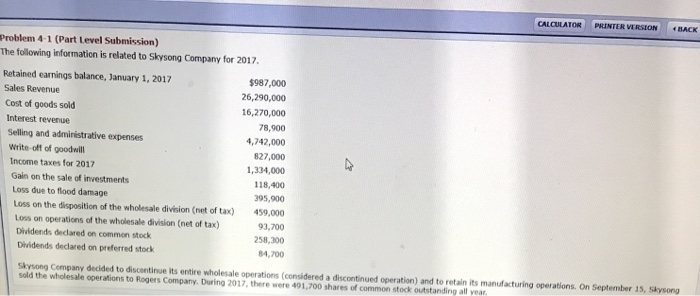

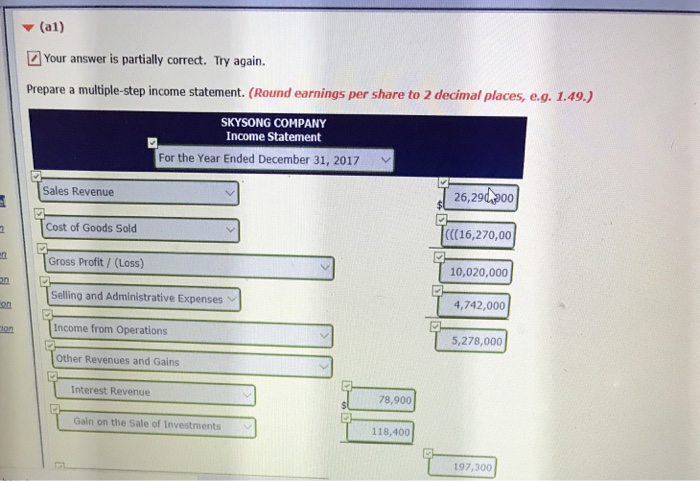

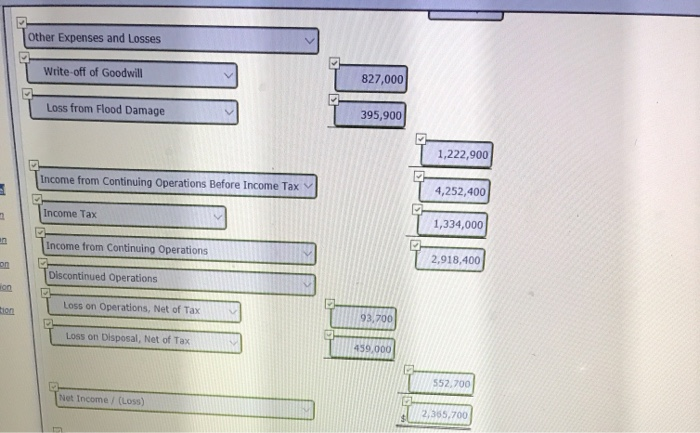

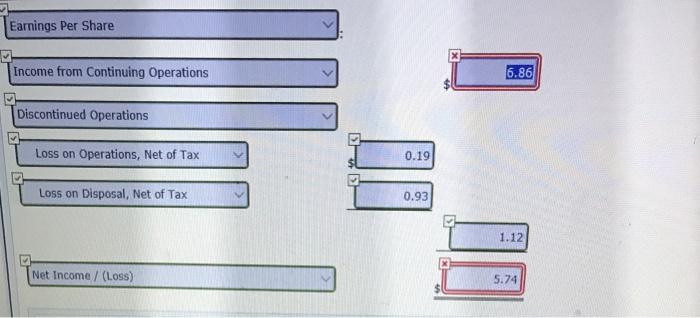

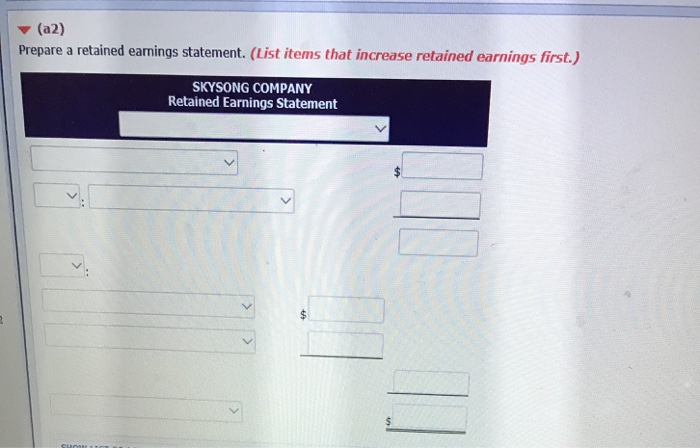

CALCULATOR PRINTER VERSION BACK "roblem 4-1 (Part Level Submission) The following information is related to Skysong Company for 2017. Retained earnings balance, January 1, 2017 $987,000 Sales Revenue 26,290,000 Cost of goods sold 16,270,000 Interest revenue 78,900 Selling and administrative expenses 4,742,000 Write-off of goodwill 827,000 Income taxes for 2017 1,334,000 Gain on the sale of investments 118,400 Loss due to flood damage 395,900 Loss on the disposition of the wholesale division (net of tax) 459,000 Loss on operations of the wholesale division (net of tax) 93,700 Dividends declared on common stock 258,300 Dividends declared on preferred stock 84,700 Skysong Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Skysong sold the wholesale cerations to Rogers Company. During 2017, there were 601.700 shares of common stock outstanding all year (al) Your answer is partially correct. Try again. Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, e.g. 1.49.) SKYSONG COMPANY Income Statement For the Year Ended December 31, 2017 V Sales Revenue 26,290,200 Cost of Goods Sold T(16,270,00 Gross Profit/ (Loss) (Loss) T 10,020,000 Selling and Administrative Expenses 4,742,000 Income from Operations 5,278,000 Other Revenues and Gains s and Gains Interest Revenue 78,900 Gain on the sale of investments 118,400 197,300 Other Expenses and Losses and Losses Write-off of Goodwill 827,000 Loss from Flood Damage 395,900 1 1,222,900 Income from Continuing Operations Before Income Tax 4,252,400 Income Tax 11,334,000 Income from Continuing Operations 2,918,400 6 BB Discontinued Operations perations Loss on Operations, Net of Tax Loss on Disposal, Net of Tax 39.000 552.700 Net Income (Loss) 365,700 Earnings Per Share Income from Continuing Operations y 6.86 Discontinued Operations T Loss on Operations, Net of Tax 0.19 Loss on Disposal, Net of Tax 0.93 Net Income /(Loss) 5.74 (a2) Prepare a retained earnings statement. (List items that increase retained earnings first.) SKYSONG COMPANY Retained Earnings Statement