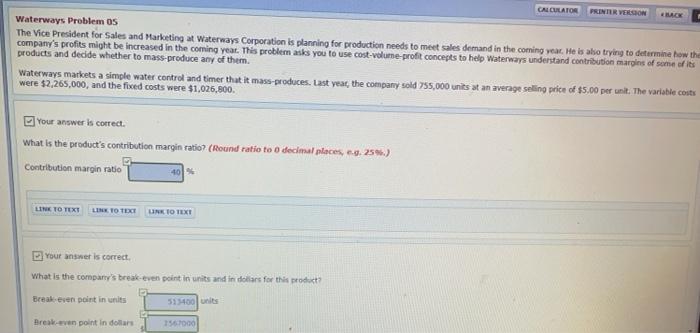

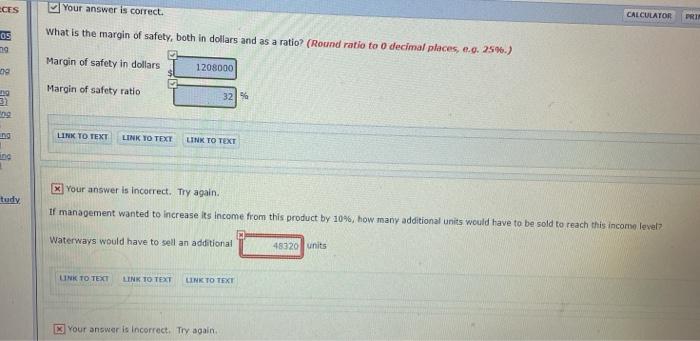

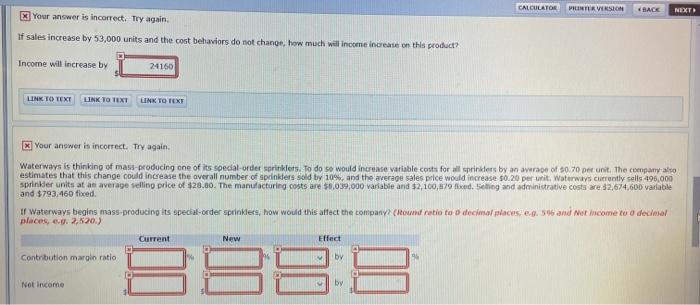

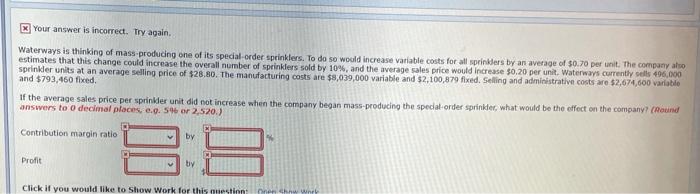

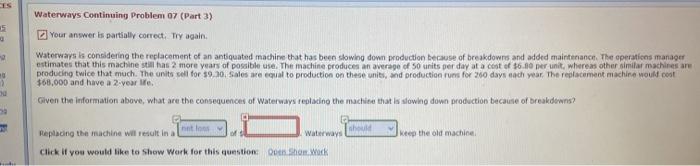

CALCULATOR PRINTER VERSION Waterways Problem OS The Vice President for Sales and Marketing at Waterways Corporation is planning for production needs to meet sales demand in the coming year. He is also trying to determine how the company's profits might be increased in the coming year. This problem asks you to use cost-volume-profit concepts to help Waterways understand contribution margins of some of its products and decide whether to mass produce any of them. Waterways markets a simple water control and time that it mass produces. Last year, the company sold 735,000 units at an average selling price of $5,00 per unit. The variable costs were $2,265,000, and the fixed costs were $1,026,800. Your answer is correct. What is the product's contribution margin ratio? (Round ratio to o decimal places, c.g. 25.) Contribution margin ratio 401 LINK TO TEXT LINE TOTEC LINK TO TEXT Your answer is correct What is the company's break-even point in units and in dollars for this prochet Break even point in units 515400 Break-even point in dollars 156700 CES Your answer is correct. CALCULATOR PRIE What is the margin of safety, both in dollars and as a ratio? (Round ratio to 0 decimal places, e... 259.) 05 ng Margin of safety in dollars 09 1208000 Margin of safety ratio 32% 3) ng ing LINK TO TEXT LINK TO TEXT LINK TO TEXT ing x Your answer is incorrect. Try again. tudy, If management wanted to increase its income from this product by 10%, how many additional units would have to be sold to reach this income level? Waterways would have to sell an additional 48320 units UNK TO TEXT LINK TO TEXT UNK TO TEXT 3 Your answer is incorrect. Try again CALCULATOR PRIRTER VERSION RACE NEXT Your answer is incorrect. Try again. If sales increase by 53,000 units and the cost behaviors do not change, how much will income increase on this product Income will increase by 24160 LINK TO TEXE LINK TO TEXT LINK TO TEXT x Your answer is incorrect. Try again Waterways is thinking of mass-producing one of its special-order orinklers. To do so would increase variable costs for all sprinklers by an average of 50 70 per unit. The company also estimates that this change could increase the overall number of sprinklers sold by 10%, and the average sales price would increase 50.20 per unit, Waterways currently sells 496,000 sprinker units at an average selling price of $20.00. The manufacturing costs are 0,039,000 variable and $2,100,879 fixed. Seting and administrative costs are $2,674,600 variable and $793.460 fixed Waterways begins mass-producing its special-ceder sprinklets, how would this affect the company (sound entio to decimal places. e... 5 and Net Income to o declina/ ) Current New Effect Contribution margin ratio bv Not Income by x Your answer is incorrect. Try again. Waterways is thinking of mass producing one of its special order sprinklers. To do so would increase variable costs for all sprinklers by an average of $0.70 per unit. The company also estimates that this change could increase the overall number of sprinklers sold by 10%, and the average sales price would increase $0.20 per unit. Waterways currently sells 496.000 sprinkler units at an average selling price of $28.80. The manufacturing costs are $8,039,000 variable and $2,100,879 fixed. Selling and administrative costs are $2,674,600 variable and $793,460 fixed. If the average sales price per sprinkler unit did not increase when the company began mass-producing the special-order sprinkler, what would be the effect on the company? (Round answers to decimal places, e.. 5% or 2,520.) Contribution margin ratio by 99 Profit ty Click if you would like to show Work for this miestinn nenhunt 5 Waterways Continuing Problem 07 (Part 3) Your answer is partially correct. Try again. Waterways is considering the replacement of an antiquated machine that has been slowing down production because of breakdowns and added maintenance. The operations manager estimates that this machine still has 2 more years of possible use. The machine produces an average of 50 units per day at a cost of $6.00 per unit, whereas other similar machines are producing twice that much. The units well for $9.30 Sales e equal to production on these units, and production runs for 260 days each year. The replacement machine would cost $68,000 and have a 2.voare Given the information above, what are the consequences of Waterways replacing the machine that is slowing down production because of breakdowns? Replacing the machine will result in a Waterways whe Keep the old machine Click if you would like to Show Work for this questione Don Show Work