variance s Labor quantity variance s INK TO TEXT VIDEOI SIMILAR EXERCISE Question Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER Exercise 11-12 (Video) Byrd Company produces one product, a putter called GO-Putter. Byrd uses a standard cost system and determines that it should take one hour of direct labor to produce one GO-Putter. The normal production capacity for this putter is 135,000 units per year. The total budgeted overhead at normal capacity is $877,500 comprised of $337,500 of variable costs and $540,000 of fixed costs. Byrd applies overhead on the basis of direct labor hours During the current year, Byrd produced 78,100 putters, worked 87,600 direct labor hours, and incurred variable overhead costs of $152,295 and fixed overhead costs of $452,650 Compute the predetermined variable overhead rate and the predetermined fixed overhead rate. (Round answers to 2 decimal places, e.g. 2.75.) Variable Fixed Predetermined Overhead Rate VIDEO SIMELAR EXERCISE Compute the applied overhead for Byrd for the year Overhead Applied Compute the total overhead variance Total Overhead Variance LINK TO TEXT VIDEOI SIMILAR EXERCISE Question Attempts: O of 3 used SAVE FOR LATER Problem 11-2A (Video) Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2020 Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour $1.95 1,300 10,900 77,310 $171,760 4,900 15,200 $2.10 F201,700 $205,200 41,500 62,250 $3.00 $1.50 Overhead is applied on the basis of standard machine hours. 3.00 hours of machine time are required for each direct labor hour. The jobs were sold for $452,000. Selling and administrative expenses were $37,800. Assume that the amount of raw materials purchased equaled the amount used Compute all of the variances for (1) direct materials and (2) direct labor. (Round per unit values to 2 decimal places, e.g. 52.75 and final answers to 0 decimal places, e.g. 52.) 1) Total materials variance Materials price variance Materials quantity variances Total labor variance (2) Labor price variance Labor quantity vaniance LINK TO TEX Compute the total overhead variance Total overhead variance SHOW LIST TEXT LINK TO