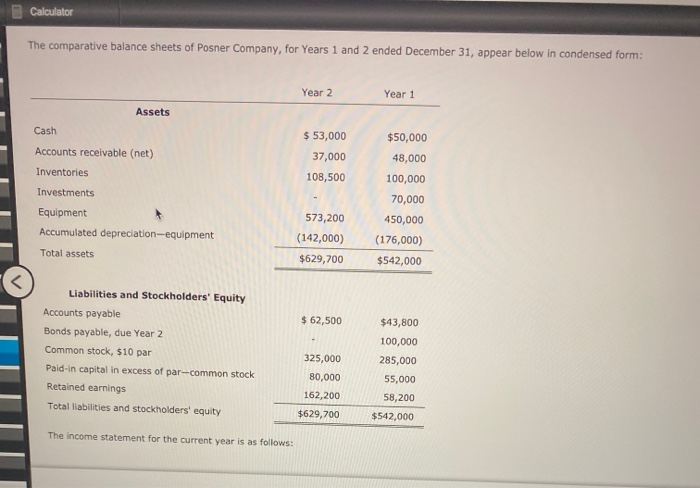

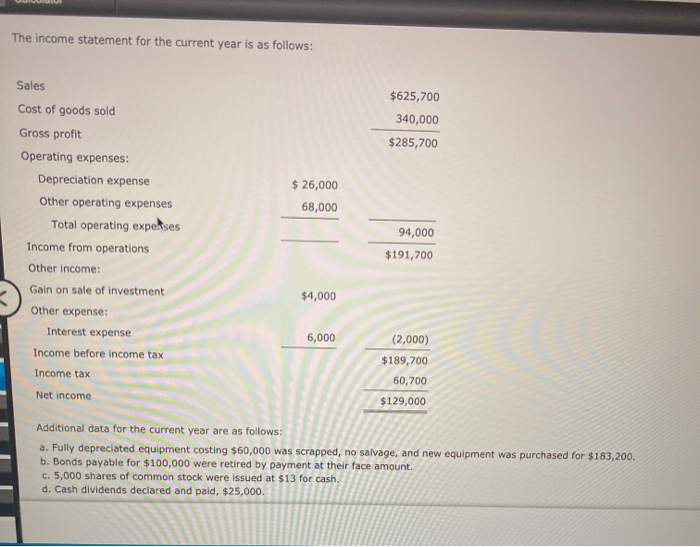

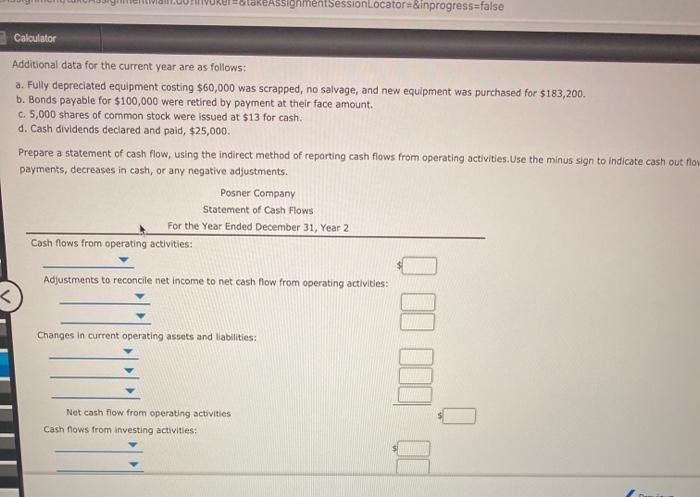

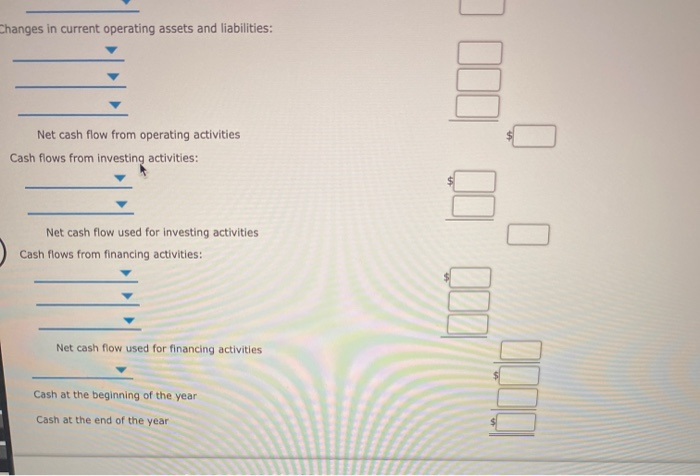

Calculator The comparative balance sheets of Posner Company, for Years 1 and 2 ended December 31, appear below in condensed form: Year 2 Year 1 Assets Cash $50,000 $53,000 37,000 108,500 48,000 Accounts receivable (net) Inventories Investments Equipment Accumulated depreciation-equipment Total assets 573,200 (142,000) $629,700 100,000 70,000 450,000 (176,000) $542,000 $ 62,500 Liabilities and Stockholders' Equity Accounts payable Bonds payable, due Year 2 Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity 325,000 80,000 162,200 $629,700 $43,800 100,000 285,000 55,000 58,200 $542,000 The income statement for the current year is as follows: The income statement for the current year is as follows: $625,700 340,000 $285,700 $ 26,000 68,000 Sales Cost of goods sold Gross profit Operating expenses: Depreciation expense Other operating expenses Total operating expekses Income from operations Other income: Gain on sale of investment Other expense: Interest expense Income before income tax Income tax 94,000 $191,700 $4,000 6,000 (2,000) $189,700 60,700 $129,000 Net income Additional data for the current year are as follows: a. Fully depreciated equipment costing $60,000 was scrapped, no salvage, and new equipment was purchased for $183,200. b. Bonds payable for $100,000 were retired by payment at their face amount. C. 5,000 shares of common stock were issued at $13 for cash. d. Cash dividends declared and paid, $25,000. eAssignmentSessionLocator=&inprogress=false Calculator Additional data for the current year are as follows: a. Fully depreciated equipment costing $60,000 was scrapped, no salvage, and new equipment was purchased for $183,200. b. Bonds payable for $100,000 were retired by payment at their face amount C. 5,000 shares of common stock were issued at $13 for cash. d. Cash dividends declared and paid, $25,000. Prepare a statement of cash flow, using the indirect method of reporting cash flows from operating activities. Use the minus sign to indicate cash out flow payments, decreases in cash, or any negative adjustments. Posner Company Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: 10 W I 0 Net cash flow from operating activities Cash flows from investing activities: Changes in current operating assets and liabilities: Net cash flow from operating activities Cash flows from investing activities: Net cash flow used for investing activities Cash flows from financing activities: o Net cash flow used for financing activities Cash at the beginning of the year Cash at the end of the year